At Travel Freely, we’re all about maximizing your free travel in the easiest way possible. So, start here with the Chase Sapphire Preferred® card. It’s the easiest recommendation for beginners who are looking for the best travel rewards credit card. With its spot at the top of ‘best rewards cards’ lists, this credit card is designed for beginner free travelers looking for simple ways to get great value. Why? Chase Ultimate Rewards points are highly valued and incredibly flexible.

Link: Learn How to Apply Now: Chase Sapphire Preferred (60,000 points)

Here are some great reasons to love the Chase Sapphire Preferred:

1) Up to $750+ in free travel!

When you hit your minimum spending bonus of $4,000 in the first 3 months, you’ll get 60,000 Chase Ultimate Rewards points. In the Chase Travel℠ portal, points are redeemed at 25% extra. At a minimum, you’re getting $750 in free travel with your bonus. If you transfer to partners, you could get a value of 2 cents per point or more, and that is over $1,200 in free travel. For those who do not like annual fees, you can actually use points to erase the annual fee by redeeming 9,500 points for cash.

2) It’s EASY to redeem

You can redeem your points in the following ways:

1) Book travel directly through the Chase Travel portal (or by calling). You’ll get a 25% boost when you book through the portal. So points are worth 1.25 cents per point when you go this route.

2) Transfer points to their loyalty travel partners (Examples include Southwest, United, Hyatt, Marriott). This is where the best value is. For example, booking expensive domestic or international travel with United can bring in redemption rates at 4-5 cents per point.

Get to Hawaii with the signup bonus from the Chase Sapphire Preferred!

Get to Hawaii with the signup bonus from the Chase Sapphire Preferred!

3) Redeem points for cash If you’re looking for a travel card that gives you added flexibility for cash back and not just for travel redemption, then the Chase Sapphire Preferred is a great card for you. With a redemption rate of 1 point = 1 cent, you can easily convert 60,000 Chase Points to $600 cash for anything you want to spend on.

1,000 points = $10 cash

10,000 points = $100 cash

60,000 points = $600 cash

Link: Learn How to Apply Now: Chase Sapphire Preferred (60,000 points)

3. Earn 3x points at restaurants (2x on travel)

Beginners and advanced free travelers use the Chase Sapphire Preferred card. You can travel a lot or a little, and you’ll still rack up points. Any travel you do pay for (hotels, airfare, rental cars) will be double points. Even things like taking an Uber or paying for parking will get 2x points, too.

You also earn 3x points on dining. So, anytime you eat out, you’re earning triple the points!

Earning 3x points at restaurants can supercharge your earning.

Earning 3x points at restaurants can supercharge your earning.

4. Awesome travel benefits.

First of all, you get a $50 hotel credit to use annually. You can use this whenever you want. This one benefit essentially reduces your annual fee to $45.

Traveling abroad? There are no foreign transaction fees. This is huge. Avoiding the 3% fee is big time savings. Plus, you can avoid using a debit card or cash. Credit cards often get the best exchange rate abroad, and you don’t even have to worry about carrying around extra cash.

Waive your rental car coverage. Primary car rental insurance is also covered when you pay for your rental car with this card. Waive the fee and save an extra $15-30 per day!

Other benefits include trip delay, trip cancellation, and baggage delay insurance. These benefits alone could be super helpful right when you need them.

Going to Europe? Save on rental car insurance and waived foreign transaction fees. You’ll still earn 2x on travel expenses and 3x points at restaurants, too!

Going to Europe? Save on rental car insurance and waived foreign transaction fees. You’ll still earn 2x on travel expenses and 3x points at restaurants, too!

5. Transfer to Southwest, United, Hyatt and more

You are missing out if you think that an airline or hotel card is all you need. Normal rewards enthusiasts miss out on extra rewards and flexibility because they don’t know about this amazing benefit of the Chase Sapphire Preferred.

The Chase Sapphire Preferred card allows you to transfer points to its partners. For example, Southwest Airlines is a transfer partner. You can transfer Chase Ultimate Rewards points to Southwest at 1:1. Because of the travel partners and ease of transferring rewards, this card can act like a Southwest, United, Marriott, and Hyatt card rolled into one. Whenever you need those rewards, you can transfer them. So, you can stay flexible and only make a transfer when you need to transfer.

