Plastiq is an online bill payment service that lets you pay some of your bills by credit card. This can be a great way to reach spend targets for new credit card signup bonuses.

The catch? A fee is charged to the payer (not the payee) for each payment.

Plastiq Overview

- Standard credit card fee: 2.9%

- Standard debit card fee: 2.9%.

- Visa, MasterCard, Discover, and Amex credit, charge, and debit cards are accepted.

- Plastiq cannot be used to pay friends and family. It is intended only for paying bills.

- Prepaid cards are accepted, but are officially limited to either $5,000 or $10,000 total per month (depending on the individual account).

- Credit card payments count as purchases, not as cash advances. Plastiq will prevent any payments that could possibly incur cash advance treatment. If Plastiq thinks that there’s a chance of a payment being treated as a cash advance, Plastiq won’t let you finalize that payment.

- Plastiq sometimes requires proof that you are paying a legitimate expense. They may ask you to upload an invoice, for example.

- Plastiq does not submit tax forms on behalf of customers or payees

- Some people have asked if they can have checks that are addressed to others sent to their own house so that they can submit the check with a payment stub or so they can hand the check to the payee directly. Plastiq does not allow this.

Credit cards that can be used with Plastiq

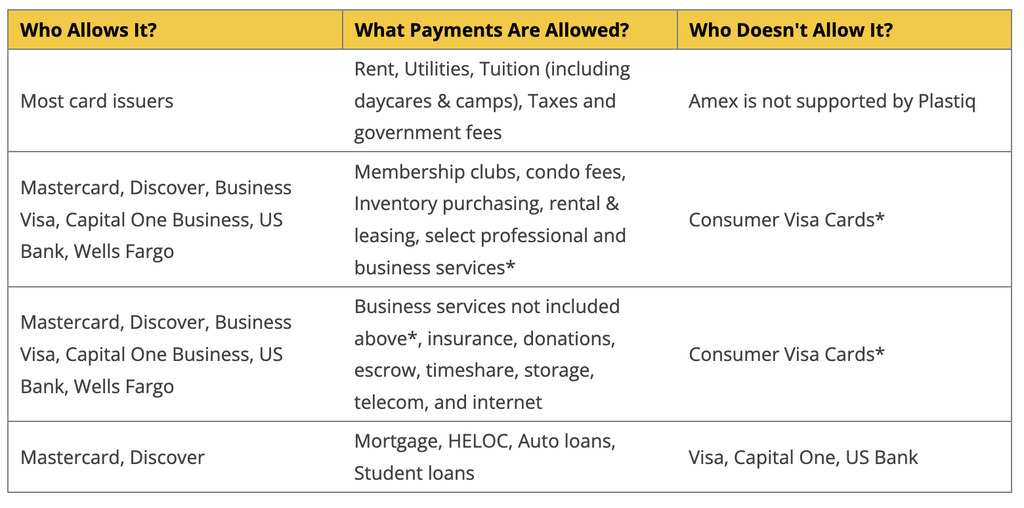

Plastiq originally had one set of rules as to which types of payments were allowed. Soon, though, payment networks and banks came up with their own unique rules, which Plastiq was forced to follow. Now, figuring out which cards can be used for which purpose is really hard. The image above is my attempt to summarize the rules. For more complete rules, see the following pages on Plastiq’s website:

- Supported Payments by Card Brand. This shows a detailed list of bill types (rent, mortgage, auto purchase, landscaping, advertising services, etc.), and it indicates whether or not each is payable with Amex, Discover, Mastercard, or Visa. This page appears to cover everything, but it doesn’t. It leaves out some important details covered in the following pages…

- Personal Visa Card Restrictions. Most personal Visa cards (but not business Visa cards) are limited to the following types of payments: Rent, Utilities, Tuition (daycares & camps included), Taxes & Government Fees, Insurance, and Club Fees. Chase, though, allows additional payment types but applies a lower transaction limit to these payments (i.e. lower than your available credit limit).

- American Express Restrictions. Amex has a specific list of payment types they accept. This page summarizes Amex’s rules. Better details of what is allowed and what is not is found here: FAQ- What can I pay with my American Express?

- Capital One Card Restrictions. Personal Capital One cards can’t be used with Plastiq. Capital One Business cards can be used, but not for Mortgage, Home Equity Line of Credit, Auto Loans, or Student Loans.

- U.S. Bank Credit Card Policy. U.S. Bank cards, cannot be used to pay Mortgage, Home Equity Line of Credit, Auto Loans, or Student Loans.

- Prepaid Card Restriction. Personal prepaid cards are officially limited to either $5,000 or $10,000/month, depending on the account. In practice, some people can exceed those limits.

Visa cards issued by Alliant, Navy Federal Credit Union, and USAA supposedly won’t earn rewards for Plastiq payments.

Payment types that aren’t allowed with Plastiq

Some types of payments are never allowed by Plastiq:

- Payments to credit cards

- Payments to self

- Payments to friends or relatives*

- Payments to savings accounts, trust accounts, retirement accounts, health savings accounts, or similar

- Payments to 529 Education Savings Programs

- You may not send payments to your own address so that you can include your bill’s pay stub when you send in the check. Instead, put your account number and other relevant info into Plastiq’s memo field.

* Paying friends or relatives is not allowed unless friends/relatives provide truly billable services. For example, if your uncle is your landlord, you could pay rent to your uncle through Plastiq.

Frequently Asked Questions

Why pay bills with Plastiq?

Since Plastiq charges a fee for credit card payments, I wouldn’t recommend using Plastiq to pay bills that can already be paid by credit card with no fee. For those bills that can’t already be paid by credit card, though, there are a number of reasons to consider Plastiq:

- Easy way to meet credit card bonus minimum spend requirements. See: Best credit card offers.

- Earn credit card rewards. It is ideal to use Plastiq when the value of your credit card rewards outweighs Plastiq’s fee.

- Earn credit card “big spend” bonuses (bonus points, free nights, companion tickets, elite status, etc.).

- Some credit cards and debit cards offer rewards for frequent use. One example is the Amex Everyday Preferred card that offers a 50% bonus for every billing cycle in which you make 30 eligible charges. Plastiq can be used, for example, to make weekly payments to a variety of payees in order to help increase your monthly charges.

- Convenient to consolidate all bill payments to a single service and/or credit card.

- It is safer to pay by credit card for services or goods not yet fully delivered because it gives you the ability to initiate a credit card chargeback if the payee doesn’t deliver as promised.

- Plastiq makes it possible to pay bills when you do not have the cash readily available. While it is never a good idea to go into credit card debt, paying by credit card can give you more time to get the required funds.

Are Plastiq payment fees a business expense?

Businesses can use Plastiq for many purposes, such as:

- Paying vendors and suppliers

- Paying employees and contractors

I believe that bill payment fees are legitimate business expenses that will reduce your businesses taxable profits. So, the net cost to your business, after taxes, will be less than Plastiq’s fee. Note: I am not an accountant, so you should not take this as professional advice.

Can you pay taxes with Plastiq?

Plastiq can be used to pay federal or state taxes. To do so:

- Go to Plastiq’s US tax page.

- Select whether you are paying federal or state taxes and which state you are from.

- Pick the type of tax you’d like to pay.

- Click “Pay my taxes” and sign into your account.

Note that for federal taxes, there are other options for paying with credit and debit cards with lower fees. See the Complete guide to paying taxes via credit card, debit card, or gift card.

How long does a Plastiq payment take to be delivered?

Payments by check usually take about a week, but two weeks is not unusual. Keep in mind that the payee who receives the payment may take even longer to process the payment, so it is important to have payments sent well in advance of their due date.