Capital One Miles has become a premier transferable currency system over the past several years. In addition to Capital One’s long-popular ability to cover travel charges with points, Capital One miles cards feature 1:1 transfers to a range of valuable airline and hotel partners. Furthermore, Capital One makes it very easy to combine rewards between your cards or even between cardholders. Capital One’s “Miles” rewards compete directly with other transferable points programs such as Chase Ultimate Rewards, Citi ThankYou Points, and Amex Membership Rewards.

Capital One Miles can be redeemed for $0.01 each toward travel purchases or transferred 1:1 to most airline and hotel partners. Miles can be earned via credit card bonuses, and ongoing spend and cashback can be converted to miles if transferred to a miles-earning card. In addition to being used to cover travel purchases or transferred to partners, Capital One Miles can be redeemed for gift cards or converted to cash back (Note: cash back redemptions are a horrible value).

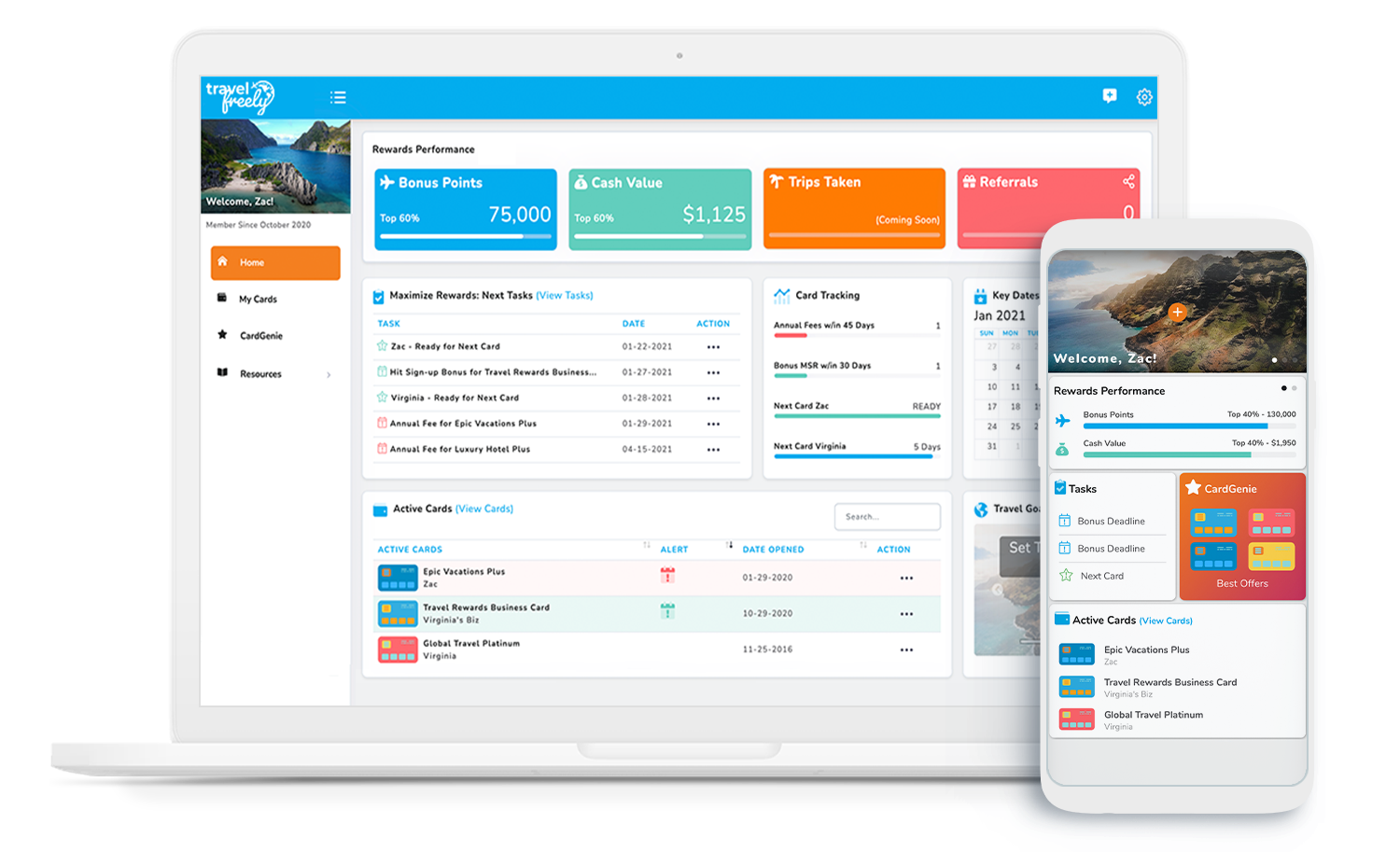

For a beginner, I like Capital One Miles for three reasons.

1) They are the easiest to redeem. Using miles to reimburse yourself for travel expenses you put on a Venture card is a fairly easy process.

2) Your free travel can be felt immediately. If your trip is just a few weeks away, you can use your card immediately for travel purchases before hitting your bonus. Then, once you hit your bonus, you can redeem miles retroactively for travel purchases.

3) You earn your bonus ASAP when your spending requirement is reached. Once you meet your required spending, those miles show up right away. No waiting for billing cycles or next month’s statement.

Below, you’ll find everything you need to know about Capital One Miles.

Earning Capital One “Miles”

Earn Capital One Miles from credit cards

The easiest and quickest way to earn Capital One “miles” is through Capital One® Venture® and Capital One® Spark® Miles credit card welcome offers. Below are the current Capital One cards that earn Capital One miles.

Personal Cards:

Great "ultra-premium" card. Despite the big annual fee, the overall first year value is worth it for most people. This is due to the large signup bonus, extra benefits like Priority Pass, up to $300 annual travel credit and Global Entry/TSA PreCheck credit.

Best "easy to use" starter card (or complement to the Chase Sapphire Preferred) for those who don't want to think when it comes to earning and redeeming miles.

Business Cards:

Another good business card for those who like Capital One. Similar to the Spark Cash, but instead of cash, it allows you to earn and redeem miles as statement credits for travel purchases.

Redeem Capital One “Miles”

Capital One “miles” are worth 1 cent each when redeemed to cover travel purchases. It is possible to get even more value by transferring points to airline partners.

Reimburse Yourself Using Miles

The easiest way to use Capital One Miles is to reimburse yourself for travel expenses put on the card. Purchases made from airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and time shares are generally considered to be travel purchases for the purposes of requesting a statement credit by redeeming Capital One miles (note that this is based on the merchant category code assigned to them by the merchant). Requests for a statement credit must be made within 90 days of the date your travel purchase posts to your account and can be done easily online.

Since you can make your purchases directly from travel providers, you can make bookings that qualify for elite credit / benefits and then apply your Capital One Rewards “miles” after the fact. Another somewhat unique feature in the Capital One system is that you do not need to have earned the necessary miles before making a booking since you have 90 days from the date the charge posts to your account to make a redemption.

Why is this such a good idea for those traveling ASAP? For those taking a trip in just a weeks, you can signup for a Capital One Venture Rewards Credit Card and use it for travel purchases right away. Then, you can earn your signup bonus and retro-actively apply your miles to those initial purchases. Most of the travel rewards cards require you to hit your bonus spending before taking advantage of free travel.

Purchases made from airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and time shares are generally considered to be travel purchases for the purposes of requesting a statement credit via Capital One’s “Cover Travel Purchases” (though note that this is based on the merchant category code assigned to them by the merchant). “Cover Travel Purchase” requests for a statement credit must be made within 90 days of the date your travel purchase posts to your account and can be done easily online.

Since you can make your purchases directly from travel providers, you can make bookings that qualify for elite credit / benefits and then apply your Capital One Rewards “miles” after the fact. Another somewhat unique feature in the Capital One system is that you do not need to have earned the necessary miles before making a booking since you have 90 days from the date the charge posts to your account to make a redemption.

Book through Capital One Travel

Often the best use of a transferable currency is to transfer points to airline partners in order to book high-value awards. Your best bet is usually to wait until you find a great flight award before transferring points. Also, Capital One added two new partners namely: Accor Live Limitless and Wyndham.

Transferring to your chosen program is simple: log in to your credit card account, click your Rewards Miles balance, then choose “Transfer Your Rewards”. From there, select your chosen program and enter your loyalty account information as well as the number of miles you wish to transfer in increments of 100 Capital One Rewards miles.

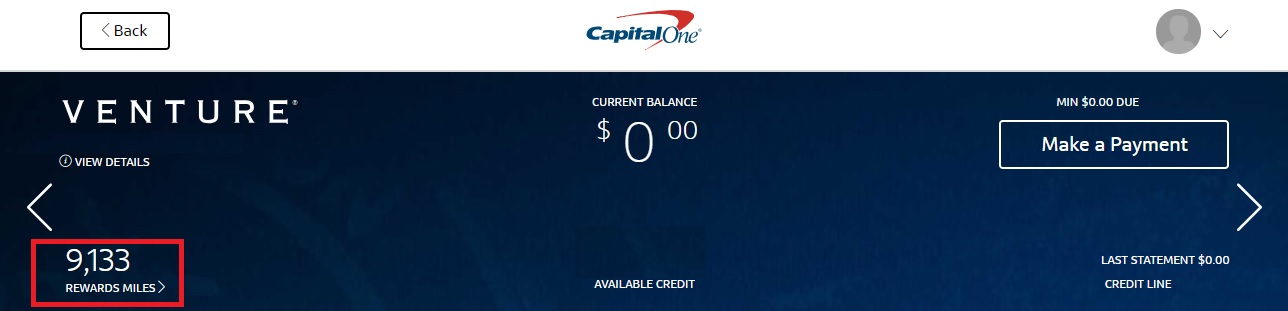

Step 1: Log into your credit card account

Log in to your account and click on your “Rewards Miles” balance.

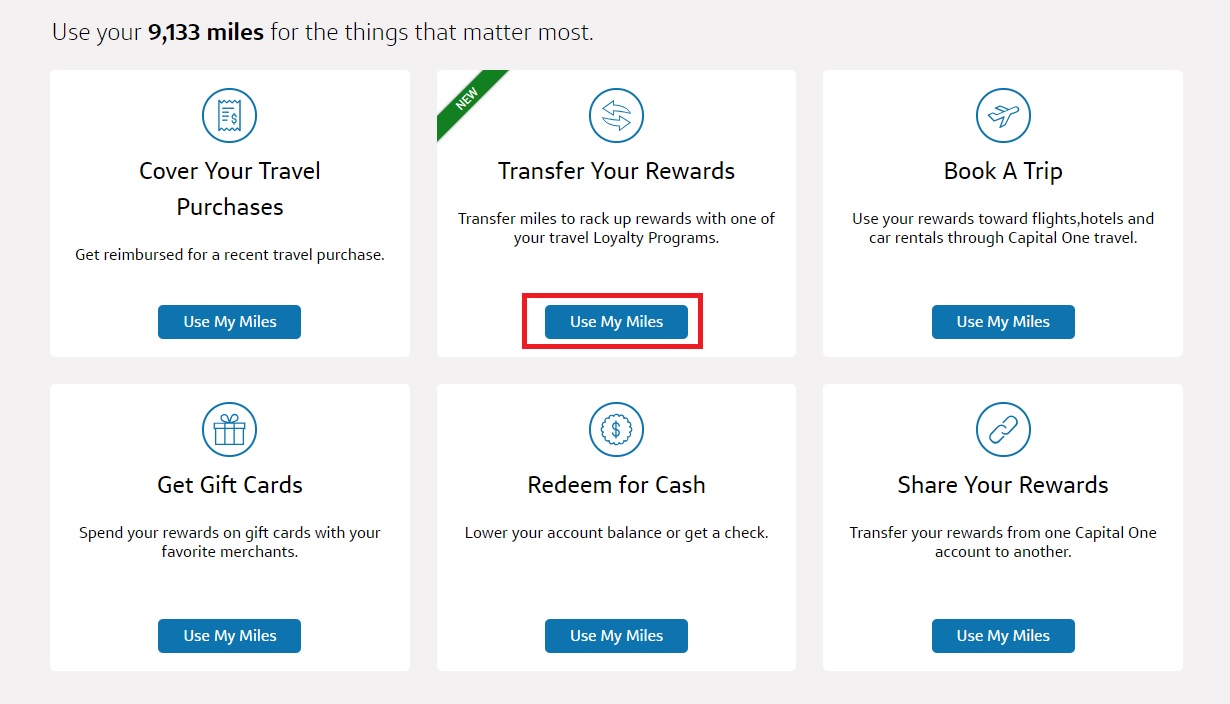

Step 2: Scroll down and click “Use My Miles”

On the next page, scroll down to “Transfer Your Rewards” and click “Use My Miles”.

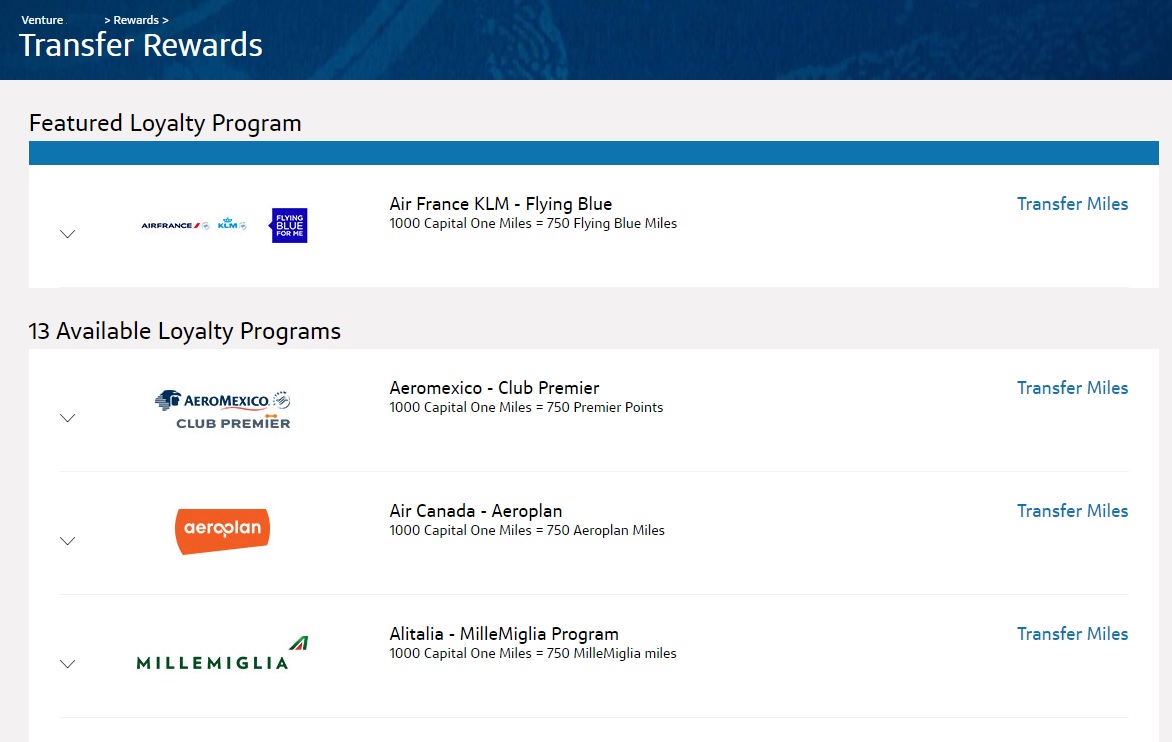

That will bring you to the page of transfer partners and ratios.

Step 3: Click on your chosen partner

From there, if you click on a partner, it will expand details and provide a link to “Enroll Now” if you are not yet a member of that rewards program.

Next click “transfer miles” to the right of the ratio.

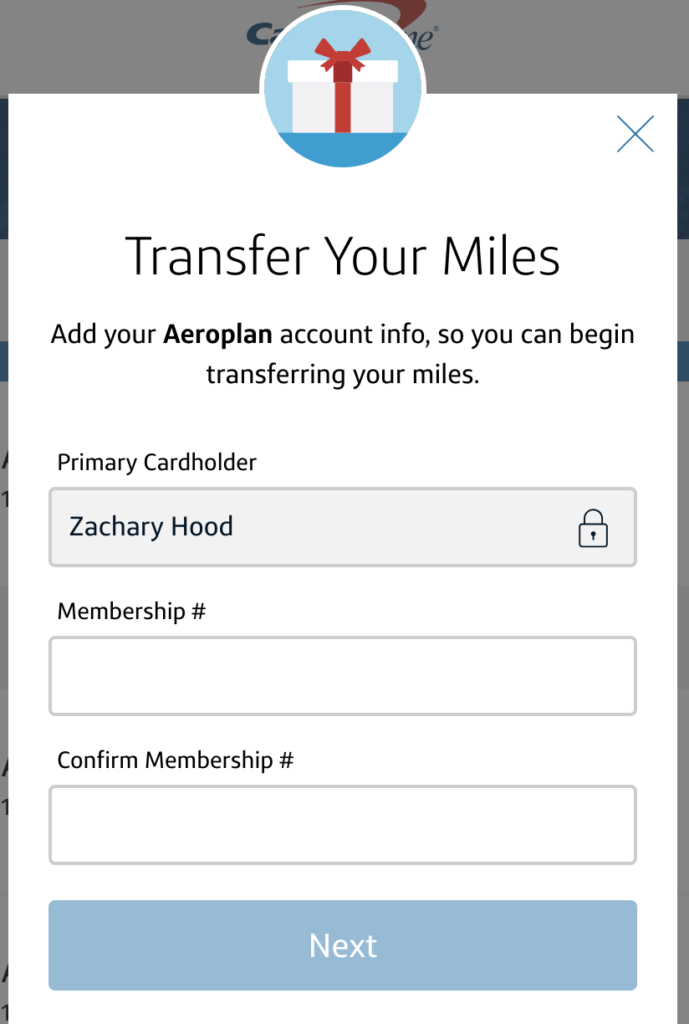

Step 4: Enter your loyalty account information

You’ll next need to enter your Membership Number twice. You can paste it into the first field, but you’ll have to type it in the second time.

One notable point here: the terms state that the Loyalty Program must be registered to the exact username on the Capital One account.

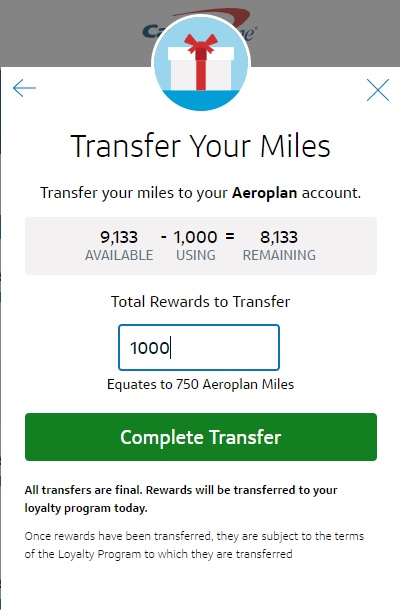

Step 5: Choose the amount and complete the transfer

Finally, choose the number of miles you would like to transfer and click “Complete Transfer”. That’s it!

Transfer Partners

| Rewards Program | Capital One Transfer Ratio | Best Uses |

|---|---|---|

| Accor Live Limitless | 1000 to 500 | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia |

| Aer Lingus Avios | 1 to 1 via BA | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. |

| AeroMexico ClubPremier | 1 to 1 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air Canada Aeroplan | 1 to 1 | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. |

| British Airways Avios | 1 to 1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of first class by adding on a business class flight. |

| Choice | 1 to 1 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan |

| Emirates Skywards | 1 to 1 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. |

| Etihad Guest | 1 to 1 | Etihad has a very competitive award chart for American Airlines flights, among others. For example, they charge only 50,000 miles one-way for business class flights from North America to Europe. Partner awards must be booked over the phone. |

| EVA Air Infinity MileageLands | 1000 to 750 | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. |

| Finnair Plus+ | 1 to 1 | Award prices are quite high compared to competing programs. Interestingly, miles can be exchanged for tier points (towards elite status). |

| Iberia Avios | 1 to 1 via BA | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower when booking with Iberia rather than British Airways. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| TAP Air Portugal | 1 to 1 | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few great sweet spot awards including ANA first class between the US and Japan for as low as 55K points one-way; and US to Europe on Delta One business class for 50K points one-way. |

| Wyndham | 1 to 1 | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Additionally, you can book Vacasa vacation rentals for only 15K points per room per night. Wyndham Earner cards offer automatic 10% discount on award stays. |

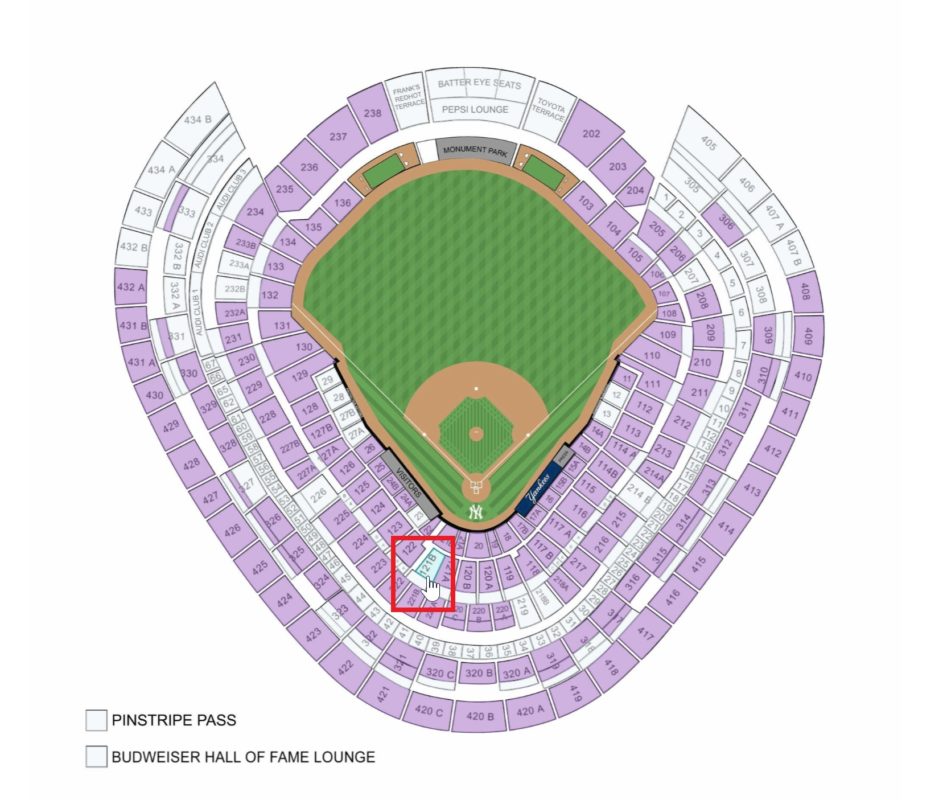

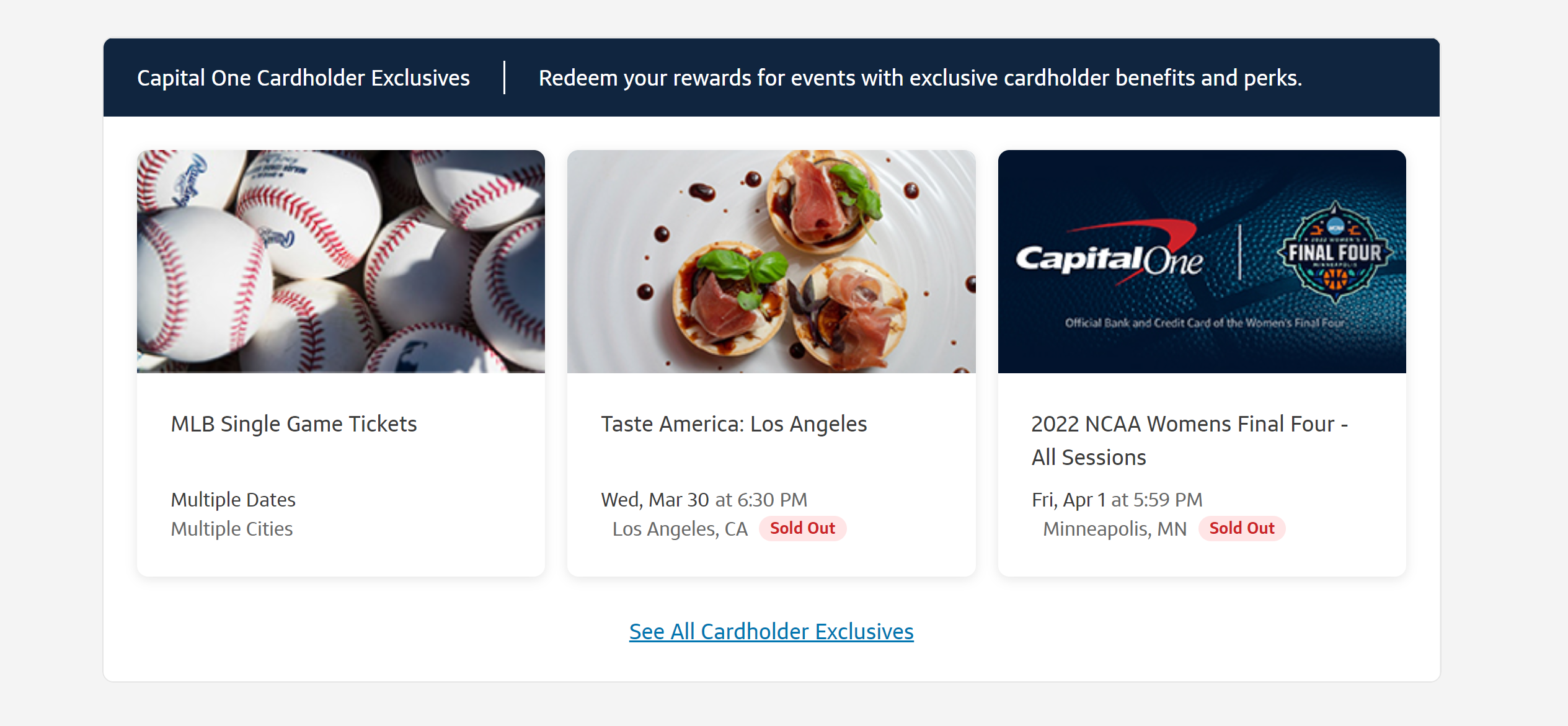

Capital One Entertainment experiences (baseball games, concerts, and more)

Capital One Entertainment is a portal for booking tickets to events and experiences. While many of these event tickets offer poor value for miles, some offer outstanding value.

For instance, Capital One Entertainment offers an incredible deal on great seats to Major League Baseball games.

Tickets using points have been available to events like the NCAA Final Four and college bowl games. If you like attending events, it is worth keeping your eye on the “Cardholder Exclusives” section at Capital One Entertainment.

Redeem Capital One miles for cash back

Capital One Rewards Miles can be redeemed for 0.5 cents each either as statement credits or as cash back via check. That’s a very poor value and not recommended.

Other ways to redeem Capital One miles

Through the Capital One Rewards portal you can redeem Rewards miles for gift cards. Most merchant gift cards (like Amazon, Best Buy, etc) yield exactly $0.01 per mile — that is to say that a $25 gift card costs 2,500 Rewards Miles. We generally don’t recommend redeeming for gift cards unless you value the gift cards at very near face value since you can get a full $0.01 per mile toward travel bookings or potentially more value yet with transfer partners and some brands of gift cards are frequently available for purchase below face value.

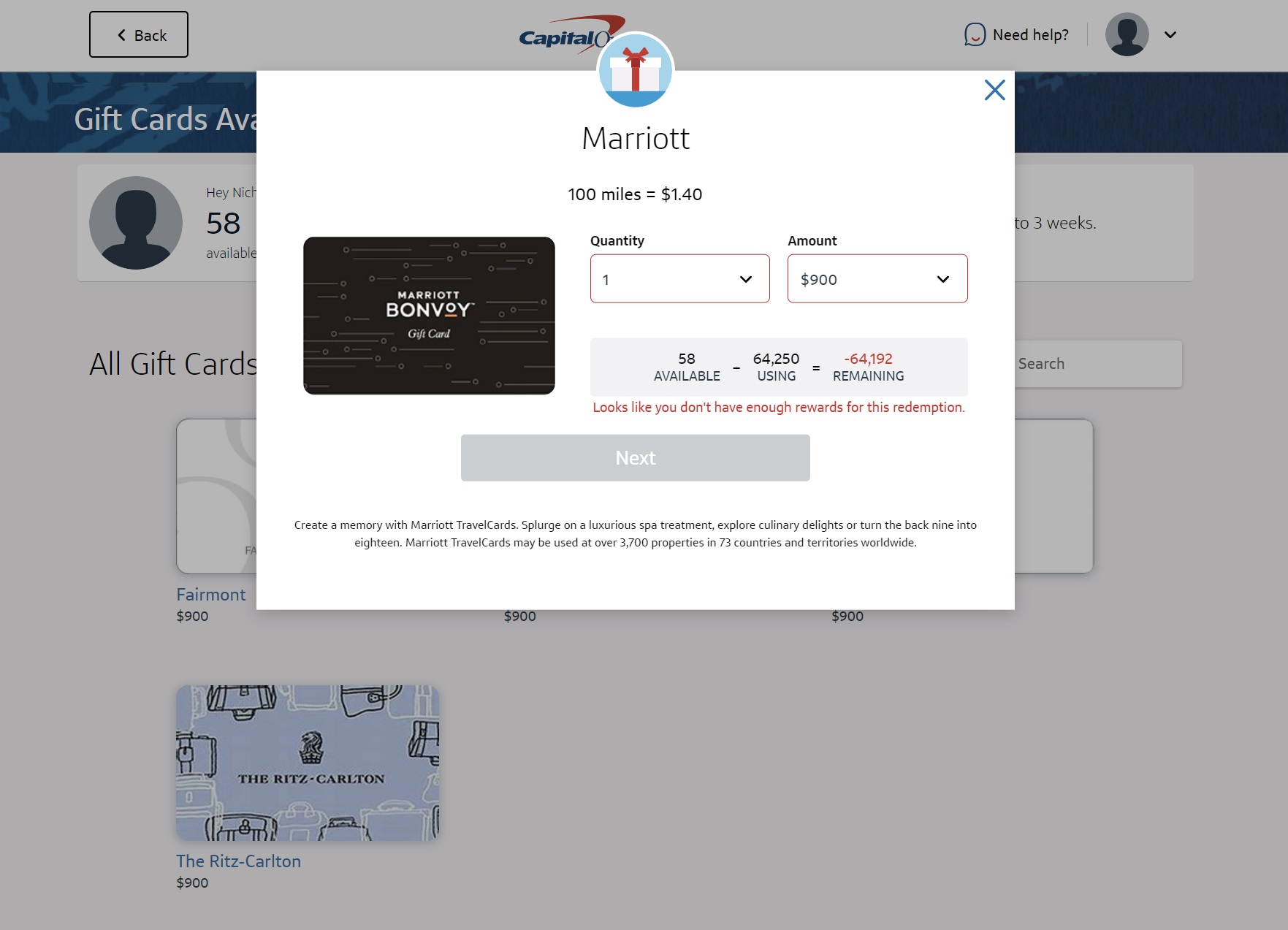

One notable exception is the ability for some (very small number of) cardholders to redeem for “Special Hotel Offers”, which are specific hotel gift cards offered at much better rates. At the time of writing, this section of the Rewards portal offers a $900 gift card to Fairmont, Marriott, Ritz-Carlton, or St. Regis for 64,250 miles (note that Marriott, Ritz, and St. Regis cards are practically the same as any of them can be used at any Marriott property; there used to be options to redeem for Four Seasons and Raffles gift cards but those have disappeared). This redemption yields a value of 1.4 cents per Rewards mile and certainly might be worth considering for those few cardholders targeted. We believe that this capability only exists on some old Capital One cards that were opened during a specific window of time when this benefit was offered, so this redemption capability won’t apply to most cardholders. Still, if you have an old Capital One account, it can be worth checking your account.

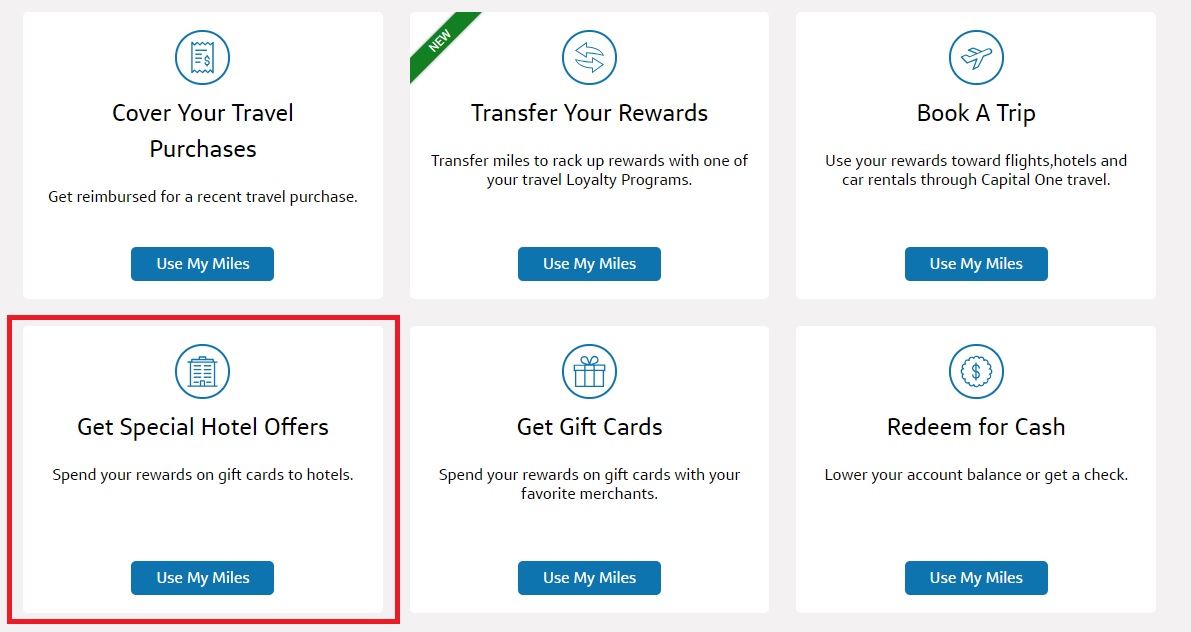

Those targeted for this redemption will not find the Special Hotel Offers under the “gift cards” section. To find these offers, log in to your credit card account, click on your Rewards miles balance, and then choose “Get Special Hotel Offers,” as seen below (if you do not see this option, you won’t have access to this redemption).

Our post, Capital One Miles Sweet Spots, details the best value uses of Capital One “Miles.” Either click here or click below to jump to a section of the post:

Manage Capital One “Miles”

Combine Points Across Cards

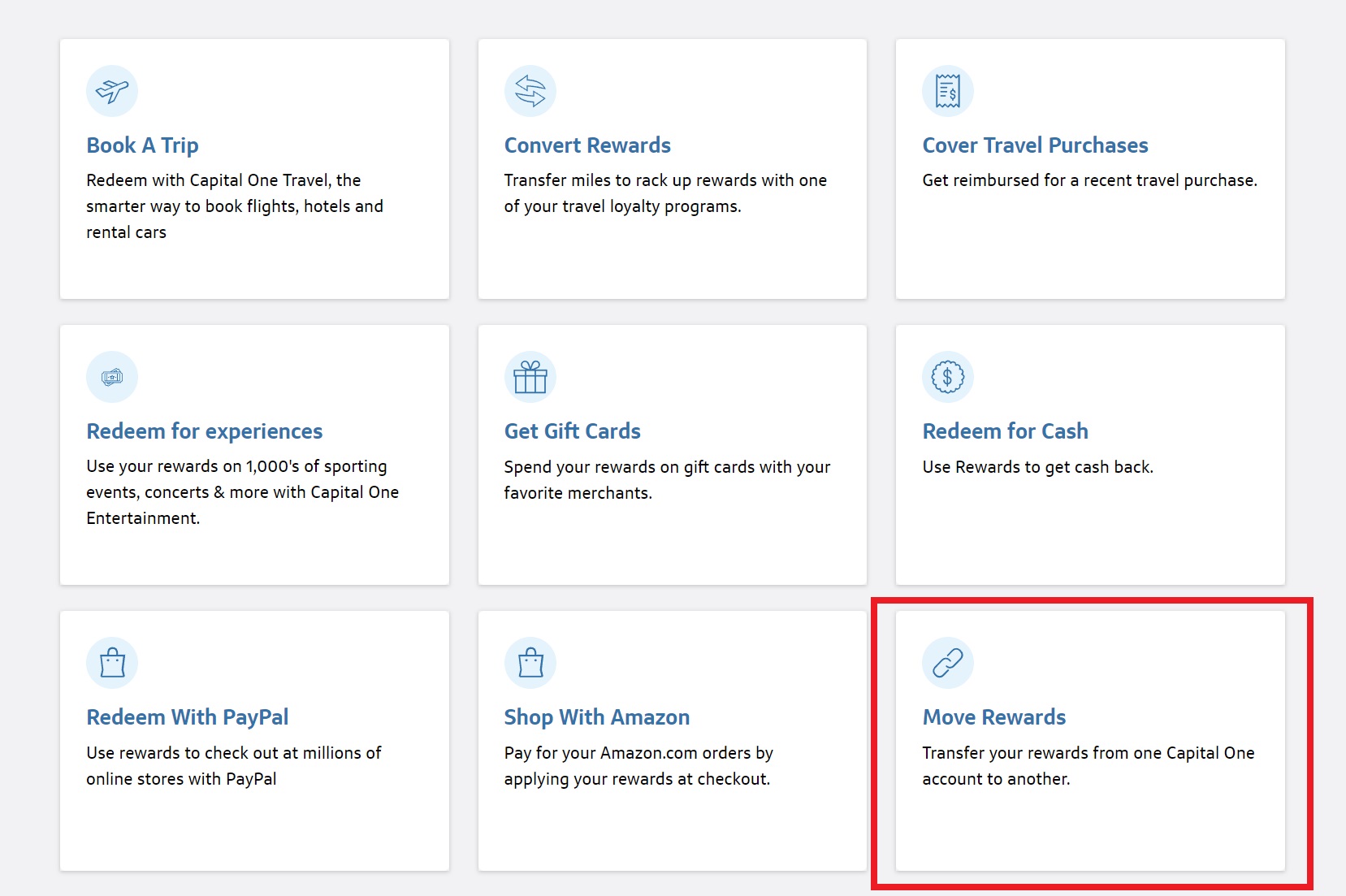

Capital One makes it very easy to combine Rewards among your own accounts. To do so (for example, to move Rewards miles from your Venture One card to your Capital One® Spark® Miles card), simply open the card account from which you wish to move the miles, click on “Redeem” under your Rewards miles balance, and choose “Move Rewards.”

This will give you a drop-down menu where you can choose the account to which you want to send your Rewards miles. You can then enter the exact amount you wish to transfer. There is no minimum transfer. The maximum is simply your current available Rewards miles balance.

Note that you can also move cash back earned on Capital One cash back cards to miles. While not a published program feature, if you click “Redeem” under your cash back rewards and choose “Move Rewards”, you can move cash back to your miles card at a value of $0.01 to 1 mile.

