If you’re a business owner, you don’t have time to waste by researching cards. We’ve done it for you. This list includes the very best business card offers. Check out Rewards Cards 101 to understand the basics of rewards cards. You can support Travel Freely by using our partner links when you sign up for a card, which may earn us a commission.

Please note: If there’s a better link I can offer that will not earn us a commission, I will post the better offer. I hope that earns your respect and trust over time.

Looking for instructions on how to apply for a business credit card? Click here to skip down below for step-by-step instructions.

Not sure if you’re eligible? You probably are. Read “Am I Eligible for a Business Card?”

#1 Overall Business Travel Card – #1 Sign-up Bonus

This is the best overall business card right now with a great sign-up bonus and 3X categories. It’s hard to beat the Chase Ink Business Preferred if you’re looking for an all-around business card that has flexible redemption options and can be combined with your personal Chase Ultimate Rewards points. We value Chase points at 1.8 cents per point because of their value when transferred to travel partners like Southwest, United, and Hyatt.

🔥 Update 6/29/23: Awesome news! The Chase Ink Business Preferred has dropped their minimum spend requirement from $15,000 to $8,000. Great news for those who can hit the bonus and earn 100,000 Chase Ultimate Rewards!

Who’s it for? Anyone with a business who can reach the required spending of $8,000 $15,000 in the first 3 months, especially those who value Chase points as high as we do (1.8 cents per point).

Estimated Value: $1,000 – $1,750+ ($1,000 when you redeem for cash back, $1,250 in Chase Travel℠ portal, or $1,750+ when you use Chase’s transfer partners)

Annual Fee: $95

Pair with Personal Card: Chase Sapphire Preferred® Card or Chase Sapphire Reserve® Card

Spending Categories: Earns 3X rewards on travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year)

Notable Perks: Points worth 25% more when redeemed for travel; Cell phone protection against theft or damage; No foreign transaction fees

Major Transfer Partners: British Airways, Southwest, and United; Hyatt, IHG, and Bonvoy (see all transfer partners)

#1 Business Travel Card with No Annual Fee – #1 Business card great for carrying a balance

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Spending Categories: Earn 5x (on first $25k spent) for phone service, cable, internet, and office supply stores.

Notable Perks: Great for carrying a balance; No Annual Fee

Major Transfer Partners (if paired with Ink Preferred or Sapphire card): British Airways, Southwest, and United; Hyatt, IHG, and Bonvoy (see all transfer partners)

#1 Ultra Premium Business Card – #1 for Elite Travel Perks

This is a card with a huge welcome offer and loaded with benefits for frequent travelers. However, the very large annual fee needs to be weighed versus the benefits. Terms apply.

An ultra-premium card with a high annual fee, but it’s well worth it for those frequent travelers who can get instant hotel status and airport lounge access. Some of my friends love the hotel deals that come with the Platinum card, too. For many, the benefits will far outweigh the high annual fee.

Who’s it for? Medium to larger business owner who can handle the larger spending, or frequent travelers who can benefit from the elite travel perks that come with this card.

Annual Fee: $695

Pair with Personal Card: Any Amex card that earns Amex Membership Rewards

Spending Categories: 5x flights and prepaid hotels at AmexTravel.com; 1.5x points per dollar on eligible purchases of $5000 or more (up to 1 million additional Membership Rewards points per year); 1.5x points on eligible purchases at US construction material; hardware suppliers, electronic goods retailers and software; cloud system providers, and shipping providers; 1x elsewhere on eligible purchases

Notable Perks: Up to $200 a year in statement credits for airline incidental fees; $100 Global Entry fee reimbursement; $189 CLEAR membership reimbursement; airport lounge access benefits; rental car elite status; Marriott Bonvoy and Hilton Gold status; free Boingo wifi; statement credits for various technology purchases; and more

Major Transfer Partners: Air Canada, British Airways, Cathay Pacific, Delta, and JetBlue; Hilton and Bonvoy (see all transfer partners)

#1 Business Card with Longest Introductory Offer for Carrying a Balance

#1 Card for Everyday Cash Back

Intriguing small business card for business owners wanting simple, easy earning. Note: the annual fee is higher than most comparable cards.

Not many business cards offer unlimited 2% cash back, and this card has an awesome spend bonus. While some cards have specific bonus categories, this card earns 2% cash back on everything. That’s straightforward and simple for business owners who don’t want to mess with complicated rewards programs.

Who’s it for? Any business owners looking for the simplest card with best cash back.

Annual Fee: $150

Pair with Personal Card: Those who like cash back and Capital One will be drawn to the Capital One Savor card.

Spending Categories: 2% cash back on everything

Notable Perks: No foreign transaction fees

Major Transfer Partners: Air Canada, Cathay Pacific, Air France (see all transfer partners)

Best Cards for Hotels

The Marriott Business Amex card offers several perks for those who love to stay at Marriott hotels. Certain hotels have resort fees. Terms apply.

This card has a great welcome bonus and several great perks. One of the best perks about this card is the 1 Free Night Award that you earn annually after your card account anniversary. This award can be used on a one night stay for a hotel costing up to 35,000 points at at participating hotels (certain hotels have resort fees). However, you can also top off the award by adding up to 15,000 Marriott Bonvoy points from your account to stay at a hotel requiring more points.

Who’s it for? Any business owners looking for a great hotel card with a major rewards program.

Annual Fee: $125

Pair with Personal Card: Chase Marriott Bonvoy Boundless

Notable Perks: 35K free night award each year upon renewal; Marriott Bonvoy Silver Elite status; 15 elite night credits each calendar year; Free in-room premium internet

Major Transfer Partners: See all transfer partners

Limited time offer ends 6/5/24. This is a great business card for those who love Hilton. Terms apply.

If you stay at Hilton Hotels frequently, this card is a no-brainer. The great welcome fee and various perks are well worth the lower annual fee on the card.

Who’s it for? Any business owners looking for a great hotel card with a major rewards program.

Annual Fee: $95

Pair with Personal Card: American Express Hilton Honors Aspire

Notable Perks: Free Hilton Honors Gold status (Diamond Status with $40K spend), earn 12x on Hilton spend; 6x on Business and Travel, and 3x on everything else on eligible purchases.

For the small business owner who loves Hyatt, this is an intriguing offer. If you have high monthly spending, this card will also help you earn Globalist status.

Hyatt is known for having one of the best redemption values, and those loyal to Hyatt brand will find great value in the welcome offer, although it does not include a free night.

Who’s it for? Any business owners looking for a great hotel card with a major rewards program.

Annual Fee: $199

Pair with Personal Card: The World of Hyatt Credit Card

Notable Perks: Automatic Hyatt Discoverist status, up to $100 Hyatt credit each year, 5 elite night credits each time you spend $10,000 in a calendar year, trip cancellation/interruption insurance.

Next Best Cards

Great Southwest business credit card with a low annual fee. Card offers two free Early Bird Check-Ins each year and the points earned from the signup bonus count towards the Companion Pass.

This card has a great signup bonus for a big chunk of miles. It’s also a must get if you are looking to get the Southwest Companion Pass for up to 2 years. Southwest is one of the best airlines for free travel. Southwest offers free cancellation for reward flights, which makes it super easy to book and change as needed. Also, remember that Southwest offers free bags. (Note: If you love Southwest, don’t skip straight to this card. Consider the Chase Ink Business Preferred which allows you to transfer points 1:1 to Southwest. Translation: Instead of 60,000 miles sign-up bonus, you could get 100,000 miles!)

Highest bonus amongst the Southwest business cards. You are eligible even if you have the Southwest Premier Business card. Great to combine with personal card to earn the Southwest Companion Pass.

This is a new premium business card from Southwest. The large sign-up bonus is super attractive, and the extra benefits help make the higher annual fee pretty reasonable. Definitely can play a key role in getting the companion pass, and a great card to get overall.

For frequent American Airline flyers, this is great business credit card — with a great signup bonus and some usable benefits.

This card has some nice perks for frequent AA flyers, including first checked bag free, priority boarding, reduced mileage awards, and save 25% on inflight purchases. You can earn double miles on AA purchases, certain telecommunications merchants, car rental companies, and gas.

For business owners with high monthly spend, this is worth a strong look with a nice signup bonus and ongoing benefits.

If you travel frequently on United, this card is a no-brainer. Get free bags, 2 United Club passes, but most importantly, a nice signup bonus. If your travel dates are flexible, you can often find good deals on award flights for lower than standard rates.

A fairly hefty annual fee compared to Ink cards. Earn 4x points from the top two categories where your business incurs the most expenses each billing cycle, out of qualifying categories. The 4x points are awarded on up to $150,000 in combined purchases from these two categories annually (then 1x points thereafter). Terms apply.

The high annual fee will deter most business owners, but you could really benefit if you utilize the 4x earning on the two qualifying categories where your business spends the most each billing cycle. The categories are: Airfare purchased directly from an airline (Update 10/4/23: Category being removed; existing cardholders earn 4x through January 31, 2024); U.S. shipping (Update 10/4/23: Category being removed; existing cardholders earn 4x through January 31, 2024); US purchases at restaurants; U.S. purchases for advertising in select media; U.S. purchases at gas stations; U.S. purchases made from electronic goods retailers and software & cloud system providers; Transit purchases, including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways; Wireless telephone service charges made directly from a U.S. wireless telephone service provider. 4X applies to the first $150,000 in combined purchases in your two categories each calendar year, 1X point per dollar thereafter, and on other purchases.

Another good business card for those who like Capital One. Similar to the Spark Cash, but instead of cash, it allows you to earn and redeem miles as statement credits for travel purchases.

This card allows you to use miles as statement credits for travel purchases. A nice signup bonus, but slightly less valuable rewards compared to something like Chase Ultimate Rewards. You earn double miles on everything. This card does not charge foreign transaction fees, includes travel and emergency assistance services, and offers some purchase protections. (Pair with Capital One Venture personal card)

How to Apply

Click through on a link to move forward with a certain card.

Tell the bank about your business

The first part of the application is about your business. If you already have a well-established business, then the answers should be straightforward. If you are just getting started with your business and you do not have any employees, then you most likely operate as a sole proprietorship

When you apply for a business credit card as a sole proprietor, you need to use your own name as your business name, use your own address and phone as the business’ address and phone, and your social security number as the business’ Tax ID / EIN. However, it may help your approval odds to have an EIN, and you can get one for free from the IRS, in about a minute, through this website.

If you are a sole prop, do NOT make up a business name and do NOT add a title to the end of your name. For example, if you do consulting but you are a sole prop, write “John Smith.” Do not write “John Smith Consulting.” This will most likely cause a denial.

Business Information Based on Sole Proprietorship Application

- Legal Name of Business: If you don’t already have a business name, I recommend using your own name as the business name.

- Business Name on Card: Again, this can be your own name if you don’t have a business name to use.

- Business Mailing Address: This can be your home address if you don’t have a separate business address.

- Type of business: Sole Proprietor

- Tax Identification Number: This can be your SSN, but you can also create an EIN for your business (found here)

- Business category/type/subtype: Pick whichever categories are closest to your business

- Number of Employees: 1 (you)

- Annual Business Revenue: 0 (or project an amount based on monthly revenue to-date)

- Years in Business: (number of years you’ve been operating the business with or without revenue)

Personal Information

This part of the application is about you, personally:

- Authorizing Officer: Owner

- Gross annual income: Include all of your income, not just business income

- The rest should be self-explanatory

How to improve your chances of success

The following tips can help with approval, but none are guaranteed:

- Use an EIN instead of your SSN when entering your Business Tax ID on the application

- Do not call if your application goes to pending

- Call if your application is denied

Do not call if your application goes to pending

When applications go to pending, people frequently find that they get approved without calling. When people do call, they often get tough analysts who deny the application.

Of course, if the bank contacts you asking for more information, then you absolutely should talk to them on the phone. In some cases, they may simply need more information about you or your business before your application can go through the next review stage.

Call if you are denied (and call again)

If your application is outright denied (either instantly or by mail), then call the business reconsideration number listed below. There are many cases where analysts have overturned denials over the phone. If denied, call reconsideration.

Reconsideration Phone Numbers

1. American Express Credit Card Reconsideration

- 800-567-1083 (application status)

- 877-399-3083 (new accounts; can forward you to reconsideration reps) 8am-midnight EST M-F, 10am-6:30pm Saturday

2. Bank of America / Bank of Hawaii Credit Card Reconsideration

- 888-663-6262 (business credit analyst)

- Bank of America Online Application Status Check to check the status of a credit card application

3. Barclaycard Credit Card Reconsideration

- Business Cards: 866-710-2688, open 8AM-8PM ET

- Barclaycard Online Application Status Check to check the status of a credit card application.

4. Chase Credit Card Reconsideration

- 800-453-9719 (business credit analyst, 8am-10pm EST M-F)

5. Citibank Credit Card Reconsideration

- 800-695-5171 or 888-201-4523 (credit analyst) 7am – midnight ET (6am – 11pm CT) daily

- 800-763-9795 (personal and business card application status) 7am-midnight EST 7 days a week

The analyst will likely ask a lot of questions. Make sure your answers match your application. Also, if you have multiple business cards, make sure to let the analyst know that you don’t need more credit. Tell them that you are willing to move available credit from another card or to cancel another card if necessary. Be prepared to answer financial questions about your business. It’s okay if you have $0 revenue. Be prepared to answer questions about why you want the card and how you expect to use it. There is absolutely nothing wrong with saying that you were attracted by the signup bonus, the spending categories, and other benefits.

If the analyst doesn’t approve your application, call again. Many people have had luck simply calling a few times until the reached an analyst willing to take a chance on their business.

Best Strategies by Business Type

For large businesses or owners of multiple businesses: If your business spends a lot of money in certain categories, it may be worth having two of these cards. For example, you would obviously want the Ink Business Preferred for the large sign-up bonus and great ongoing benefits like 3x categories with monthly spending. Then, you could pair it with the Ink Business Cash and utilize the 5x categories for specific monthly spending. Then, you would connect your accounts and transfer those Ink Cash points to the Ink Preferred portal to get an extra 25% in the Chase Travel Portal.

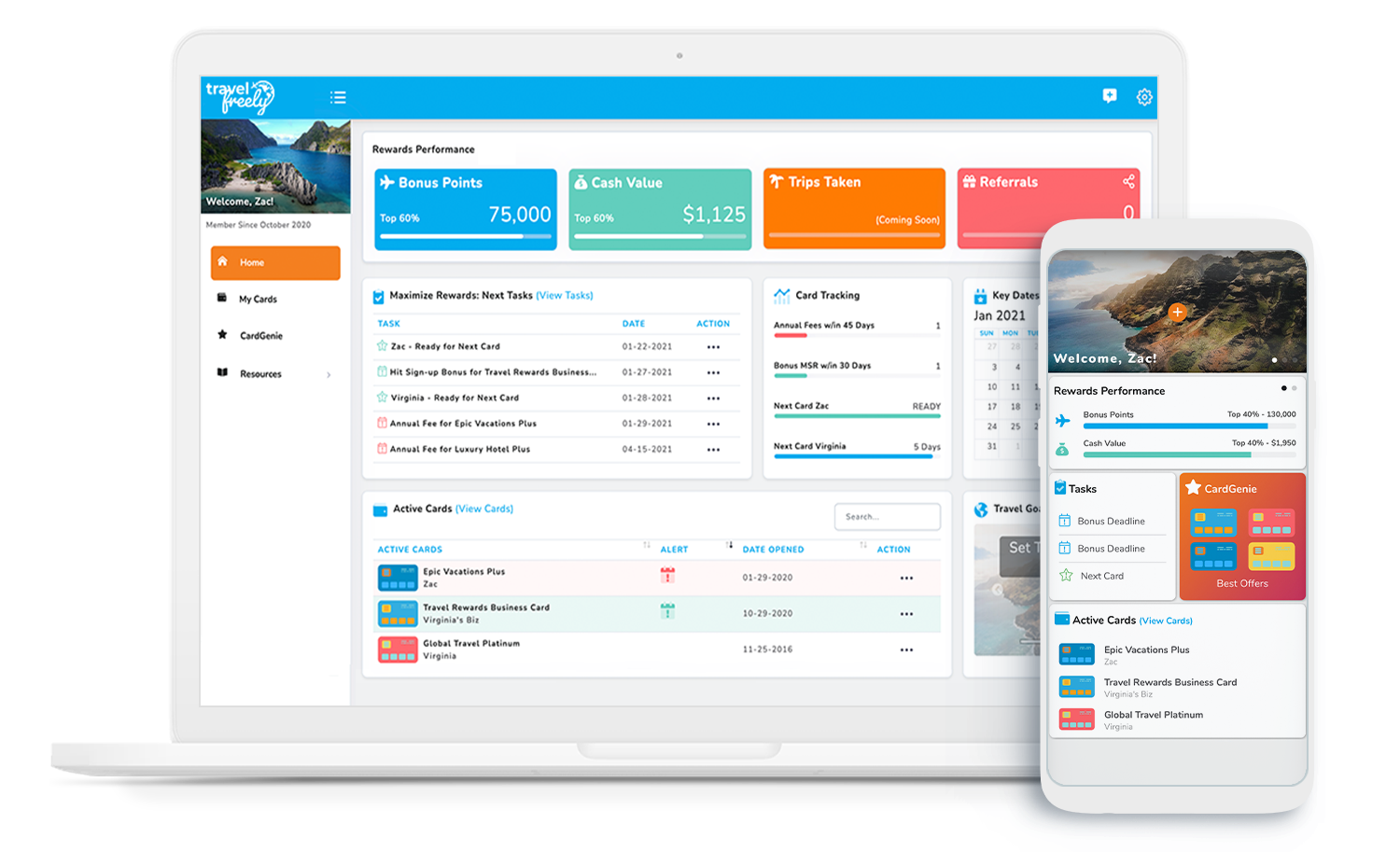

For owners of multiple businesses: You can get more than one of these cards if you have multiple EINs or a spouse that can apply for an additional card using her SSN. You want to take a look at your monthly spending, and see if you could benefit by having separate business cards for each business. Travel Freely Member Rob has 6 LLCs and got six Ink Preferred cards this year! Tip: Use Travel Freely to automate your card management.

For very small or side business owners: Yes, you have a business. It’s common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.

For Sole Proprietors: When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business’ address and phone, and your social security number as the business’ Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Common Questions:

Can I put personal spending on business cards?

This is fairly common. While it’s good practice to separate business and personal spending, and banks may dissuade you from doing this, it isn’t illegal and many people do this.

What are the rules on getting more than one of these cards?

These cards are all treated as separate cards. You can only apply and get approved for more than one. Keep in mind that Chase only allows you to apply and be approved for 2 cards (2 personal, 2 business, or 1 personal + 1 business) per 30 days. Also, people have reported issues when trying to apply for two cards on the same day. So it’s better to space out the applications by a few days.

If I have a personal Chase card, like the Chase Sapphire Preferred or Chase Sapphire Reserve, can I transfer the points I earn on my business card to my personal card?

Absolutely. You can transfer points to other Chase accounts you have or those who are household members or authorized users. Here’s a walkthrough on how to Chase merge points.

Do these cards count towards 5/24?

If you’re getting into travel rewards, you know that the Chase 5/24 rule is important. You must be under 5/24 to be approved. However, compared to personal cards, these Chase cards do NOT count towards your 5/24 count.

Need Help?

Need help choosing a card? Travel Freely members can check their CardGenie in order to utilize our card rankings and to make sure they’re eligible for the card they want. Otherwise, we’re here to help, too. Email us at moc.y1713545694leerf1713545694levar1713545694t@kla1713545694tstel1713545694.

https://travelfreely.com/am-i-eligible-for-a-business-credit-card/