“Why should I pay the banks to use their credit cards?” I’ve heard this saying way too many times. People think that annual fees don’t make sense. On the surface, they don’t. But when you dig deeper, you can really start to see why you shouldn’t worry about paying annual fees.

You Shouldn’t Worry About Annual Fees Because You Come Out Ahead

The biggest reason you shouldn’t worry about annual fees is that you’re getting more overall value!

Let’s do a quick experiment. If I told you that you could get $625 if you paid me $95, would you?

Everyone would take that deal in a heartbeat.

This is why you shouldn’t worry about annual fees. When you get your sign-up bonus, you are getting more value than the annual fee you’re paying. The numbers I used in the experiment were chosen for a reason. Let’s say that a sign-up bonus for the Chase Sapphire Preferred is 60,000 points, but the card comes with a $95 annual fee. When you redeem your points for travel in the Chase Travel℠ Portal they’re worth 1.25 cents each. This makes the 60,000 point bonus worth $750 in free travel.

When you’re following a strategic plan to earn sign-up bonuses, annual fees don’t matter because you’ll be beating the value. Every. Single. Time.

Premium Annual Fees Come With Premium Services

Many people find a $95 annual fee easier to swallow than a $550 annual fee. For good reason. $550 is a lot to pay for a credit card. You shouldn’t worry about these high annual fees because they are providing you with some great premium services.

Let’s look at the $550 annual fee on the Chase Sapphire Reserve, one of my personal favorite cards.

For $550 you get a $300 travel credit, and a $100 global entry credit every 4 years. In the first year, that’s $400 in value, effectively making the annual fee $50. Every year after that, you’ll still get the $300 travel credit leaving you with a net annual fee of $250.

Not so bad anymore. So what are you getting for that $250 to make it worthwhile?

One of my favorite perks is $75,000 in primary rental car insurance. This means every time you rent a car you don’t need to pay for any additional insurance. In some countries, such as Mexico, this can save you about $25 or more every day. I’m taking a 7-day trip to Mexico this month and renting a car. Using my rental car insurance will save me at least $175.

This doesn’t even begin to discuss lounge access that I receive thanks to a free Priority Pass membership!

Great choice for a frequent traveler, but note the large annual fee. If you're starting out or not going to travel frequently in the coming year, you might want to instead consider the Chase Sapphire Preferred.

You Should Be Strategic with the Cards That Don’t Give You Value for the Annual Fee

So you don’t like rental cars, you’ve already gotten PreCheck, and you have priority pass membership from another card. Then should you worry about annual fees?

Yes, but you still shouldn’t worry because you have options. If our goal is earning free travel through sign-up bonuses, then we have to make a decision as to whether we keep the cards that have high annual fees beyond earning the sign-up bonus. After all, it’s easy to get enough value in the first year because of the sign-up bonus. After the first year, if you’re not using the additional benefits enough to justify the cost, you have the option to downgrade or cancel your card. Be sure to check out our blog post, “Be Strategic About Upcoming Annual Fees” to read our take on what you should do if you’re no longer getting value on your high-fee card.

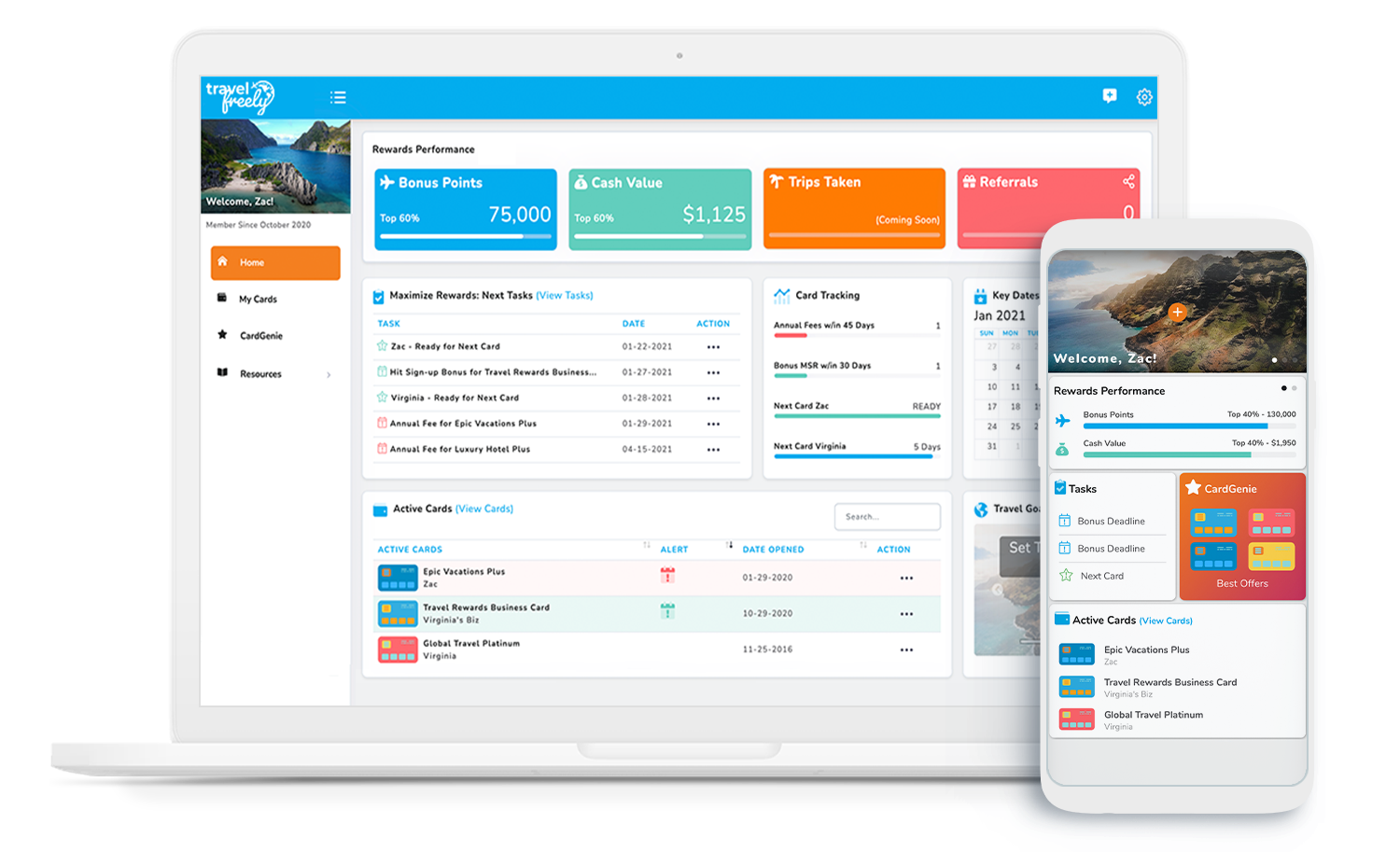

Don’t forget! Automate your annual fee tracking with Travel Freely. We’ll send you email reminders when your annual fees are due (and when your sign-up bonus deadlines are coming up too). Sign up now. It’s free. =)

Related Articles: