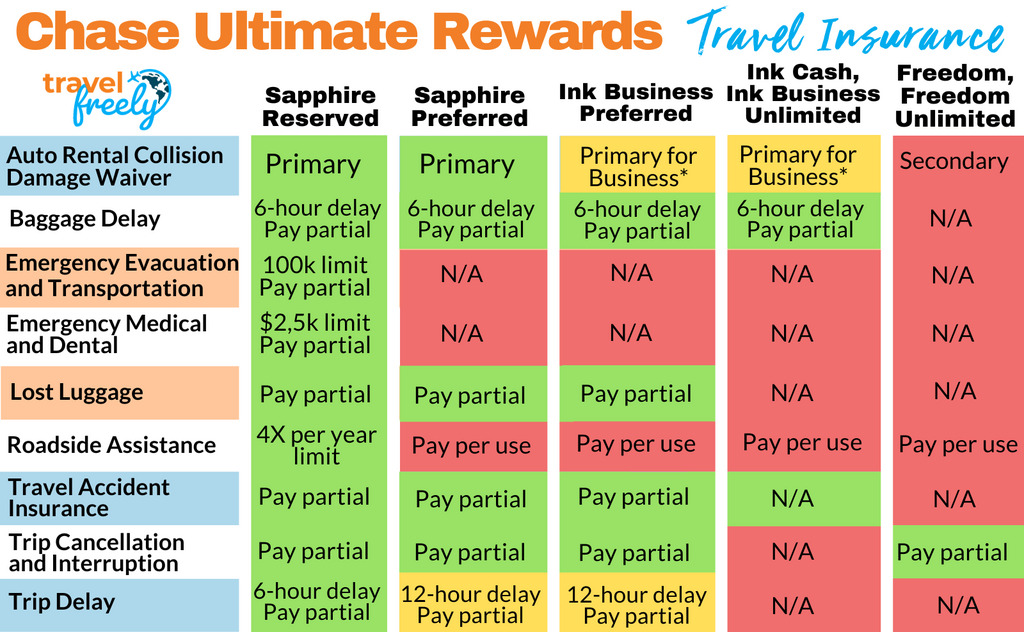

Many credit cards include automatic travel protections when you use your card to purchase travel. In this post, you will see the comparison of protection provided by each of Chase’s Ultimate Rewards cards including the Sapphire Reserve, Ink Business Preferred, Sapphire Preferred, and more.

The following chart summarizes travel insurance provided automatically by each Ultimate Rewards card. Cells in green indicate best in class coverage, yellow indicates good coverage, red indicates worse than peers’ coverage. “Pay partial” means that you can get full coverage even if you pay only part of your transportation costs with this card. For example, you could pay just the taxes and fees for an award flight. Or, you could pay part of a cruise with gift cards and the rest with the credit card.

* Each of these cards offers primary coverage outside of your country of residence. Unfortunately, the Ink Cash, Ink Business Unlimited, and Freedom Unlimited cards all incur foreign transaction fees outside of your country of residence.

Based on the above chart, we can conclude that:

- Chase Sapphire Reserve has the best all-around coverage compared to other Ultimate Rewards cards (it also has the best when compared to ultra-premium cards).

- The Sapphire Preferred and Ink Business Preferred cards have nearly identical coverage. The only obvious difference is that the Sapphire Preferred offers primary coverage within your country of residence for personal or business travel. The Ink Business Preferred offers primary coverage within your country of residence only for business purposes. Outside of your country of residence, all of the cards in this roundup offer primary coverage.

Card comparison for other travel-related perks

| Sapphire Reserve | Sapphire Preferred | Ink Business Preferred | Ink Cash, Ink Business Unlimited | Freedom Flex, Freedom Unlimited | |

|---|---|---|---|---|---|

| Foreign Transaction Fee | Waived | Waived | Waived | Yes | Yes |

| Points per dollar for travel | 3X | 2X | 3X | 1X (Ink Cash) 1.5X (Unlimited) | 1X (Flex) 1.5X (Unlimited) |

| Points per dollar for dining | 3X | 3X | 1X | 2X (Ink Cash) 1.5X (Ink Unlimited) | 3X |

| Cents per point redeemed for travel | 1.5 | 1.25 | 1.25 | 1 | 1 |

| Transfer points to partners? | Yes | Yes | Yes | No* | No* |

| Priority Pass Select Lounge Membership | Yes | No | No | No | No |

* Points earned on the fee-free Ink and Freedom cards cannot be directly transferred to airline and hotel partners, but you can move the points to your or a household member’s Preferred or Reserve card and then transfer.

Card overviews

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.

Great choice for a frequent traveler, but note the large annual fee. If you're starting out or not going to travel frequently in the coming year, you might want to instead consider the Chase Sapphire Preferred.

Conclusion

It should be no surprise to anyone that the ultra-premium Sapphire Reserve card offers the best travel protection and perks. For those who use points primarily to transfer to airline and hotel partners, the much cheaper Chase Sapphire Preferred and Ink Business Preferred cards may be good alternatives. Like the Sapphire Reserve, both of these cards provide very good travel protections (not as good, but very good), no foreign transaction fees, and the ability to transfer points to airline and hotel programs. The Ink Business Preferred has the edge over the Chase Sapphire Preferred is offering 3X for travel, but the Sapphire Preferred counters with 2X for both travel and dining.

Note: This article was inspired by Frequent Miler – any content used with permission.