I cringed when I heard my friend Rebekah say, “I only fly on Southwest, so I just need the Southwest credit card.” She thought she had it all figured out. She signed up a few years ago, got her spending bonus, and is now putting all her spending on the card.

It’s not just Rebekah, it’s a lot of people who have this approach to rewards cards. They get a great sign-up bonus (around 40,000 to 50,000 points) on their favorite airline, and they think they’re set for 10 years. They accumulate another 10,000 to 15,000 points per year through their monthly spending. Sadly, they are really missing out. Big time.

If they’re open to suggestions, like Rebekah was, I normally say, “What if you could get another 100,000 points right now?! (And if you’re married, another 200,000.) Your spouse of travel companion can be your secret free travel weapon. What if you could get a companion pass and get a free flight for your companion every time you booked a flight with miles on Southwest? What if you could get 150,000 points every couple of years? With your current strategy, you’ll have about 100,000 points in five years. With Travel Freely, you could be at half a million. All this can be done without changing any of your spending.”

This is all true.

The reason this happens is because rewards credit cards can seem so complicated. Many people get one card and shut the door. I don’t blame them because every other tv commercial is for a credit card. Most of these cards are not the good ones either. With a little wisdom, you can be racking up years of free travel with very little effort. Read more below to find out what cards are better than your typical airline card.

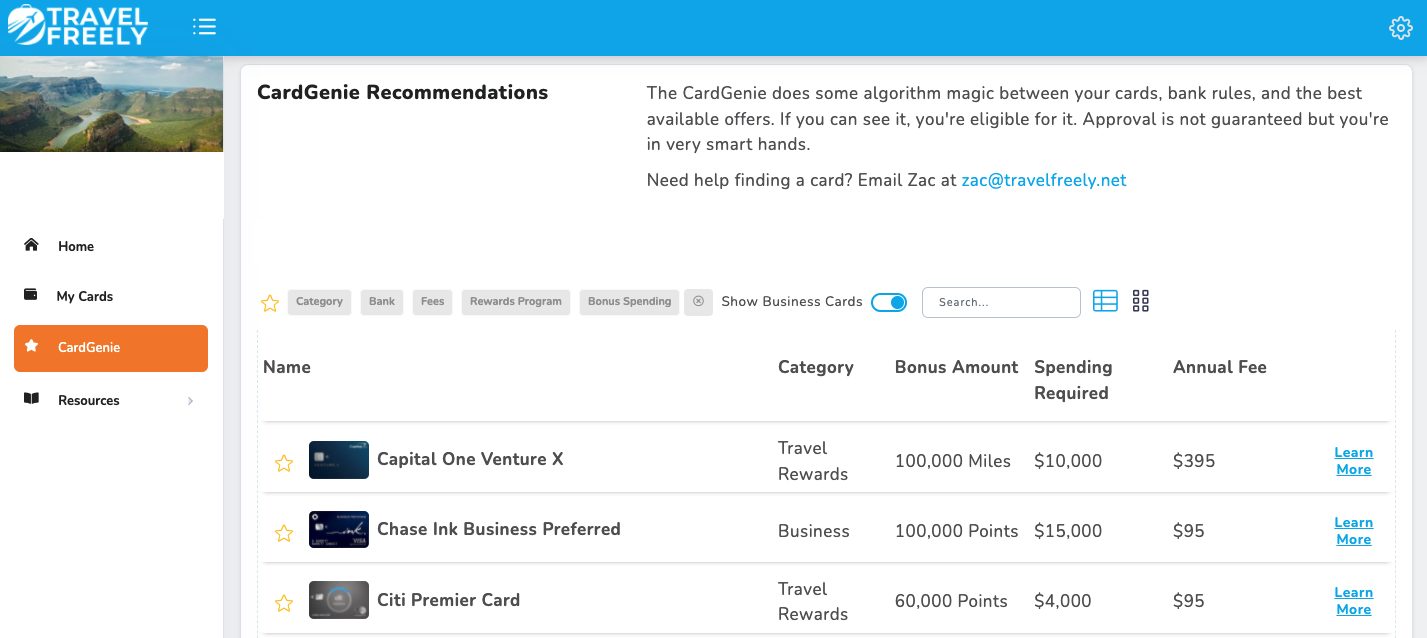

The Capital One Venture Rewards Credit Card has become a much better card in recent years.

In this example, Rebekah thought that her Southwest card was the only way to get Rapid Rewards points. However, there’s more than one Southwest card AND an even better way to earn Southwest points, via Chase’s Ultimate Rewards cards. Chase has some top-notch rewards cards. The Chase Sapphire Preferred Card (our #1 rated personal card for beginners) and the Chase Ink Business Preferred (our #1 ranked business card) allow you to earn points that can transfer to Southwest points, immediately.

Essentially, these Chase cards ARE Southwest cards. They come with big bonuses and even better spending multipliers than Southwest cards. Add in a spouse or a business (where there are even higher sign-up bonuses), and you are staring at so many points you might not know what to do with them all!

You might ask, “How do I know if I’m missing out? What cards are right for me? How do I keep up with all these cards?” You’re probably asking about what this does to your credit too, but a quick google search will confirm that most people see their credit scores increase! If you sign up for Travel Freely (for free), we’ll send you a Free Travel 101 beginner’s guide right away.

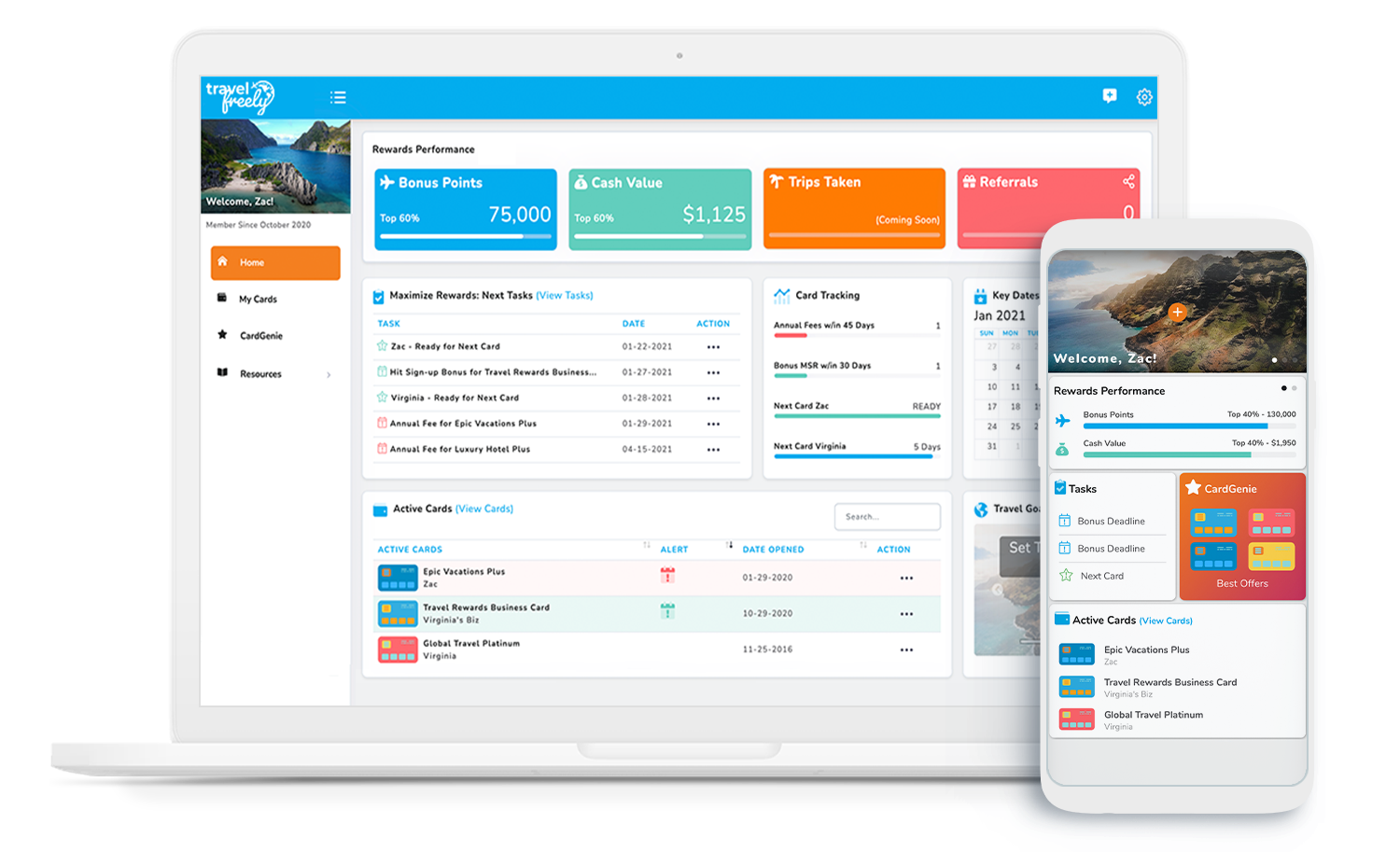

Travel Freely exists for the beginner and the expert who doesn’t want to spend any extra time but still reap all the benefits of free travel. With a card dashboard, automated email reminders for key dates, and a sophisticated recommendation system, you’re all set. For beginners, we have a step-by-step guide to getting started.

Travel Freely’s CardGenie recommendations are based on your personal preferences and cards you already have.

How is Rebekah doing? Well, she’s been to Peru, France, Alaska and Mexico since our chat. She’s already earned more than $4,500 in free travel. Here we are at one of the seven wonders of the modern world:

Rebekah (pictured right) with us in Machu Picchu after a private tour with a guide and personal chef. It was an easy decision to upgrade to a private tour when we got free flights, some of us on business class.

So, what IS in your wallet? What are you waiting for?

Learn more or jump in and start with Travel Freely. No credit card required.

Related Articles: