If you love to travel and only use cash back cards, you’re wasting the opportunity to earn an incredible amount of points and miles with your regular spending.

When looking for your next credit card, you’ll find that each card has something different to offer. Some cards provide rewards points and others offer the option of cash back. If you’re new to points and miles (and especially if you haven’t booked a trip yet), it can be confusing to know which is more valuable.

I’ve been helping many people who are just getting started with points—especially with Chase Ultimate Rewards from the Chase Sapphire Preferred® Card—and I always share this same message:

Points are much more valuable than cash back.

If you love to travel and only use cash back cards, you’re wasting the opportunity to earn points and miles with your regular spending.

Let’s break this down:

Most cash back cards earn anywhere from 1% – 2% cash back on purchases. There are special “spending categories” that can earn up to 4% – 6% back these days, but most of those are capped at a relatively small amount of maximum spending. For these examples, I’m going to compare the rewards redemptions to someone getting 2% cash back on everything.

1Example 1: Regular spending boosted by rewards card signup bonuses

Let’s understand the real “cash back” value of your rewards card signup bonuses.

Someone takes 10 minutes to sign up for the Chase Sapphire Preferred and puts every expense on their Sapphire for the next 2-3 months. Let’s say the minimum required spending to hit the bonus is $4,000 in spending. They spend their $4,000 on the card and earn a hefty sign-up bonus. If done correctly, they would have earned these points for their typical, everyday spending (no extra spending needed).

Offers go up and down, but let’s say the Sapphire Preferred sign-up bonus is 60,000 points. If the Sapphire cardholder used their 60,000 points to book travel through the Chase Travel℠ portal, the points would value at $750. This means that the $4,000 in spending adds up to over 15% cash back!

Meanwhile, the person using a cash back card would need to spend $37,500 in order to earn $750!!!

The value of this one signup bonus clearly outweighs the value of cash back.

Example 2: Points and miles crush the value of cash back in many travel planning scenarios

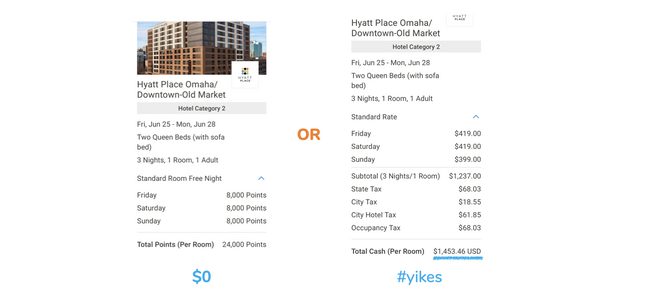

I’ve been watching a lot of college baseball lately, and my favorite team is Vanderbilt. When they made it to the College World Series in Omaha, Nebraska, I knew I had to go! When looking at hotel prices, I was finding basic rooms for a ridiculous cost of $200 – $400 per night.

In less than two minutes, I opened up my Hyatt app and saw there were rooms at the Omaha Hyatt for $399/night or 8,000 points. Because Hyatt is a Chase transfer partner, I transferred 16,000 Chase Ultimate Rewards points over to Hyatt and booked a hotel room for two nights, knowing I could cancel my reservation for free and get my points back.

My out of pocket costs = $0 + 16,000 points.

The person using a cash back card would have to pay $800 + taxes for the room. And, if they were earning 2% cash back on their card, they would have to spend $40,000 to earn that amount of cash.

Example 3: Emirates Business class

Most intermediate and advanced free travelers know that international business or first class tickets can be some of the absolute best value of points and miles. It can take a bit of work to find the right airline and transfer partner, but it pays off big time. The reason for this significant value is because international business class award tickets can be double the points required for the economy ticket. In contrast, a business class cash price is 5-10x the cash price for economy. Plus, there is the luxurious awesomeness of booking a flight you would probably never pay cash for is pretty awesome!.

I recently booked a first class ticket back from Europe on Emirates. This ticket cost me 85,000 American Express Membership Rewards points + $99 in fees. This was less than one bonus I recently earned by opening the Amex Platinum Business Card. You can also transfer Citi ThankYou® Points to Emirates. Learn more about the Citi Premier® Card here.

The cash price would have been $4,270. This means the person focusing on cash back would need to spend $213,500 over time to earn the same redemption. This is clearly unrealistic.

Summary

When it comes to rewards vs. cash back, would you rather be a free traveler or someone who earns cash back? I hope you can see the major contrast in strategies and the huge value of points when compared to cash back.

If you’re hesitant to redeem points instead of cash back, it’s important to know that there are cards out there that allow you to earn points and redeem them in a variety of different ways. By using flexible points like Chase Ultimate Rewards, you’re not limited to a certain airline or hotel brand. See: Chase Ultimate Rewards Guide.

This is a card with a huge welcome offer and loaded with benefits for frequent travelers. However, the very large annual fee needs to be weighed versus the benefits. Terms apply.

An excellent rewards card with a solid signup bonus and 3x spending categories. This card is comparable to the Chase Sapphire Preferred, but with different transfer partners. Read new application rule carefully regarding "48 months."