Our #1 priority is getting you well on your way to your first free vacation. And, fast!

Not sure which card to open? Check out This Month’s Best Offers to see which cards are making the top of our list this month.

By now, you’re getting ready to sign up for your first card. And, you’re probably wondering: which card is right for me?

The Chase Sapphire Preferred is our #1 favorite card for beginners. But, beyond this card, there are several other cards out there that will get you on your way to free travel!

While all reward credit cards come with different advantages, there isn’t a one-size-fits-all in the credit card world.

And more importantly, as long as your card is earning you points, there’s not really a wrong card.

But, picking your first card (or, next card) with your travel goals in mind will help make sure you maximize your rewards and get the most out of your points.

We’ve narrowed it down to TWO different types of rewards cards:

- Transferable cards (we call these “Wild Cards”)

- Co-branded cards (the ones you’re probably most familiar with)

Transferable “Wild” Cards

What Are They?

Transferable cards are our favorite in the world points and miles. Plus, this type of rewards card is the most recommended for beginners because they’re the most valuable and flexible.

The rewards for these cards are tied to the bank’s rewards programs, and not a specific airline, hotel, or other rewards program. This means that you’re not tied down to a specific airline or hotel—you have more flexibility with your points!

You get to choose how to redeem your points.

Probably our favorite part of these cards is that the banks allow you to transfer your points to different rewards programs. These other rewards programs are called, “Transfer Partners,” and differ from bank to bank.

So, the points you earn on a transferable card can be redeemed for almost ANY type of travel!

Our top 3 favorite transferable cards are:

Often, transferable cards offer great sign-up bonuses with values that range from $500-$850 (and, sometimes more)!

What does that mean for you?

Transferable cards will get you to your first free vacation, fast!

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Why We Like Them for Free Travel

Need we say more?

Besides getting you to your first free vacation, there’s another reason we really love transferable cards (and it has a lot to do with our favorite household game).

We like to compare these cards to a Wild card in Uno.

Wild cards are obviously the best cards to have in your hand, right? You don’t want to be nailed down to a specific color or number.

With a Wild card, you have more options.

With the Chase Sapphire Preferred, you can transfer your points to a wide range of transfer partners to book your dream trip!

What does that mean?

You can transfer the points you earn on your Chase Sapphire Preferred card to United Airlines (and their alliance partners) to book a business class trip to Europe for free!

Or, stay at an all-inclusive, luxury resort in the Caribbean for free by transferring your points to Hyatt!

A few of our favorite transfer partners are:

- Southwest

- JetBlue

- United

- Hyatt

- Marriott

For a full list of transfer partners, click here.

If you have a lot of miles for one specific program, you may have a hard time redeeming them for the travel you want.

For instance, what if your preferred airline suddenly doesn’t fly to your dream destination by the time you’re ready to book your flight?

If all your points are for this specific airline, you may have to make some unfortunate travel adjustments.

Instead, if you had the Chase Sapphire Preferred, you could choose another airline to take you on your dream trip (we show you how in our easy-to-read E-book)!

Did we mention you can redeem your points for cash back?

If you find yourself in a pinch, or don’t see yourself traveling in the near future, you can always cash out your points for a statement credit.

Our Advice to You

Once you have a transferable “Wild” card in your wallet, you’re going to earn a HUGE sign-up bonus after opening the card. Then, you’ll earn 2-3x more for your everyday spending compared to the co-branded cards most people use.

We’ve mentioned it before, but we can’t stop here:

The Chase Sapphire Preferred is our #1 beginner card, and also happens to be a transferable card!

Check out why we love this card and think it’s the PERFECT beginner card for you!

Megan traveled to Rome and Croatia for 11 days using her Chase Ultimate Rewards points

Already have the Chase Sapphire Preferred?

Don’t stop there!

The Capital One Venture Rewards Credit Card is the perfect complement to the Chase Sapphire Preferred, and we often recommend this as our #2 best card for beginners!

Why?

Because this no-thinking credit cards simplify your journey to free travel!

And, who doesn’t love simple?

By opening a Capital One Venture Card shortly after the Chase Sapphire Preferred, you maximize your ability to redeem flexible rewards for free travel.

While this card is a transferable card, it also has a unique feature that the Chase Sapphire Preferred doesn’t.

You can use Venture Miles (earned from the Capital One Venture Card) to cover other travel expenses, like train tickets. If you use your Venture card to pay for them, you can later use your Venture Miles to cover the charge on your statement.

These miles can also work if you find an awesome hotel on Priceline, Hotels.com, or want to stay at an Airbnb.

My favorite way to use my Capital One Venture card for free travel?

Rental cars! I love booking my rental cars through Costco for a great price. And, if I pay for the car rental with my Capital One Venture card, I can easily reimburse myself for those charges on my statement.

You can look at the last 90 days of travel purchases and redeem miles.

The strength of this type of card is that you don’t have much to figure out. You purchase your travel with the card and reimburse yourself later with miles.

Check out why we love the Capital One Venture Card here.

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

Travel Freely members Andy and Katelyn used their Capital One Venture Card to reimburse for their Airbnbs on their 3-week trip to Italy!

Like videos? We have a free 12-min "Rewards Cards 101" webinar replay available.

Co-Branded Credit Cards (Airline and Hotel Cards)

What Are They?

Co-branded cards are credit cards that are specific to a certain airline or hotel. More specifically, airlines and hotels partner with credit card companies (like Chase and American Express) to offer these cards.

With a co-branded credit card, you’ll earn points/miles for that particular loyalty program. And, they often come with benefits (e.g. free night stay or free checked bags) exclusive to the card and company.

You’ve probably heard of these—we’re talking about cards like a Southwest or Delta credit card that earn miles with every dollar spent.

Sound familiar?

If you already have our recommended transferable cards, these cards might be a good option!

Why We Like Them for Free Travel

If you always travel on Southwest or love to stay at Marriott Hotels, then it makes sense to get a card with a great bonus and rack up the points with that particular brand. Also, most brands will give you extra points for purchasing their flights or hotel stays when you use their card.

Unlike transferable cards, your earned rewards on a co-branded card go directly to your loyalty account.

Our Advice to You

Airline rewards usually have the best value for free travelers. Think about this: how often can you find a discounted hotel? But, very rarely will you ever find discounted airfare!

With this being said, hotel cards are starting to offer some amazing bonuses and benefits. So, once you get your card(s) for free airfare, make sure you pick up a hotel card for free stays.

While co-branded credit cards certainly have a time and place, don’t stop there!

Picking one airline card and using it exclusively for the rest of your life will never maximize your free travel. It might be easy, but you’re missing out on thousands of dollars!

Transferrable “Wild” cards often include your favorite airlines and hotels as transfer partners. Choosing a Transferable card over a co-branded card could earn you an extra 100,000 points!

So, here’s the question: What kind of cards do YOU want in your wallet?

Just remember, no card is a bad card to get. But, there are cards out there that are better for your specific circumstance and travel goals!

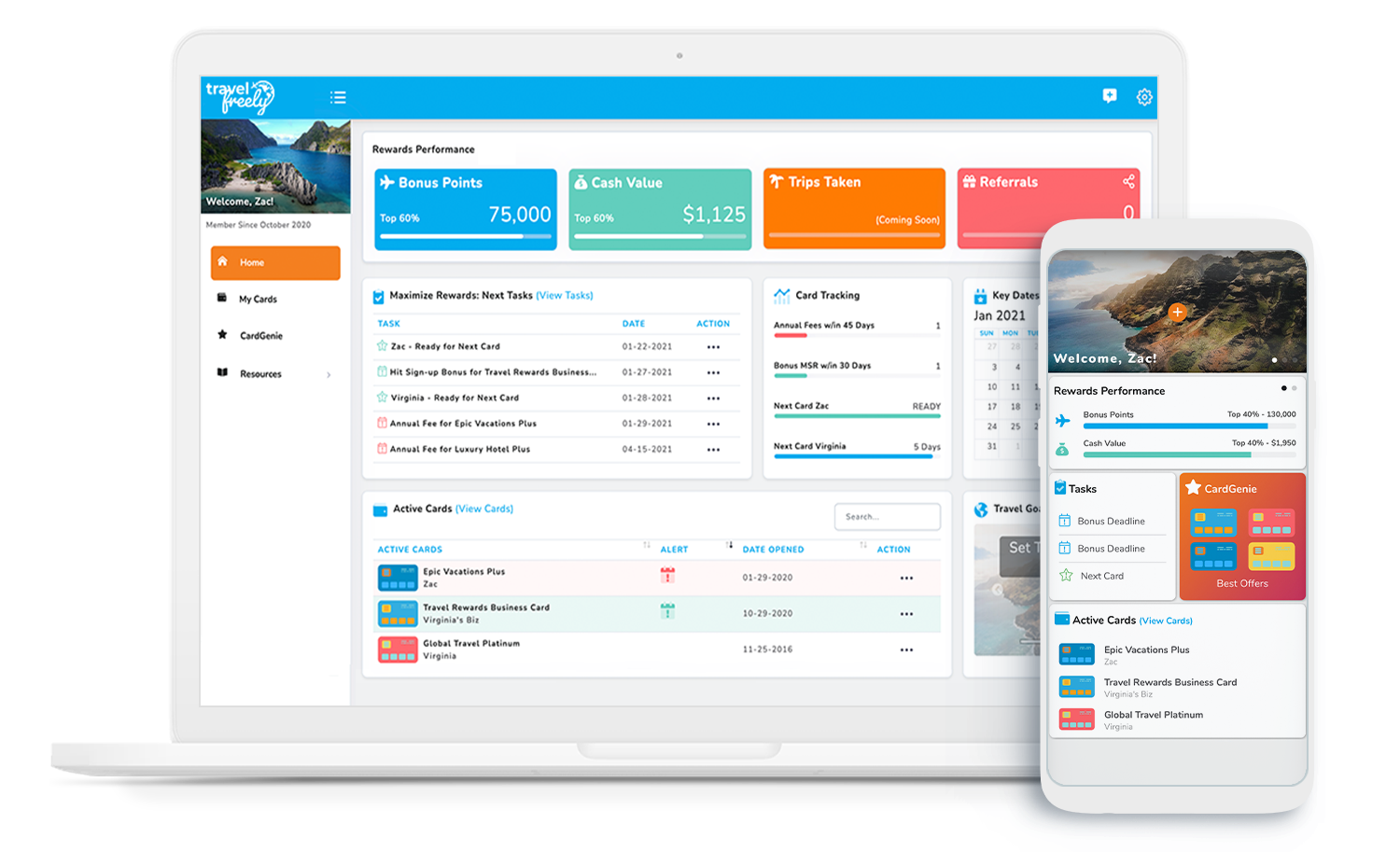

Make sure your MyCards dashboard is up to date, and head over to the CardGenie to see which cards are recommended for you!

Still not sure which card to open? Check out This Month’s Best Offers to see which cards are making the top of our list this month.