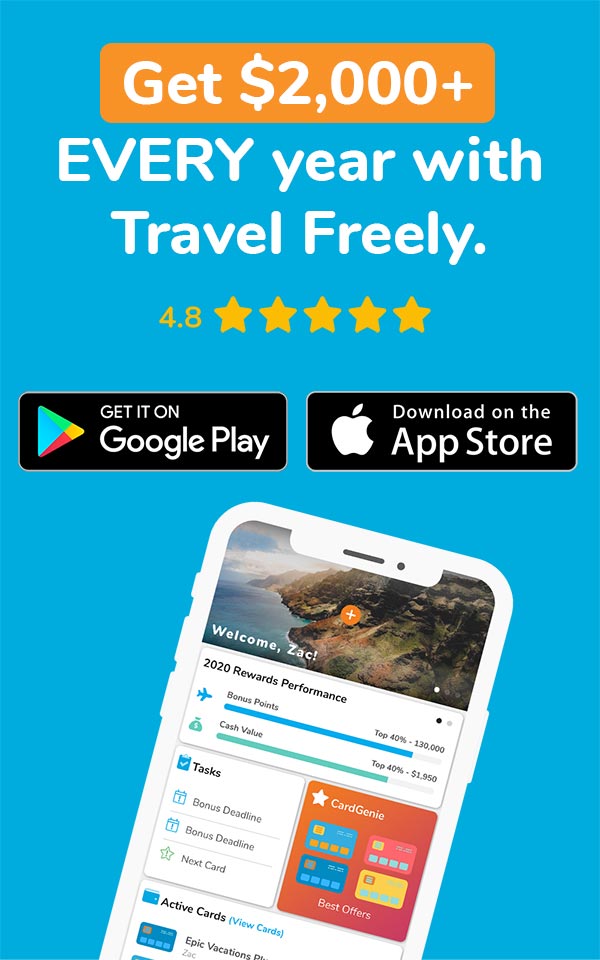

We’ve simplified things with our “Best Of” rankings for best travel credit offers for travel rewards. If you don’t have time to research cards, take advantage of our expertise! Travel Freely is here to help you with the best travel credit card offers. Need a primer on Rewards Cards? Sign up for Travel Freely (for free), check out Rewards Cards 101, or jump into why this rewards travel card is our #1 recommended card.

Don’t Let Offers Disappear – We’ve seen a LOT of offers come and go. Some offers have clear expiration dates, and others just vanish without warning. My advice: If you are ready for another card, and you know the card you want… Don’t delay!

Brand new here? Free Travel Starts Here.

Make sure you sign up for Travel Freely – it’s free, and you’ll immediately get access to the short ebook Free Travel 101 and receive custom recommendations for the best travel credit card offers. Travel Freely is 100% Free. We don’t ask for credit card info or any sensitive information. Want to know more? Check out the benefits and features of our 100% free tool.

If this is your first time to our best offers page, it is so easy to travel for free! Please read our “How to Get Started” Travel Freely strategy overview so you can know our secret approach to earning tons of points and miles in no time.

Best Travel Credit Card Highlights for April 2024

Our NEW #1 Recommended Business Credit Card

The Ink Business Cash® Credit Card just rolled out a new offer for 75,000 points (marketed as $750 cash back) for 2 spending thresholds. First, earn 35,000 for spending $3,000 in the first 3 months. Then, earn an additional 40,000 points for spending $6,000 total in the first 6 months.

Here’s why this offer is a big deal: Some of you already have this card on your radar because you can easily hit the bonus spending required. But to others, this is a big open door to getting your first big bonus on one of our 3 favorite business cards. The points amount on the offer has not changed, but the spending required to hit the bonus has become significantly more achievable for many people. This new offer stretches out your required spending to an average of $1,000 monthly over 6 months. Previously, and still for its cousin equivalent, the requirement was $6,000 in 3 months, or $2,000 monthly.

Just got an Ink card with an elevated offer? Here’s some strategy.

Many of you recently took advantage of the big Ink Business Cash® Credit Card and Ink Business Unlimited® Credit Card offers. If you have one of the no-annual fee Ink cards and don’t have any other Chase Ultimate Rewards earning cards, you’ll want to think about either the Chase Sapphire Preferred® card (personal card) or the Chase Ink Business Preferred®. You can pool your points together. But, the biggest reason to get one of these cards is because the Ink Cash and Ink Unlimited cards do not have access to Chase transfer partners or a boost in the Chase Travel℠ portal. You must have a Chase Sapphire Preferred (or Reserve) personal card or a Chase Ink Preferred to use transfer partners. Also, if you plan on using the Chase Travel portal, then the Chase Sapphire Preferred and Ink Preferred give you a 25% boost when paying with points! Read more on Chase Ultimate Rewards and best strategies here.

