The Capital One Venture Rewards Credit Card and the Capital One Venture X Rewards Credit Card are are among some of our members’ preferred cards for free travel. Their miles are easy to redeem as reimbursement for any travel purchases, but they also have have transfer partners that can increase both flexibility and overall redemption value.

If you’re just getting into the free travel movement, the number of cards out there that could get you to your goals may seem pretty overwhelming. The key to picking the right card is to see which one offers you the best value towards your spending habits, travel preferences, and your travel goals.

Here at Travel Freely, we consider the Capital One Venture card and the Capital One Venture X card to be some of the best cards for beginners. Here’s why:

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

Welcome Offer = Free Travel

When you sign up for the Capital One Venture Card or the Capital One Venture X card, you get a lot of value right off the bat. Most notably, cardholders reimburse themselves in the form of statement credits for travel purchases made on the card. This is what sets this card apart from many others.

The minimum value of Capital One Venture Miles are 1 cent per point.. So 75,000 miles = $750 cash value with your travel reimbursement. For the Venture X it’s the same thing, 75,000 miles = $750 cash value.

Capital One Venture Card

You’ll earn a good chunk of Capital One Venture Miles as a bonus for signing up (after you hit the minimum spending requirement).

Capital One Venture X Card

Similar to the Capital One Venture card, you’ll earn a great deal of Capital One “miles” as a bonus for signing up. The annual fee on this ultra-premium card might scare some people off, but the net value of the card far exceeds the annual fee!

Travel benefits with the Venture X to offset annual fee:

- Receive up to $300 annually for bookings made on Capital One Travel

- Earn 10,000 bonus miles each account anniversary

- Receive a $100 credit for TSA PreCheck or Global Entry

- Great lounge access for primary cardholder and authorized users

- For a limited time, new cardholders will earn up to $200 in statement credits for vacation rental purchases (like Airbnb or VRBO)

As noted above, in addition to the sign-up bonus, you’ll also be given an annual $300 travel credit that can be used for any travel expenses you place on your card. And the best part is that you can start using this benefit immediately!

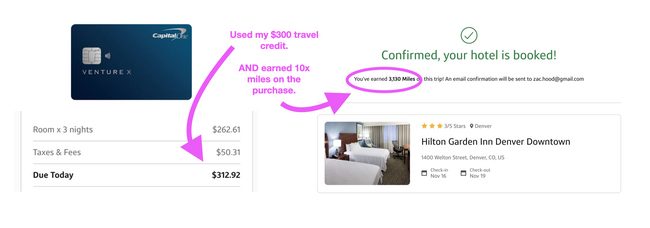

In fact, Zac was recently approved for the Capital One Venture X card and was able to use his $300 travel credit when he booked a hotel stay the following week!

The $300 travel credit (free money for travel) is super easy to use. Plus, I earned 3,130 miles because you get 10x in the portal.

Both of these cards also come with a $100 value for Global Entry or TSA PreCheck Applications. This is an every-four-year expense that is reimbursed directly to you.

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

Earn Rewards Points Every Time You Use Your Card

Capital One Venture Card

Unlike other cards with different earning structures, the Capital One Venture Card is very straightforward. There are no categorizations for earning points or miles.

It’s simply this: 2x miles per dollar spent.

This translates to a powerful earning potential on all your purchases (not just travel and dining purchases, but ALL purchases). This makes the Capital One Venture Card a great card for your everyday use.

Capital One Venture X Card

This card features some of the best-earning structures we’ve seen in a premium travel rewards card. The value, though, is dependent on whether you see yourself spending in these categories:

- Earn 10x on hotels and rental cars booked through Capital One Travel

- Earn 5x on flights booked in the Capital One Travel portal

- Earn 2x everywhere else

The good news is that if you don’t see yourself booking travel via the Capital One Travel portal, you’ll still earn 2x on every purchase!

Easy Redemption of Capital One “Miles” for Free Travel

Redemption with the Capital One Venture card and the Capital One Venture X card is also straightforward at 1:1, that is 1 cent per 1 mile.

Capital One also features an option that you can use to offset any travel expenses you’ve made through your card. This means you can use your card practically anywhere – with any airline or hotel. You don’t have to worry about booking with limited travel options, you can use your miles on anything that counts as travel – Airbnb bookings, experiences, cruises, and more. But, you do have only up to 90 days from the date of your purchase to use this feature. Learn more about the reimbursement feature here.

Airbnb is hands down one of the best ways to use Capital One Venture miles. Airbnb doesn’t have its own loyalty program, and you often can’t find rental properties through travel portals (they mainly show you hotels).

