The no-fee Chase Freedom Unlimited® card is a great choice for beginners, and those who also carry a premium Ultimate Rewards card such as the Chase Sapphire Reserve, Chase Sapphire Preferred, or Chase Ink Business cards.

The Freedom Unlimited card is unique among Chase’s Ultimate Rewards cards in that you’ll earn a minimum of 1.5 points per dollar for all spend while also earning 3 to 5 points per dollar within specific bonus categories. Chase advertises the Freedom Unlimited as a cash back card, but it actually earns Chase Ultimate Rewards points. When paired with a premium card, the points earned with the Freedom Unlimited card become more valuable.

Additionally, Chase is also offering a special welcome offer for the Chase Freedom Unlimited where you’ll receive an additional 1.5% cash back on all first-year earnings, up to $20,000. The extra cash back earned is not reflected in the guide, as this is part of the welcome bonus and not a benefit you’ll earn year-after-year.

For clarity, here’s what this means for your earning within the first 12 months under this particular welcome offer:

+ You would earn 4.5x points on restaurants (because you normally earn 3x points)

+ You would earn 4.5x points at drugstores (because you normally earn 3x points)

+ You would earn 3x points on ALL other purchases (because you normally earn 1.5x points)

With the current offer, you'll now earn a total of 4.5x on dining (including takeout and eligible delivery services), 4.5x on drugstores, 6.5x on travel purchased through Chase Travel℠, and 3x on everything else for the first year, up to $20,000. This special offer is best for those who have a healthy amount of monthly spending on dining and general expenses.

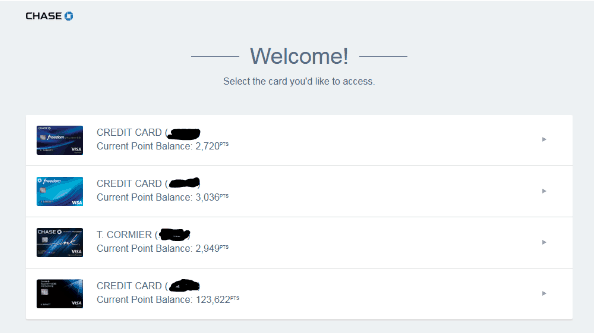

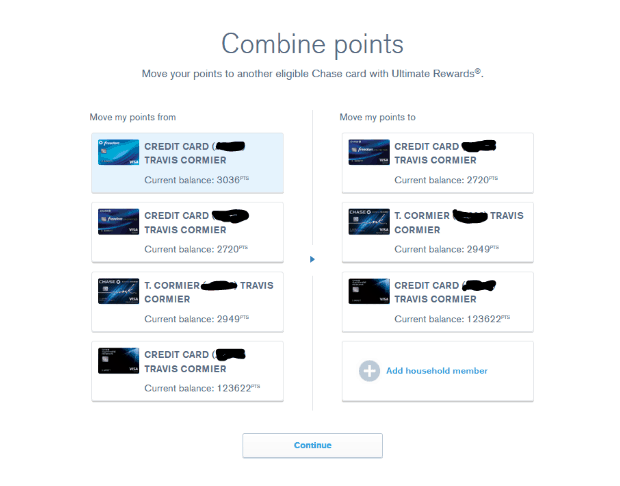

You can easily move your points to a premium card in order to get better than 1 cent per point value for travel. For example, if you move points to a household member’s Sapphire Preferred or Reserve card, you can get 1.25 cents or 1.5 cents per point value, respectively. Check out our Chase Ultimate Rewards Guide for more information.

This card does charge foreign transaction fees, so be sure to use a different card when traveling internationally. Within the US though, the Freedom Unlimited is an excellent choice both for its category bonuses and as an “everywhere else” card which earns a minimum of 1.5 points per dollar.

Table of Contents

Should you apply?

The Freedom Unlimited is a good choice in many cases, but it’s especially good if you or a household member has (or plans to get) the Chase Sapphire Preferred or Chase Sapphire Reserve card. Use the Freedom Unlimited to earn 5X for travel booked through Chase, 3X for drugstores and dining, and 1.5X on all other spend. Move your Freedom Unlimited points to the Sapphire Reserve account to get at least 1.5 cents per point value from all points. When you earn 1.5X with the Freedom Unlimited and redeem at 1.5 cents value with the Sapphire Reserve, you get a combined 2.25% return on your spend.

Are you eligible?

To apply for the Freedom Unlimited card, you must not currently have the same card (it’s okay to have a different Freedom card), and you must not have received a welcome bonus for the Freedom Unlimited in the past 24 months.

Additionally, to get this card you must be under 5/24.

How to apply

You can find the current best welcome bonus offer and application link at the top of this page: Chase Freedom Unlimited.

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, call for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Freedom Unlimited Perks

Travel Protection

- Auto Rental Coverage: Chase offers secondary auto rental CDW (collision damage waiver) when renting within your country of residence (presumably it is primary for rentals in other countries).

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.

Purchase Protection

Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.”

Chase Freedom Unlimited Earn Points

Welcome Bonus

The welcome bonus for this card is advertised as cash back, but the rewards are actually delivered as Chase Travel points. Here’s the current offer:

With the current offer, you'll now earn a total of 4.5x on dining (including takeout and eligible delivery services), 4.5x on drugstores, 6.5x on travel purchased through Chase Travel℠, and 3x on everything else for the first year, up to $20,000. This special offer is best for those who have a healthy amount of monthly spending on dining and general expenses.

Chase Freedom Unlimited Redeem Points

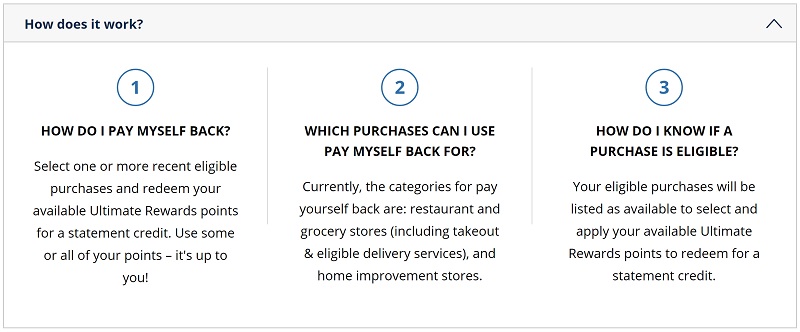

Pay Yourself Back

Cash Back

Cardholders can cash out points for 1 cent each. Cash back can be taken as a statement credit, check, or ACH transfer.

Travel

Redeem points for travel: 1.5 cents per point

Redeem points for travel: 1.25 cents per point

This option requires that someone in your household has a premium Ultimate Rewards card: Chase Sapphire Preferred or Chase Ink Business Preferred. First, move (or, combine) your points from your no-fee card to one of these premium cards. Next, log into Chase under the account that now has the points, and go to the Chase Travel portal to book your travel. A $500 flight would usually cost 50,000 points if you used points attached to a no-fee Ultimate Rewards card, but with the Chase Sapphire Preferred it would cost only 40,000 points.

Details about booking travel through Chase

You can use the Chase Travel portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards. Worse, hotels booked through the portal often won’t offer you elite benefits even if you have status. Unfortunately, Chase switched to an Expedia-backed portal and removed some ultra low cost carriers. For example, you can no longer book Spirit Airlines or Southwest through Chase Ultimate Rewards, although there is a work-around for some carriers.

Travel protections apply

When you pay with points for travel, Chase’s automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card’s rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your Ultimate Rewards points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value (1.5 cents per point) and better travel protections.

Transfer points

Move points to premium or ultra-premium card first

Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. |

| Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Great value can be had in redeeming BA points for short distance flights. Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. Aer Lingus shares the “Avios” currency with British Airways and Iberia. In most cases it is best to move points to one of those programs in order to book awards for less. |

| Emirates Skywards | The best use of Emirates miles is to fly Emirates itself. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth at least 1.5 cents each, but they’re sometimes worth far more. One hidden bonus: award nights are not subject to resort fees. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG credit cards can increase value: IHG Select Card (no longer available to new applicants) offers a 10% rebate on awards. IHG Premier and IHG Traveler Cards offer fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket. The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary due to certain taxes not being charged on awards, but tend to average around 1.5 cents per point. |

| United MileagePlus | Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United usually charges more miles for the same awards that are bookable with other Star Alliance miles. One good use of miles is to make use of United’s Excursionist Perk awards. United no longer charges change or cancellation fees on awards cancelled at least 30 days prior to booking. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers quite a few sweet spot awards including ANA first class between the US and Japan for as low as 110K points round-trip; and US to Europe on Delta One business class for only 50K points one-way. |

Other ways to redeem points

Chase Freedom Unlimited Manage Points

Combine Points Across Cards

Share Points Across Cardholders

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

Transfer difficulties? Create a loop

If you have trouble transferring between accounts, some users have been able to combine points between their own accounts — like from Bob’s Ink Business Cash to Bob’s Sapphire Reserve — via secure message.

For example, let’s say that Joe and Suzy live in the same household and are joint owners of a business and have the following accounts:

- Chase Freedom Unlimited (Joe)

- Chase Ink Business Cash (Joe)

- Chase Sapphire Reserve (Suzy)

First, Joe combines points from his Freedom Unlimited to Suzy’s Sapphire Reserve. Later, he logs into his Ink Business Cash account and tries to combine points with Suzy’s Sapphire Reserve. Joe may run into an error adding Suzy’s Sapphire Reserve card to combine points. This has happened in our household several times. In that case, Joe should log into his Freedom Unlimited account and remove Suzy as a household member (click “remove saved card). About 24 hours later, he should be able to add Suzy to his Ink Business Cash in order to combine his points to her account.

How to Keep Points Alive

Chase Freedom Unlimited Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

Is this card worth keeping in the long run? Yep. With no annual fee and strong earning power, why not? If you decide to cancel anyway, make sure to first redeem any remaining points or move them to another Ultimate Rewards card.

Related Cards

Ultimate Rewards Consumer Cards

With the current offer, you'll now earn a total of 4.5x on dining (including takeout and eligible delivery services), 4.5x on drugstores, 6.5x on travel purchased through Chase Travel℠, and 3x on everything else for the first year, up to $20,000. This special offer is best for those who have a healthy amount of monthly spending on dining and general expenses.

Great choice for a frequent traveler, but note the large annual fee. If you're starting out or not going to travel frequently in the coming year, you might want to instead consider the Chase Sapphire Preferred.

Ultimate Rewards Business Cards

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.