Chase Ink Business Preferred (business card): Last summer, the Chase Ink Business Preferred card lowered the minimum spending requirement to $8,000 in 3 months to hit the 100,000 points signup bonus. This is worth a minimum of $1,250 of free travel. Read More: Our guide to the Chase Ink Preferred, Our updated Ink comparison article, and our link to learn how to apply.

New to business cards? It’s VERY important to realize that sole proprietorships (businesses that have no official registration) are eligible for these cards! Here are our resources for those new to business cards: Am I Eligible for a Business Credit Card?; How to Apply for a Business Credit Card (with Tax ID as EIN or SSN); Travel Freely Small Business Guide.

Other interesting increased offers: The IHG Premier Business has a new tiered offer giving you 140,000 points when spending $4,000 within 3 months, plus an additional 35,000 after spending $7,000 in total within 6 months, which gives you a nice chunk of time to complete the spend, at an average of less than $1200 per month. Don’t snooze on this because the IHG Premier Business card offer ends 5/15/24! The Marriott offers (still sticking around for now) for the Marriott Bonvoy Brilliant® American Express® Card and the Marriott Bonvoy Bevy™ American Express Card have “best ever” welcome offers. The Marriott Bonvoy Brilliant card welcome offer is 185,000 points for spending $6,000 in 6 months, while the Marriott Bonvoy Bevy is 155,000 points for spending $5,000 in 6 months. Each card carries a hefty annual fee, so it’s important that you review the perks of each card carefully to offset that cost. If you’re a super fan of Avios points, the British Airways Visa Signature® Card, Iberia Visa Signature® Card, and Aer Lingus Visa Signature® Card all have offers for 75,000 Avios points after $5,000 spending in the first 3 months plus earn an extra 50,000 Avios points after spending up to $10k in gas, grocery, and dining purchases for first 12 months.

Best Travel Credit Card Offers

At Travel Freely, we are all about maximizing great sign-up bonuses with the best travel rewards credit cards. Our approach is to get the most amount of points in the least amount of time. Sign-up bonuses are the #1 way to rack up points WITHOUT traveling or spending a lot of money. Some people get more rewards in one bonus than they would in an entire year’s worth of spending on the same old card they’ve had for 5 years. Check out the BEST deals here.

-

- Overall #1 Travel Credit Card for Beginners: Chase Sapphire Preferred® Card (60,000 points)

- Best “No-Thinking” Card: Capital One Venture Rewards Credit Card (75,000 miles) or Capital One Venture X Rewards Credit Card (75,000 miles)

- Best No Annual Fee Card: Chase Freedom Unlimited®

- Overall Best Business Travel Card: Chase Ink Business Preferred (100,000 points)

- Best No Annual Fee Business Travel Card: Chase Ink Business Cash or Chase Ink Business Unlimited

- Best Stay-at-Home, Travel Later Card: American Express® Gold Card

- Best Airline Business Card: Chase United Business (100,000 miles) or Chase Southwest Performance (80,000 miles)

- Best Hotel Personal Card: American Express Hilton Honors Surpass Card or Marriott Bonvoy Boundless® Credit Card

- Best Hotel Business Card:IHG® Rewards Premier Business Credit Card or World of Hyatt Business Card

- Best Travel Card for 3x on Gas, Grocery, and Dining: Citi Premier® Card

- Best Cash Back Personal Card: Chase Freedom Unlimited® or Citi Double Cash® Card

- Best Ultra-Premium Card: The Platinum Card® from American Express or Chase Sapphire Reserve or Capital One Venture X

- Best Premium Hotel Card: Marriott Bonvoy Brilliant™ American Express® (185,000 points) or American Express Hilton Honors Aspire

- Best Ultra-Premium Business Card: The Business Platinum Card® from American Express

- Best Card for College Students/Grads: Citi Rewards+ Student Card; Chase Freedom Student; Discover It Student; or Deserve Edu

- Best Personal Cards for Carrying a Balance: Amex Blue Cash Everyday, or Citi Double Cash® Card

- Best Business Cards for Carrying a Balance: Chase Ink Business Unlimited or Chase Ink Business Cash

- Best Travel Cards for Carrying a Balance: Chase Freedom Unlimited®or Citi Rewards+(20,000 points)

- Best Personal Balance Transfer: Citi Diamond Preferred® or Citi Double Cash® Card

New to Travel Freely? Need a Refresher? Here are Beginner Mini Webinars:

Learn why Travel Freely strategy is the easiest and most effective. Check out these mini webinars to learn your best strategy. Feel free to share with others who could use a huge boost to their travel budget.