Sometimes, depending on where you’re traveling, you don’t have many great hotel options, or you want to get off the beaten path a bit. If you want to stay in an Airbnb for free, you can redeem Capital One Venture points to cover the stay. Simply use your card to book your Airbnb, then use the reimbursement feature in the Capital One portal to reimburse the purchase with miles.

Transfer Your Points to Maximize Your Free Travel

In addition, with more than 15 transfer partners for their miles, you can transfer your miles to a range of different airlines. In this case, the ratios for transfer differ from partner to partner, but most notably, you can transfer at a 1:1 ratio for most airlines. Given this point, the table below gives you a complete overview of the transfer partners and transfer ratios.

| Transfer Partner | Transfer Points Ratio | Transfer Time |

|---|---|---|

| Aeromexico Club Premier | 1:1 | Immediately/ Within the Day |

| Air Canada Aeroplan | 1:1 | Immediately/ Within the Day |

| Flying Blue AIR FRANCE KLM | 1:1 | Immediately/ Within the Day |

| Avianca LifeMiles | 1:1 | Immediately/ Within the Day |

| British Airways Avios | 1:1 | Immediately/ Within the Day |

| Cathay Pacific Asia Miles | 1:1 | Up to 3 Days |

| Emirates Skywards | 1:1 | Immediately/ Within the Day |

| Etihad Guest | 1:1 | Up to 3 Days |

| EVA Infinity MileageLands | 2:1.5 | Up to 3 Days |

| Finnair Plus | 1:1 | Immediately/ Within the Day |

| Qantas Frequent Flyer | 1:1 | Up to 3 Days |

| Singapore Airlines KrisFlyer | 1:1 | Up to 3 Days |

| TAP Air Portugal Miles&Go | 1:1 | Immediately/ Within the Day |

| Turkish Airlines Miles&Smiles | 1:1 | Within 24 hours |

| Wyndham Rewards | 1:1 | Immediately/ Within the Day |

| Accor Live Limitless | 2:1 | Within 1 business day |

Another tip you can take advantage of is to redeem your miles in exchange for gift cards, possibly getting a higher redemption value than the standard 1-cent to 1-mile ratio. To learn more about some of the best ways you can maximize your Capital One Venture Card, click here.

International Travel (for free) is a Sweet Spot

Unfortunately, one of the dreaded charges for out-of-the-country travel is the 3-5% additional foreign transaction charge placed on your card. This is why many would prefer to just bring cash instead of using their cards, missing out on the valuable points they could earn. Fortunately, by eliminating foreign transaction fees, these cards are easily a great partner for international travel.

You can also redeem your miles for train travel, which is very popular outside the U.S. Have an upcoming trip and expect to travel via train between destinations? Use the reimbursement feature mentioned above to reimburse yourself for those costs.

Additional Travel Rewards Perks

Capital One Venture Card

For starters, the Capital One Venture Card can cover up to $250,000 in travel insurance. It also offers luggage protection of up to $3,000 as well as rental car collision damage coverage. You can also enjoy a range of travel assistance services, including emergency legal, medical assistance, and 24/7 roadside assistance (subject to a flat rate of $59).

Shopping protection and guarantees are also included for certain purchases. For instance, if you purchase a covered item through your Capital One Venture card and the manufacturer offers a 2-year warranty, you get double the warranty period – so a total of 4 years. Additionally, when you purchase a covered item which is later damaged or stolen, you can claim replacement up to $500.

Capital One Venture X Card

If the annual $300 travel credit and 10,000 bonus miles aren’t enough, Capital One has added additional perks to this super-premium card, making it a serious competitor amongst the other premium cards out there. This is a “Visa Infinite” card, the same Visa class as the Chase Sapphire Reserve.

In addition to insurance (trip delay/cancellation reimbursement, rental car insurance, and lost luggage insurance, and cell phone protection), you’ll also gain complimentary lounge access to Capital One Lounges and over 1,300 Priority Pass lounges worldwide (AKA free food when flying).

You’ll also earn complimentary Hertz President’s Circle status and complimentary elite status with Avis, National, and Silvercar.

Unlike some other premium cards, you can add additional users to this card for no annual fee! This is super helpful when you’re trying to hit the minimum spend on the card to earn the sign-up bonus.

Final Thoughts

Both the Capital One Venture Card and the Capital One Venture X card provide solid reward potential for first-time free travelers. The fact that the cards each offer flexible redemption options, coupled with a powerful earning potential (2x miles for ALL PURCHASES!) the possibilities with these cards are endless.

Finally, no matter which card you choose, you’ll get great value from the sign-up bonus and redemption options.

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.