6. The Chase 5/24 Rule

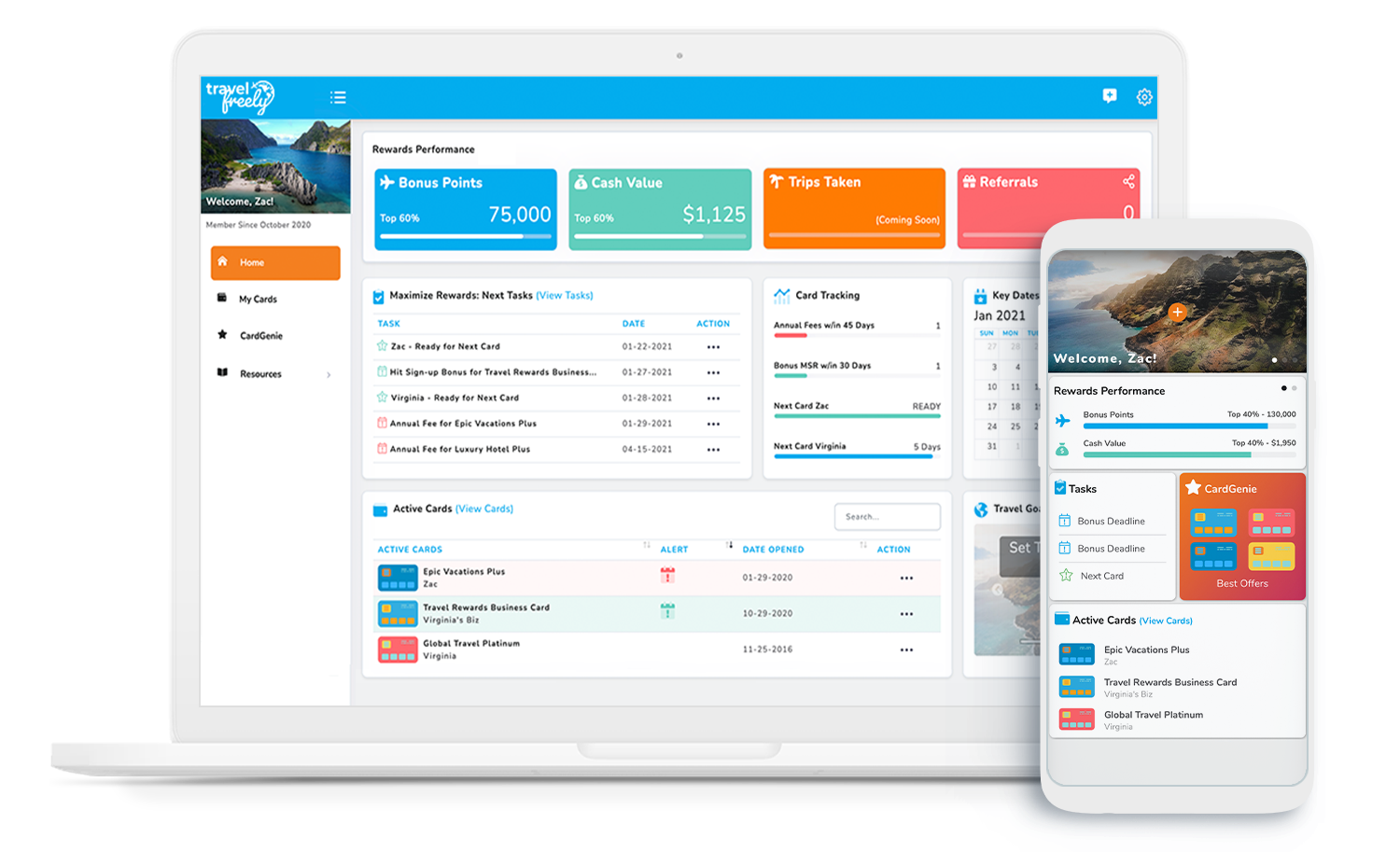

Beginners may not realize that Chase has an “unofficial” rule of denying credit card applications if someone has opened 5 cards in the previous 24 months. Some cards don’t count towards this, but most personal cards do. (p.s. the Travel Freely app has a 5/24 counter feature). When you are starting out with rewards cards, you need to get this card sooner than later. The Chase Sapphire Preferred is subject to the 5/24 rule, so you want to make sure you get it before some of the other great cards.

Bottom Line

This is an excellent all-around card. The #1 card for beginners, and one of THE best cards for any type of traveler. The Chase Travel portal and transfer partners make it very flexible. At a minimum, this card’s value is $750 when using the travel portal, but we value Chase points at 1.8 cents per point because of their value when transferred to travel partners like Southwest, United, Hyatt, or Marriott.

If that wasn’t enough, this card includes 3x points on dining, 5x on travel purchased in Chase Travel portal, 2x on all other travel purchase, and a $50 hotel credit annually with no foreign transaction fees and primary rental car coverage.

Ready for free travel? Don’t miss out.

Link: Learn How to Apply Now: Chase Sapphire Preferred (60,000 points)