Amazing Offers on Chase Business Cards

The Chase Ink Business Preferred card is the best card among the Chase business cards. This card has a great sign-up bonus and 3X categories. It’s hard to beat this Chase Ink card. Especially when you’re looking for an all-around business card that has flexible redemption options. Also, it can be combined with your personal Chase Ultimate Rewards points. Learn more about this card with our Chase Ink Business Preferred Complete Guide.

- Earns 3X rewards on travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year)

- Points worth 25% more when redeemed for travel

- Cell phone protection against theft or damage

- No foreign transaction fees

Great signup bonus for a business card with no annual fee, now with an extended timeline for hitting the spend requirement. Great for carrying a balance. 5x earning categories, and if paired with a premier Chase credit card (one that carries an annual fee), your points are worth even more.

Incredible signup bonus for a no-fee card. An excellent companion to the Ink Preferred, personal Sapphire Reserve or Sapphire Preferred. Like the personal Sapphire cards, this card earns valuable Chase Ultimate Rewards. As of 3/21/24, this card has a new multi-tiered offer where the points amount on the offer has not changed, but the spending required to hit the bonus has become significantly more achievable for many people. You now have 6 months to meet the spending requirement, where previously you only had 3 months.

- Earn 5X rewards (on first $25k spent) for phone, TV, internet, and office supply stores.

- Earn 2X rewards on gas and restaurants

- No Annual Fee

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.

An all-round great cash back business card with no annual fee. It’s very simple. You earn unlimited 1.5 points per $1 spent on all purchases. This can be a great standalone card, but it is a excellent companion card to the Ink Business Preferred, Sapphire Reserve or Sapphire Preferred!

-

- Earn 1.5X rewards on Everything

- No Annual Fee

| Card | Sign-up Bonus | Spending Required | Annual Fee |

|---|---|---|---|

| Ink Preferred | 100,000 | $8,000 in first 3 months | $95 |

| Ink Cash | 75,000 | $6,000 in first 3 months | $0 |

| Ink Unlimited | 75,000 | $6,000 in first 3 months | $0 |

Read: How to Apply for a Business Credit Card

Our Top Recommendations for carrying a balance

If you’re looking to carry a balance, think about the Citi Diamond Preferred World Mastercard. The next best option would be the Citi Double Cash Card. Note: You will not earn rewards for the balance transfers. Make sure to check terms when applying.

For great introductory offers, check out the Amex Blue Cash Everyday or Chase Freedom Unlimited because they also have a welcome bonus.

Now with a signup bonus! A great complement to the Citi Premier card.

In addition to the welcome offer you receive after meeting the minimum spend requirement, you'll also receive 10% back as a statement credit on purchases made at restaurants worldwide within the first 6 months of card membership (up to $150 back). Definitely worth considering if you're looking for a cash-back card, as you'll earn 3% cash back on several credit cards. Cash back is received in the form of reward dollars that can be redeemed as a statement credit. Terms apply.

With the current offer, you'll now earn a total of 4.5x on dining (including takeout and eligible delivery services), 4.5x on drugstores, 6.5x on travel purchased through Chase Travel℠, and 3x on everything else for the first year, up to $20,000. This special offer is best for those who have a healthy amount of monthly spending on dining and general expenses.

Best Business Cards for Carrying a Balance

Great offer for a no annual fee card! A no-brainer, great business card. Your choice to receive 1.5% cash back or 1.5x points.

What’s Our Criteria for the Best Cards?

-

- Value of points – Not all points and miles have the same value when it comes time to redeeming them. We take this seriously when helping you with the best credit cards with travel rewards.

- Bonuses – Travel Freely seeks to maximize sign-up bonuses, so if great sign-up bonus offers come out, those cards will move up in the rankings.

- Type of Card – We value airline cards higher than hotel cards because airfare never goes on sale (whereas hotel sites can get you almost 50% retail rates). So airfare is the highest value in free travel. So, if we see airlines and hotel cards as similarly great deals, the airline card will get the edge in the rankings.

- Bonus spending requirement – We rank cards lower that require major spending as part of sign-up bonus. For example: Some cards offer 50,000 points if you spend $3,000 in the first 3 months, but then they’ll offer an add’l 25,000 points if you spend $10-15k in additional spending over the course of the year. This is considered major spending to us and we do not factor that in for the normal free traveler.

- Ease-of-use – Factors such as customer service and redemption fees play a factor in our rankings. We don’t want you to spend hours on the phone with poorly trained, off-shore customer service when you have a question about your card. Avoiding ridiculous fees for redeeming free travel are also important to us. For example: Frontier – You might get a “free flight” on Frontier Airlines with 20,000 points. But, you have to spend a reward redemption fee, bag fee for carry-on or checked luggage, and a seat booking fee. You might spend $96 in fees for a “free” $110 flight!

Want personalized recommendations? Log In to your account to see your CardGenie Recommendations.