Citibank’s Rewards points can be earned via credit card and bank account bonuses. Those points can then be transferred to various partners, used to pay for travel or merchandise, redeemed to pay bills, or converted to cash back. Citi ThankYou® Points Rewards competes directly with four other transferable points programs: Capital One Miles Rewards, Marriott Bonvoy Rewards, Chase Ultimate Rewards and Amex Membership Rewards. Most people get these points from their version of the Chase Sapphire Preferred called the Citi ThankYou Premier card.

Like Chase Ultimate Rewards, Citi ThankYou Points are one of the best options because they are a flexible point currency. With airline or hotel loyalty programs, you often use your points for redemptions with that hotel or airline. Flexible point currencies give you a broader ability to use your points. That is why I encourage prioritizing flexible point currencies over loyalty programs.

Below, you’ll find everything you need to know about ThankYou Rewards.

Contents

- Earn Points

- Redeem Points

- Manage Points

Earn Points

Credit Cards

The easiest and quickest way to earn ThankYou points is through Citi credit card signup bonuses, category bonuses, and retention offers (call about once per year to ask if any offers are loaded to your cards). Below are the current Citi cards that earn ThankYou rewards.

Personal

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Now with a signup bonus! A great complement to the Citi Premier card.

Business

Citi Business ThankYou Card (Only available in-branch)

Redeem Points

In general, ThankYou Rewards points are worth up to 1 cent each. There are two ways in which it is possible to get more value, though: redeem points for travel or transfer points to airline partners. More below…

Travel

In general, if you book travel through the Citi ThankYou portal, you’ll get only 1 cent per point value (this doesn’t count the added value of having the Rewards+ 10% rebate). Below is how to book travel in the portal, but in most cases, it is better to pay for this travel with your card (so as to earn points) directly with the hotel, airline, or any other travel site. That way you can earn points for the spending and have an easier time dealing with the airline or hotel directly if problems occur with your itinerary. Then you can redeem points for cash back to cover those charges. You redeem Citi points for cash back at 1 cent per point, which is the same rate you get when booking in their portal. Thus, there really isn’t an advantage to using the portal.

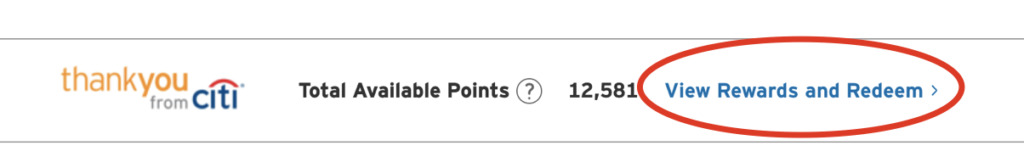

First, you’ll need to log into your ThankYou Points Portal.

How to log into your ThankYou Points Portal

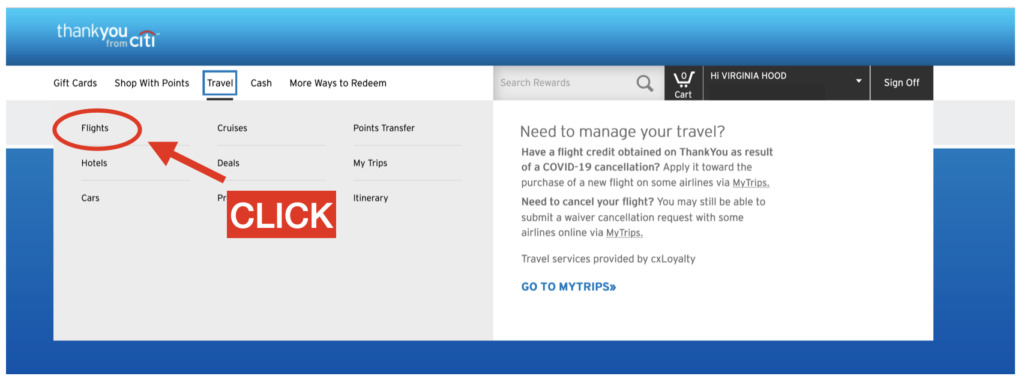

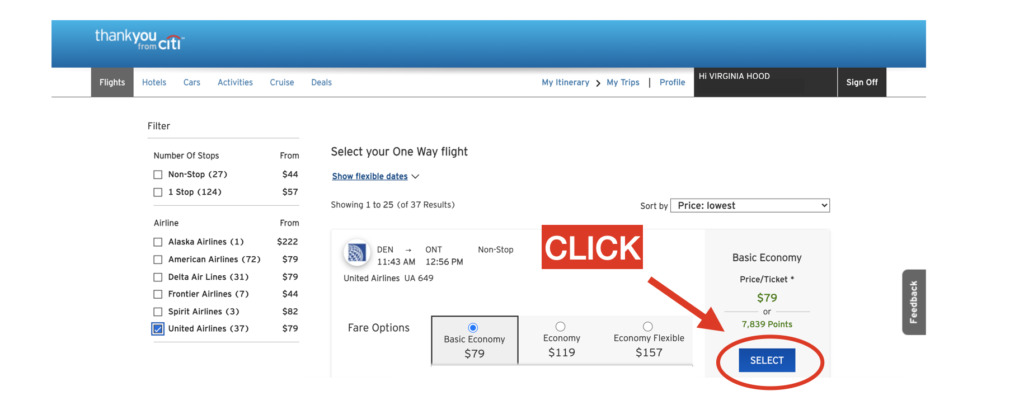

Once in the portal, click the “Travel” tab near the top of the screen. From there, you can book flights, hotels, car rentals, and even cruises.

Select the “Travel” tab to view the many booking options in the ThankYou Points portal

Here, you can easily search for your preferred booking. In the portal, you’ll earn 1 cent per each ThankYou point.

Once you’ve found your preferred booking, click “select” to checkout

Redeem points for a 4 night hotel stay: 25% point discount pre-tax (up to 1.33 cents per point value)

One exception to the 1 cent per point is the Citi Prestige 4th Night Free benefit. This option requires the Citi Prestige Card. Book a 4 night hotel stay for the price of 3 nights (not counting taxes & fees, the 25% discount results in 1.33 cents per point value). If you would like to use points earned on other cards, either combine your cards together or share your points (move points) from the other card to your Citi Prestige.

Hotels booked through the ThankYou portal way do not earn hotel rewards. Worse, hotels booked through the portal often won’t offer you elite benefits even if you have status.

Transfer points

The best use of ThankYou points can be to transfer points to various partners in order to book high-value awards. Your best bet is usually to wait until you find a great flight award before transferring points. One exception: Citi often offers 25% or 30% transfer bonuses to certain programs (Virgin Atlantic and Air France are two recent examples). If you’re confident that you’ll use the points for good value, it may make sense to transfer points when those bonuses are in effect.

Note: You must have a Citi Premier or Citi Prestige to transfer to all Citi transfer partners. The exceptions would be Choice Privileges, JetBlue, and Wyndham. These three programs allow transfers if you only hold a Rewards+ or Double Cash.

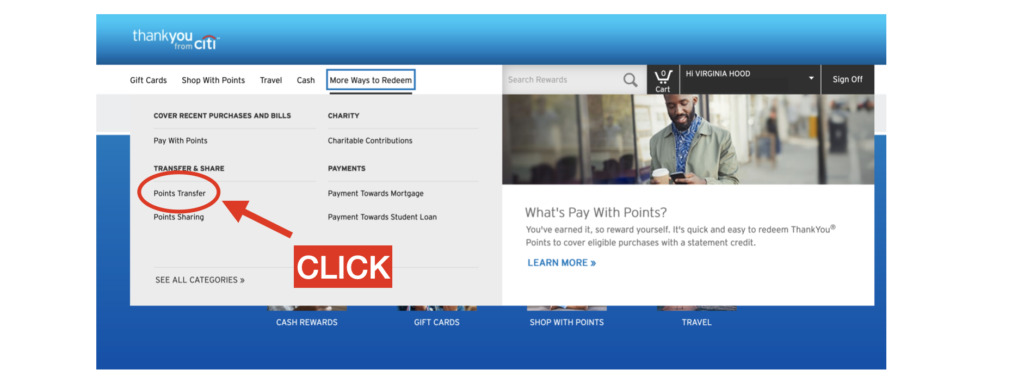

To transfer points, you’ll need to be logged into your ThankYou Portal. From here, navigate to the “More Ways to Redeem” tab.

Under “More Ways to Redeem,” select “Points Transfer”

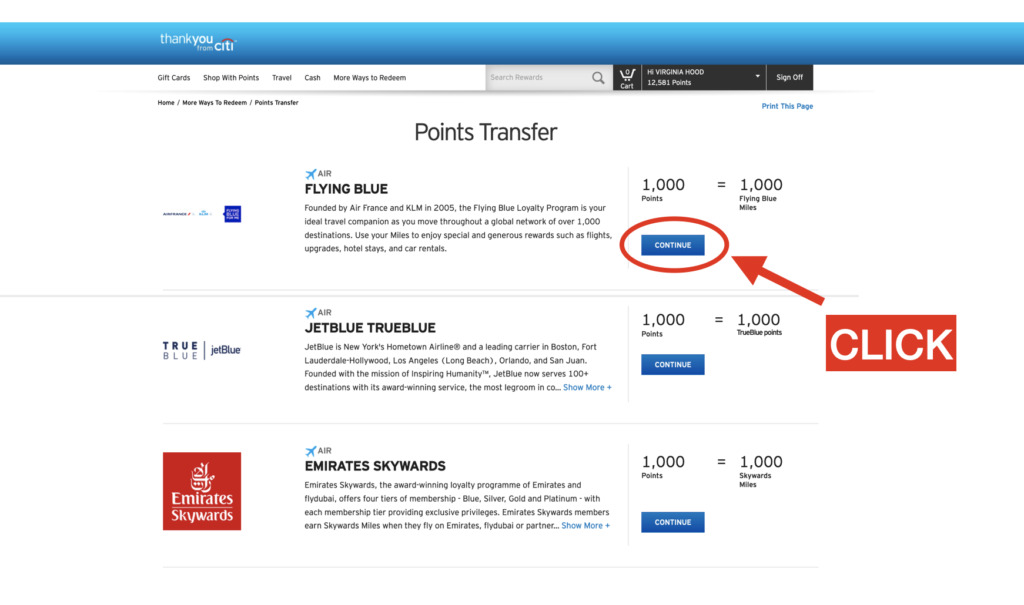

Once on the “Points Transfer” page, you’ll find a list of all of Citi’s transfer partners from which you can choose. As mentioned above, it’s best practice to confirm award availability on the airline’s website before you proceed with transferring your points.

Choose the airline you’d like to transfer your points to.

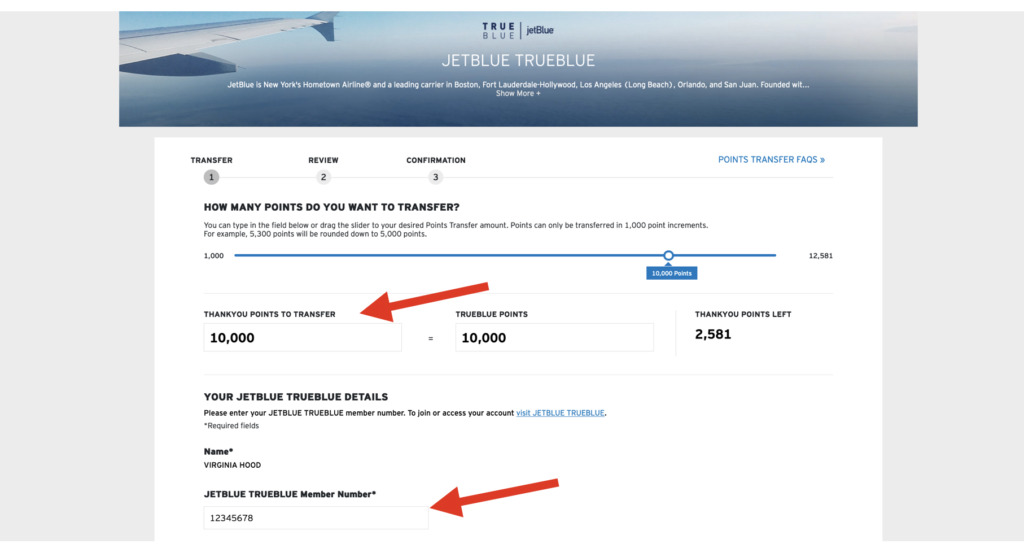

After selecting your preferred airline, you’ll be prompted to select the total number of points you’d like to transfer. Citi requires that you transfer a minimum of 1,000 ThankYou points, up to 550,000 ThankYou points.

Choose the number of points you’d like to transfer, and insert your airline rewards membership number

Transfer Partners

| Partner | Transfer Ratio | Transfer Time | Best Uses | |

|---|---|---|---|---|

| Air France / KLM Flying Blue | 1:1 | Almost instant | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | |

| Avianca Lifemiles | 1:1 | Almost Instant | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. | |

| British Airways Avios | 1:1 | 1 to 2 days | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. | |

| Cathay Pacific | 1:1 | Almost Instant | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of first class by adding on a business class flight. | |

| Choice | 1:2 | Instant | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | |

| Emirates Skywards | 1:1 | Almost Instant | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. | |

| Etihad Guest | 1:1 | 1 hour | Etihad has a very competitive award chart for American Airlines flights, among others. For example, they charge only 50,000 miles one-way for business class flights from North America to Europe. Partner awards must be booked over the phone. | |

| EVA Air Infinity MileageLands | 1:1 | Almost Instant | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. | |

| Iberia Avios | 1:1 | 1 to 2 days | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. | |

| JetBlue | 1:1 | Almost Instantly | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | |

| Qantas Frequent Flyer | 1:1 | 1 day | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. Compare award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) | |

| Singapore Airlines KrisFlyer | 1:1 | 1 day | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | |

| Turkish Airlines Miles & Smiles | 1:1 | 1 day | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. | |

| Virgin Atlantic Flying Club | 1:1 | Almost Instantly | Virgin Atlantic offers a few great sweet spot awards including ANA first class between the US and Japan for as low as 55K points one-way; and US to Europe on Delta One business class for 50K points one-way. | |

| Aer Lingus Avios | 1:1 | 1 to 2 days | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. | |

| AeroMexico ClubPremier | 1:1 | 1- 6 days | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. | |

| Jet Airways Inter Miles | 1:1 | Almost Instantly | JetAirways JetPrivilege miles are useful only for a few very specific cases such as certain flights to Hawaii for as low as 15K (30K business) one-way, or to the Caribbean or Central America for as low as 10K (20K business) one-way. | |

| Wyndham Rewards | 1:1 | Almost Instantly | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Additionally, you can book Vacasa vacation rentals for only 15K points per room per night. Wyndham Earner cards offer automatic 10% discount on award stays. | |

Cash back

Citi Premier and Citi Prestige cardholders can redeem points for 1 cent each either as statement credits or as cash back.

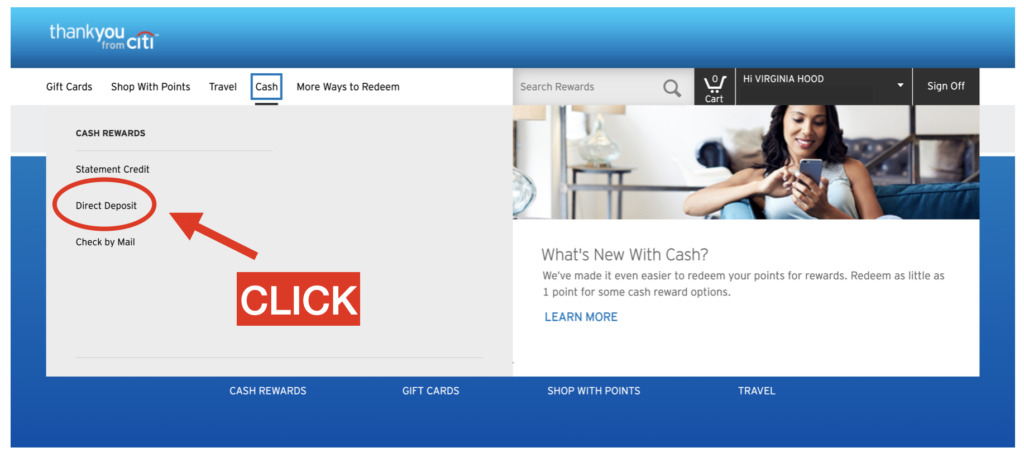

Under the “Cash” tab, select which form of credit you’d like.

Under the “Cash” tab, select “Statement Credit” or “Direct Deposit”

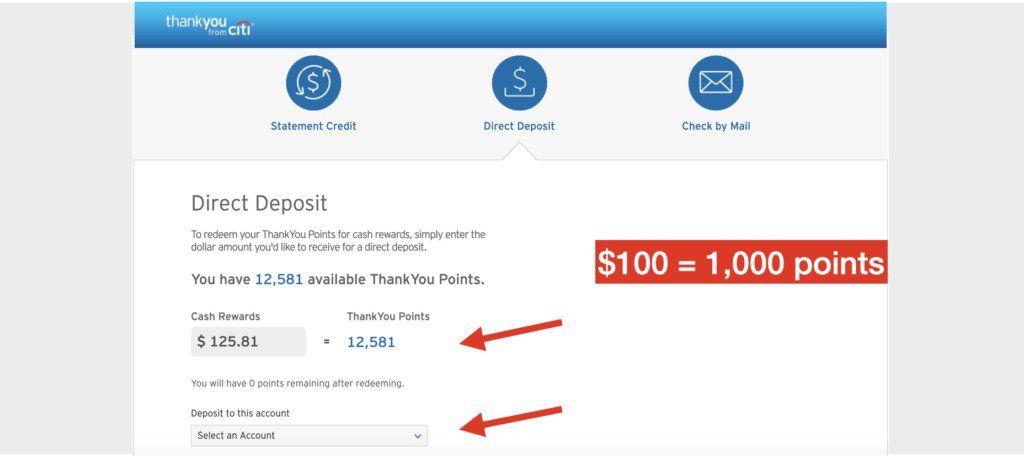

From there, you’ll insert your bank information and confirm the total number of points that you’d like to redeem in the form of cash back.

Confirm the number of points you would like to redeem

Other ways to redeem points

Through the ThankYou Rewards portal you can redeem points for gift cards, merchandise, charity, bill payments, and more. At most, with this approach you’ll get 1 cent per point value. One exception is that Citi occasionally offers gift cards at a discount so you may be able to get better than 1 cent per point value during a gift card sale.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value.

Manage Points

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can combine ThankYou Rewards accounts. When your points are combined, they can then automatically be redeemed at the same value as your best card.

There are disadvantages to combining points:

- You lose the ability to pick and choose which points are used when you redeem awards.

- You lose visibility into how many points remain with each card.

The above disadvantages become important when you want to cancel a card: when you cancel a card, all points earned from that account are lost after 60 days. I recommend downgrading to a no-fee ThankYou card rather than cancelling outright. That way your points are safe.

Share Points Across Cardholders

Citi very generously allows people to transfer ThankYou points to anyone else, for free. There are two “catches” to this:

- Shared points expire after 90 days. Make sure you have a specific near-term use in mind before transferring points.

- 100K limit: Each member may share up to 100,000 points per calendar year. Each member may receive up to 100,000 points per calendar year.

It is unclear whether this limit is actually enforced. A reader reports that the 100K limit was enforced for her.

Why this is valuable:

- A friend or family member with a Premier card can book travel for you.

- If a friend has airline elite status with one of Citi’s transfer partners with which you want to book an award, you may be better off transferring points to your friend who can then transfer the points to the airline partner and book the award for you (to get free award changes, for example).

How to Keep Points Alive

There are several situations in which you may have Citi ThankYou Rewards points that will expire:

- Points earned by a credit card account expire 60 days after cancelling that account.

- Points transferred to your account expire after 90 days.

- Points earned from some older credit cards expire in a set amount of time after points were earned (e.g. 3 or 5 years after December 31 of the year in which the points were earned).

- Points earned from some credit cards expire if your credit card account has no purchase activity in 18 months.

- Points earned from Citibank banking products expire 3 years after December 31 of the year in which the points were earned.

Credit card points: how to keep points alive

With most credit card points (except with some older credit cards which are no longer available), points remain alive until you cancel the card from which they were earned. Once you cancel the card, points expire after 60 days.

Combining accounts does not solve the problem. When you combine multiple ThankYou accounts, it’s natural to assume that as long as you keep any ThankYou Rewards credit card open, your points will be safe. That’s simply not the case. Citi keeps track of where each ThankYou point came from. If you cancel a card, the points earned on that card expire after 60 days. Period.

The best way to preserve your ThankYou points is to keep your credit card account alive.

Downgrading is another option. An easy way to keep your points alive and to avoid an annual fee is to simply downgrade to a no-fee Citi Rewards+. Citi Rewards+ only allows ThankYou Points to transfer to Choice Privileges, Wyndham Rewards, and JetBlue TrueBlue.

Important re Double Cash: Downgrading to the no-fee Citi Double Cash card will not preserve your points. Even though the Double Cash card does let you convert cash back to ThankYou points, it is not considered a full-fledged ThankYou card.

Important re Points Expiry: Citi product changes result in a weird transition period quirk. Soon after product changing from one ThankYou card to another, you can log into your account and you’ll see that your points will expire within 60 days. Don’t panic. Your points won’t really expire. Wait a few more weeks and you’ll see that the points no longer have an expiration date.

The downside to downgrading to a no-fee card, of course, is that this makes your points far less valuable. Unless you still have another premium card, you won’t be able to transfer points to loyalty programs.

Bank product points: how to keep points alive

Points earned from banking products (such as checking accounts) expire 3 years after December 31 of the year in which the points were earned. Fortunately, when redeeming points combined across multiple accounts, Citi automatically uses first whichever points have the most recent expiration date. So, in general, your banking product points (which eventually expire) will be used first if you have combined accounts.

More information

Citibank’s official ThankYou Rewards FAQ can be found here.

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Now with a signup bonus! A great complement to the Citi Premier card.

Related Articles: