The Citi Premier® Card is Citi’s premier travel rewards credit card that earns valuable and flexible ThankYou® Points. It competes with other premium cards like the Chase Sapphire Preferred, Amex Gold Card, and Capital One Venture Rewards Credit Card. It is the primary card for Citi with excellent spending categories and the ability to transfer to various transfer partners a 1:1. This guide has everything you need to know about the Citi Premier, its benefits, and how it fits into the ThankYou Rewards ecosystem.

Citi Premier® Card Application Tips

|

Citi Application Tips

|

Should you apply?

The Citi Premier typically has a reasonable welcome bonus that can yield a good deal of travel with transfer partners. It also has excellent bonus categories for ongoing spend in the most common categories. Ironically, Citi removed most travel protections from this card a couple of years ago, making it hard to consider this a primary card in a travel rewards card strategy, but as a means of diversifying your points, it can be a very good choice.

If you are eligible (see next section), the welcome bonus on this card certainly makes it worthwhile for at least the first year.

Are you eligible?

To get this card, it must be 48 months since you last received a new account bonus for the card. This is an updated rule as of 5/2023.

Note that product changing from one of these cards to another Citi card could count as closing the card and opening a new one if Citi assigns you a new card number. When calling to product change, ask the rep if a new number will be assigned. If not, you should be safe.

How to apply

You can find the current best welcome bonus information below. Click the card name to go to our Citi Premier card page to find more information and a link to apply.

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Application status

After you apply, call 1-866-252-0118 to check your application status.

Reconsideration

If your application is denied, definitely call for reconsideration (800-695-5171). It’s surprising how often denials can be changed to approvals just by asking.

Perks

Travel Benefits

- No foreign transaction fees

- Transfer Points to Partners: Points can be transferred 1 to 1 to a number of airline and hotel loyalty programs (and 1 to 2 to Choice Privileges).

- $100 Annual Hotel Savings Benefit: Once per year you can apply a coupon for $100 off on an after-tax hotel booking of $500 or more.

- No foreign transaction fees: The Premier card is the only currently available card that earns ThankYou points and which doesn’t charge foreign transaction fees.

Travel Protections

The Citi Premier no longer includes any travel protections. There is no rental car insurance, no trip delay or cancellation benefit, no lost baggage insurance, etc. Benefits that are pretty standard on most travel cards are completely absent on the Premier.

Purchase Protections

- Extended Warranty: Citi extends the manufacturer’s warranty by 24 months on items with a manufacturer’s warranty of 5 years or less. This is the best extended warranty coverage of any issuer.

- Damage and Theft Protection: Covers your new purchases for 90 days against damage or theft up to $10,000 per claim and $50,000 per calendar year.

Earn Points

Intro Bonus

This card earns valuable ThankYou points. Here’s the current welcome offer:

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Redeem Points

Cash Back

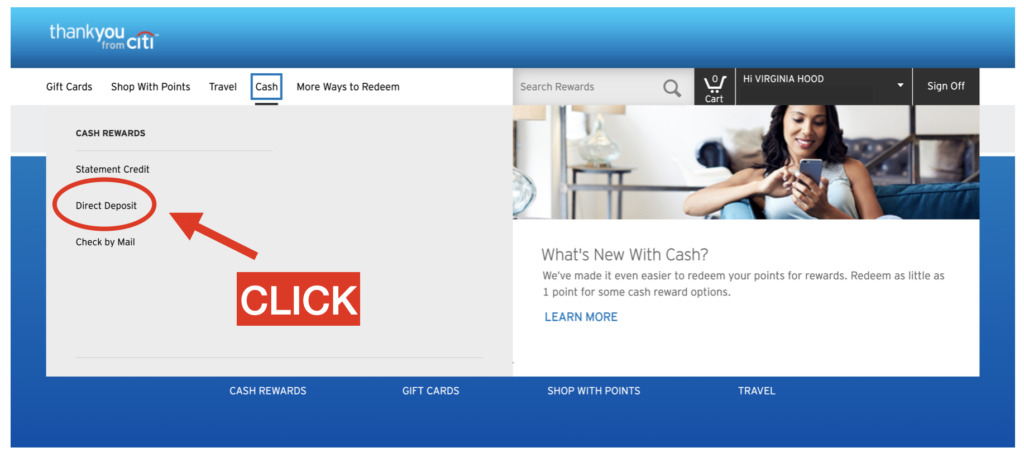

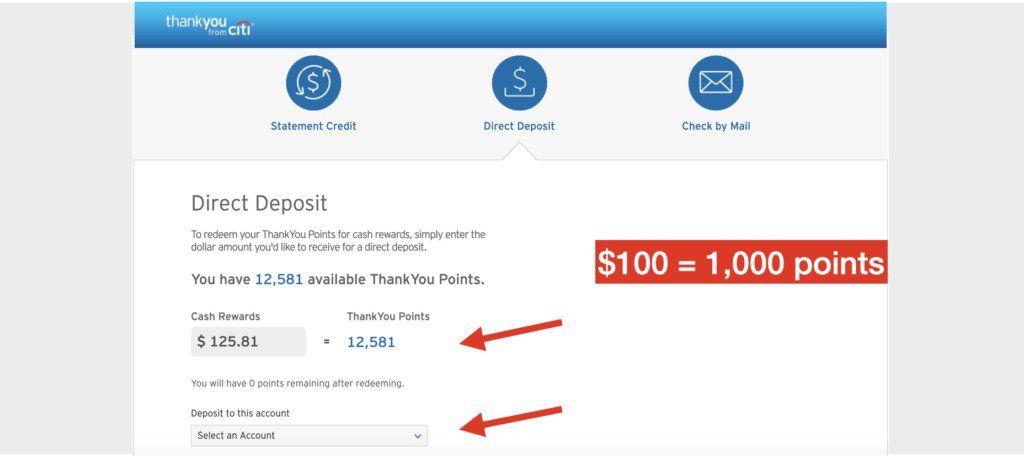

Cardholders can redeem points for 1 cent each either as statement credits or as cash back.

Under the “Cash” tab, select “Statement Credit,” “Direct Deposit,” or “Check by Mail”

From there, you’ll insert your bank information and confirm the total number of points that you’d like to redeem in the form of cash back.

Travel

Redeem points to pay for travel (no, don’t)

While it’s possible to redeem points for travel through Citi’s ThankYou Rewards travel portal, I do not recommend it. You’ll only get 1 cent per point that way, you’ll be limited to the prices found in the travel portal, and you won’t earn rewards from that spend. Unless you are taking advantage of the card’s annual $100 hotel benefit, you’re better off booking travel through other sites or direct from the travel provider. That way, you can earn points on that booking while at the same time booking with whatever source offers the best price. If you want to then use your points to cover that travel purchase, simply redeem points for cash back.

Transfer points to airlines and hotel programs

The best use of ThankYou points is to strategically transfer points to airline and hotel partners in order to book high-value awards. Your best bet is usually to wait until you find a great hotel or flight award before transferring points. If you have at least one premium card, such as the Citi Premier or Prestige card, most points transfer at a ratio of 1:1, but Citi regularly runs promotions where they offer a transfer bonus to a specific program.

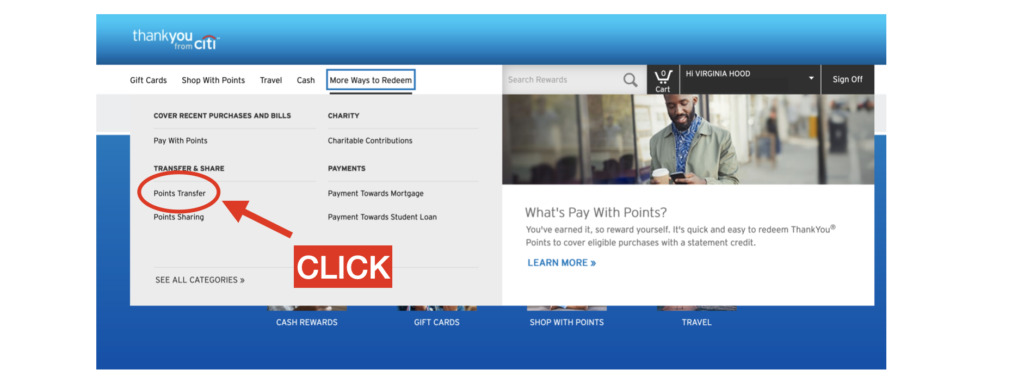

To transfer points, you’ll want to be logged into your ThankYou Portal. From here, navigate to the “More Ways to Redeem” tab.

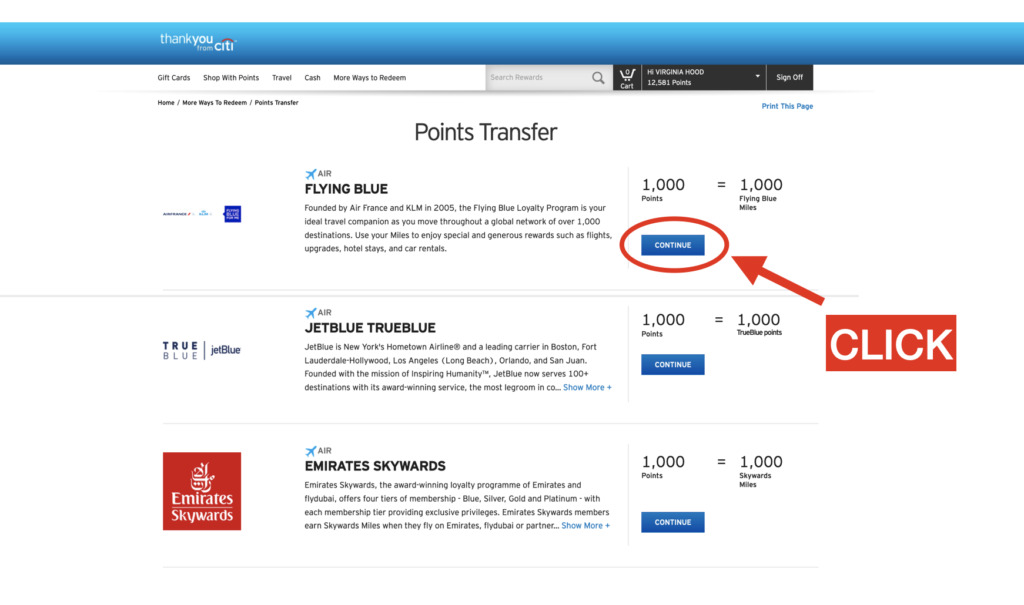

Under “More Ways to Redeem,” select “Points Transfer”

Once on the “Points Transfer” page, you’ll find a list of all of Citi’s transfer partners from which you can choose. As mentioned above, it’s best practice to confirm award availability on the airline’s website before you proceed with transferring your points.

Choose the airline to which you’d like to transfer your points

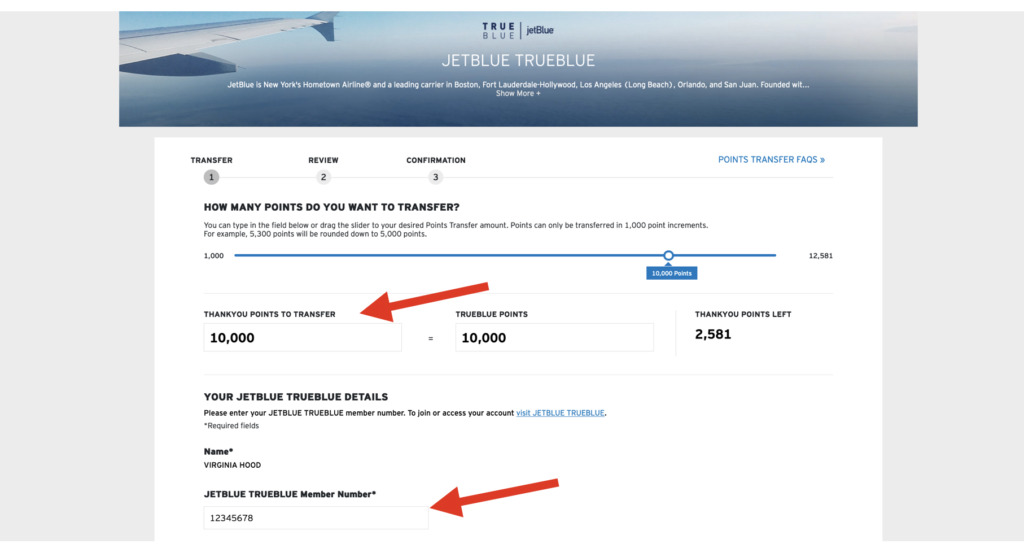

After selecting your preferred airline, you’ll be prompted to select the total number of points you’d like to transfer. Citi requires that you transfer a minimum of 1,000 ThankYou points, up to 550,000 ThankYou points.

Select the number of points you’d like to transfer and insert your rewards membership number

Combine points to transfer to partners

You cannot transfer points at the full 1-to-1 ratio from Citi’s fee-free cards, such as the Citi Custom Cash® Card or Citi Double Cash® Card, to airline & hotel partners, but you can pool points with your Citi Premier or Prestige card and then transfer the points at full value. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. For more on this check out our Citi ThankYou Points Guide.

Other ways to redeem points

Our blog post, Citi ThankYou Points Complete Guide, details the many ways you can redeem your Citi ThankYou points.

You can also use points to pay some merchants directly (Amazon.com for example). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone gets into your Amazon account, they might spend your ThankYou points – causing you a headache in getting your points reinstated). The only time it is worth using points this way is when Amazon runs a coupon to save when using points: you can sometimes use 1 point to save $15 off of $50 or something like that and in those cases it might make sense to use only 1 point, though it’s best to de-link your points from Amazon after utilizing the discount.

Transfer Points

Transfer Tips

- Wait to transfer points: Don’t transfer points until high-value awards are available and you are ready to book them. Transfers are one-way only. Citi ThankYou points are valuable for their flexibility. Once you transfer, you are locked into a single program that may or may not have awards available.

- Watch for transfer bonuses: Citi sometimes offers improved transfer ratios through limited-time transfer bonuses.

- Move points from one account to another (even to friends’ accounts): You can freely move up to 100,000 points per year to any other Citi ThankYou Rewards account. The catch is that once points are moved, they expire within 90 days. Make sure you have immediate plans for those points before moving them. Exception: The Custom Cash card does not allow moving points.

- Always have at least one transferable account: With a few exceptions, ThankYou Rewards are transferable only from Citi Premier and Citi Prestige accounts. If you or a friend has such an account, you can move points to that account from any other account before transferring to an airline or hotel program, but you are limited to moving 100,000 points per year this way. Another option is to pool points among your own accounts. For example, if you have the Citi Rewards+ card and the Citi Premier card, you can pool points between them in order to make all of the points transferable.

Transfer points to airlines and hotels

| Partner | Transfer Ratio | Transfer Time | Best Uses | |

|---|---|---|---|---|

| Air France / KLM Flying Blue | 1:1 | Almost instant | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | |

| Avianca Lifemiles | 1:1 | Almost Instant | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. | |

| British Airways Avios | 1:1 | 1 to 2 days | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. | |

| Cathay Pacific | 1:1 | Almost Instant | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of first class by adding on a business class flight. | |

| Choice | 1:2 | Instant | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. | |

| Emirates Skywards | 1:1 | Almost Instant | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. | |

| Etihad Guest | 1:1 | 1 hour | Etihad has a very competitive award chart for American Airlines flights, among others. For example, they charge only 50,000 miles one-way for business class flights from North America to Europe. Partner awards must be booked over the phone. | |

| EVA Air Infinity MileageLands | 1:1 | Almost Instant | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. | |

| Iberia Avios | 1:1 | 1 to 2 days | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. | |

| JetBlue | 1:1 | Almost Instantly | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. | |

| Qantas Frequent Flyer | 1:1 | 1 day | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. Compare award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) | |

| Singapore Airlines KrisFlyer | 1:1 | 1 day | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). | |

| Turkish Airlines Miles & Smiles | 1:1 | 1 day | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. | |

| Virgin Atlantic Flying Club | 1:1 | Almost Instantly | Virgin Atlantic offers a few great sweet spot awards including ANA first class between the US and Japan for as low as 55K points one-way; and US to Europe on Delta One business class for 50K points one-way. | |

| Aer Lingus Avios | 1:1 | 1 to 2 days | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. | |

| AeroMexico ClubPremier | 1:1 | 1- 6 days | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. | |

| Jet Airways Inter Miles | 1:1 | Almost Instantly | JetAirways JetPrivilege miles are useful only for a few very specific cases such as certain flights to Hawaii for as low as 15K (30K business) one-way, or to the Caribbean or Central America for as low as 10K (20K business) one-way. | |

| Wyndham Rewards | 1:1 | Almost Instantly | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Additionally, you can book Vacasa vacation rentals for only 15K points per room per night. Wyndham Earner cards offer automatic 10% discount on award stays. | |

Manage Points

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can combine ThankYou Rewards accounts. When your points are combined, they can then automatically be redeemed at the same value as your best card. For example, if one of your cards is the Premier card, you will be able to transfer points to various partners even if the points were earned on a card other than the Premier card. Similarly, if you combine other cards with the Rewards+ card, you’ll get a 10% rebate on all award redemptions (up to 10,000 rebated points per year), even if the points originated from a different card. If you have both the Premier and the Rewards+ cards combined together and you transfer 100K points to a partner program, you’ll get 10,000 points back.

There are some disadvantages to combining points:

- You lose the ability to pick and choose which points are used when you redeem awards.

- You lose visibility into how many points remain with each card.

The above disadvantages become important when you want to cancel a card: when you cancel a card, all points earned from that account are lost after 60 days. It’s best to downgrade to a no-fee ThankYou card rather than canceling outright. That way, your points are safe.

Share Points Across Cardholders

Citi generously allows people to transfer ThankYou points to anyone else for free. There are two “catches” to this:

- Shared points expire after 90 days. Make sure you have a specific near-term use in mind before transferring points.

- 100K limit: Each member may share up to 100,000 points per calendar year. Each member may receive up to 100,000 points per calendar year.

- Exception: The Custom Cash card does not have the capability to share points (but you can combine points with other cards that you have). Yes, it’s extremely weird that all other Citi ThankYou Rewards cards allow sharing points but not Custom Cash.

Why this is valuable:

- If you don’t have the Premier or Prestige card (the two cards in Citi’s lineup that allow full value transfers to partners), you can move your points to a friend who has one of those cards, and then they can transfer the points to an airline or hotel program in order to book high-value awards.

- If a friend has airline elite status with one of Citi’s transfer partners with which you want to book an award, you may be better off transferring points to your friend, who can then transfer the points to the airline partner and book the award for you (to get free award changes, for example).

How to Keep Points Alive

There are several situations in which you may have Citi ThankYou Rewards points that will expire:

- Points earned by a credit card account expire 60 days after canceling that account.

- Points transferred to your account expire after 90 days.

- Points earned from some older credit cards expire in a set amount of time after points were earned (e.g. 3 or 5 years after December 31 of the year in which the points were earned).

- Points earned from some credit cards expire if your credit card account has no purchase activity in 18 months.

- Points earned from Citibank banking products expire 3 years after December 31 of the year in which the points were earned.

Credit card points: how to keep points alive

With most credit card points (except with some older credit cards which are no longer available), points remain alive until you cancel the card from which they were earned. Once you cancel the card, points expire after 60 days.

Combining accounts does not solve the problem. When you combine multiple ThankYou accounts, it’s natural to assume that as long as you keep any ThankYou Rewards credit card open, your points will be safe. That’s simply not the case. Citi keeps track of where each ThankYou point came from. If you cancel a card, the points earned on that card expire after 60 days. Period. They are not known to reinstate points.

The best way to preserve your ThankYou points is to keep your credit card account alive. If you don’t want an annual fee, then call to downgrade to a no-fee ThankYou card. There is a side benefit to this approach, too: Your no-fee card may be eligible for occasional lucrative retention offers.

Card Lifecycle

How to meet minimum spend requirements

Once you are approved for a Citi card, you generally have three months to meet the required spend in order to get the welcome bonus. If your usual spend isn’t enough, consider using the Plastiq bill pay service to use your card to pay bills that can’t usually be paid by credit card (rent, mortgage, contractors, etc.). Note that Mastercards, like the Premier card, can be used to pay a greater range of payees than Visa or Amex cards.

Keep, cancel, or product change?

Is this card worth keeping in the long run? The main reason to keep this card around long term is as a way to transfer points to airlines and other programs. If you want to transfer ThankYou points to partners, you’ll need the Citi Premier (or discontinued Citi Prestige). If you don’t need that capability for a while, consider downgrading to the no-fee Citi Rewards+. Citi Rewards+ only allows ThankYou Points to transfer to Choice Privileges, Wyndham Rewards, and JetBlue TrueBlue.

Related cards

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."

Now with a signup bonus! A great complement to the Citi Premier card.