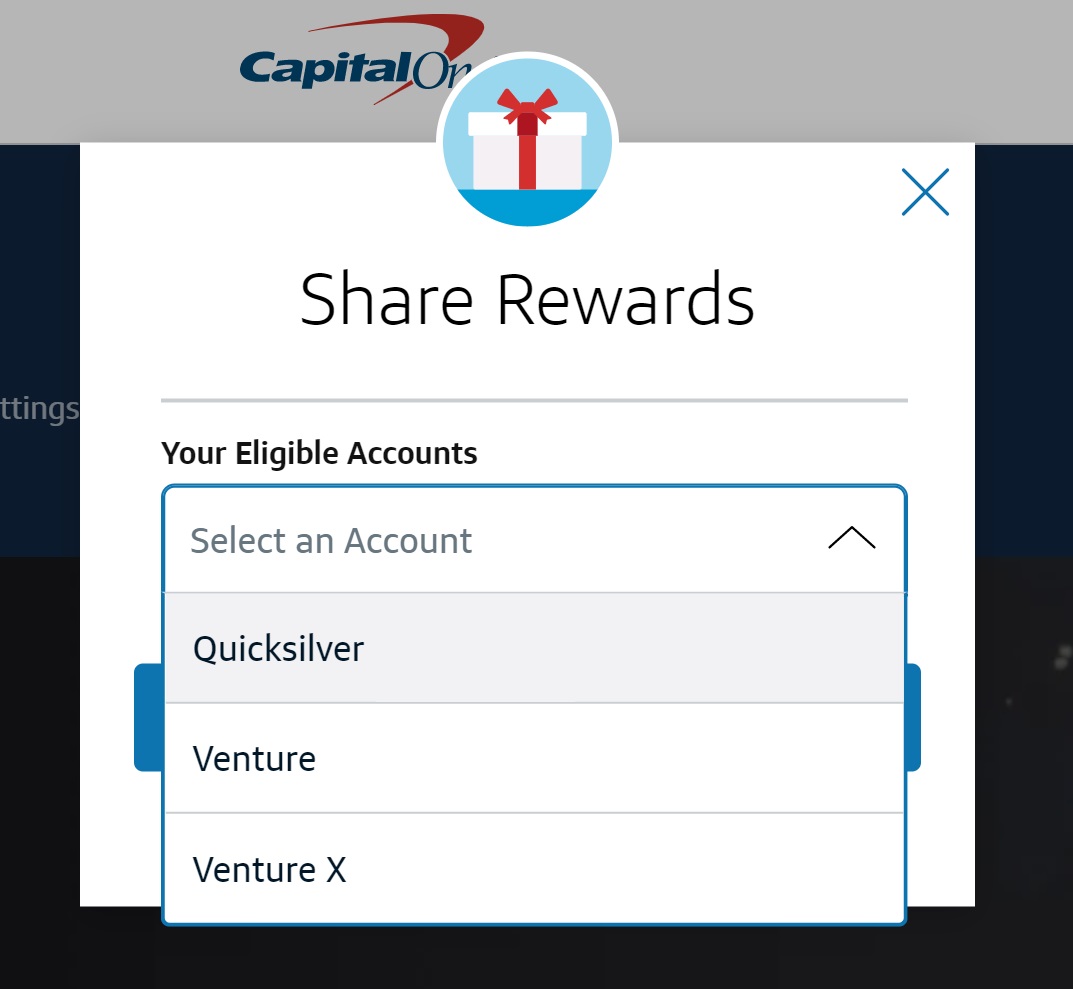

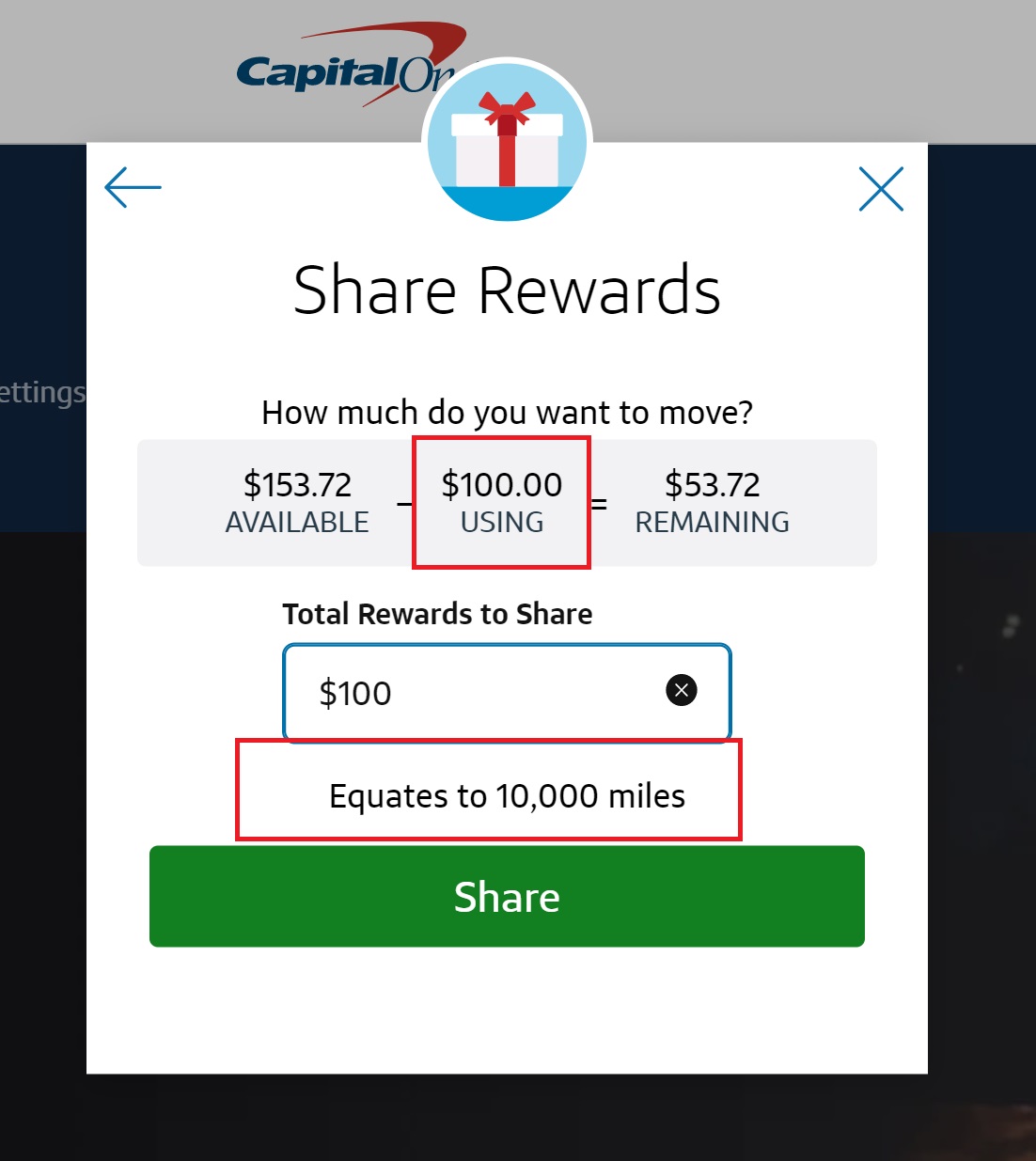

Share Points Across Cardholders

Capital One very generously allows people to transfer Rewards to anyone else for free. There are no minimums and no limits as to the number of Rewards miles you can transfer to another cardholder.

Unfortunately, this can not be done online. You’ll need to call the number on the back of your card and provide the agent with the name and card number of the person to whom you would like to transfer your Rewards miles. Keep in mind that the recipient will need to have a Capital One Rewards Miles-earning card to receive your miles.

This is valuable because:

- If your spouse/sibling/parent/neighbor/cousin/friend is a few thousand miles short of having enough for a business or first class ticket when transferred to a partner, this program feature makes it easy to top up and/or to combine with other transferable points to put together the desired award. Along the same lines, if you are redeeming points for several travelers and you would rather have them all on one PNR rather than booking multiple tickets out of separate accounts, combining points across cardholders can make this easier.

- If a friend has elite status with a particular program, there may be instances where it could be beneficial to transfer your Capital One rewards miles to your friend so that they can transfer to the desired airline or hotel program and make the booking for you (for instance, a friend with Air Canada elite status may have access to additional award inventory or preferential pricing on Air Canada flights).

How to Keep Points Alive

Capital One Rewards Miles do not expire as long as your account is open and in good standing. If you cancel an account with a Rewards miles balance, you will forfeit those rewards. For this reason, you’ll want to transfer to an airline partner or another Capital One miles-earning card via the methods above before canceling an account.

Earn Rewards through Capital One Shopping and Capital One Offers

Separate from its rewards programs, Capital One also offers a couple of ways to earn rewards through shopping, both for cardholders and non-cardholders alike.

Capital One Shopping portal: desktop, standalone app, and browser extension (no Capital One card required)

Capital One Shopping is a public shopping portal that does not require a Capital One card or account. Rewards earned through Capital One Shopping are not in any way connected to a Capital One account (I include this shopping portal in the Capital One Miles guide mostly to keep the distinction clear as the portal is otherwise irrelevant to Capital One credit cards). Instead, cash back rewards earned through Capital One Shopping are banked in your shopping portal account and can only be redeemed for gift cards. Note that Capital One Shopping exists as a desktop website, a standalone Capital One Shopping app (not affiliated with the Capital One app), and a browser extension. We have seen some very good targeted offers for those with the extension installed.

More information

You can find the full terms and conditions for your card by logging in to your account, clicking on your rewards balance, and clicking on “Terms and Conditions” or “FAQ.”