Transferable points programs are the most valuable points to accumulate. These points can often be used to book travel at more than 1 cent per point value. Even better, points can be strategically transferred to airline and hotel programs when valuable awards are available. If you’re at all interested in free travel or luxury travel with points & miles, then you need to understand the basics of each of these programs.

This post rounds out the guides to the big three transferable points programs: Amex Membership Rewards (this post), Chase Ultimate Rewards, and Citi ThankYou Rewards.

Amex Membership Rewards points can be earned via credit card spend, new account bonuses, credit card referrals, and more. Those points can then be transferred to airline or hotel partners or used to pay for travel or merchandise. In one specific case, points can be converted to cash back.

Below, you’ll find everything you need to know about Membership Rewards.

Earn Points

Credit Card Welcome Bonuses

The easiest and quickest way to earn Membership Rewards points is through Amex credit card welcome bonuses.

Most Amex welcome offers stipulate you can’t get the bonus if you’ve ever had that card before. That said, it doesn’t preclude you from getting a bonus for a similarly named card. Additionally, targeted offers sometimes do not have that once-per-lifetime language. In those cases, you can get the bonus even if you’ve had the card before.

Below are the Amex cards with the best current and public Membership Rewards welcome offers:

Personal

An ultra-premium card loaded with benefits and perks, especially for the frequent traveler. Terms apply.

A must-have for anyone who loves Amex points. Some of the highest returns (4x!) for spending at U.S. supermarkets and restaurants worldwide (plus takeout and delivery in the U.S). Definitely worth a spot in your wallet. Terms apply.

Business

This is a card with a huge welcome offer and loaded with benefits for frequent travelers. However, the very large annual fee needs to be weighed versus the benefits. Terms apply.

A fairly hefty annual fee compared to Ink cards. Earn 4x points from the top two categories where your business incurs the most expenses each billing cycle, out of qualifying categories. The 4x points are awarded on up to $150,000 in combined purchases from these two categories annually (then 1x points thereafter). Terms apply.

One of the best Amex business cards with no annual fee. It has transfer partners and offers 2x points on everyday business purchases such as office supplies or client dinners. Earn 2x on the first $50,000 of eligible purchases per year, 1 point per dollar thereafter. Eligible purchases are for goods and services minus returns and other credits. Terms apply.

Credit Card Upgrade Bonuses

Amex frequently offers bonus points for upgrading from one card to another. These upgrade offers often do not have the once-per-lifetime language. That is, if you are targeted for an upgrade offer, you may be able to earn the bonus points even if you’ve had the card before. It is best to accept these offers only after you have earned a welcome bonus for the higher-end card.

Credit Card Category Bonuses

The next best way to earn Membership Rewards points is by using the best card for each category of spend. If you spend a lot personally or through your business on any of the below categories, you can do very well. Particularly noteworthy is the no-annual-fee Blue Business Plus Credit Card, which offers 2 points per dollar for all spend, up to $50K spend per calendar year (then 1X thereafter). That’s fantastic.

| Spend Category | Best Options |

| US Supermarkets |

American Express Gold 4X (up to $25K per year, then 1X) EveryDay Preferred Up to 4.5X* (max $6K per year) |

| US Gas Stations |

Business Gold Rewards Up to 4X** EveryDay Preferred Up to 3X* |

| Restaurants | American Express Gold 4X American Express Green 3X Business Gold Rewards Up to 4X**, US only |

| Travel (Broadly Defined) |

American Express Green 3X |

| Flights |

Platinum consumer cards 5X Business Platinum (via Amex Travel) 5X Business Gold Rewards Up to 4X** American Express Gold 3X American Express Green 3X |

| Prepaid Hotels |

Platinum cards (via Amex Travel) 5X American Express Green 3X |

| Select Car Rental Companies | American Express Green 3X Morgan Stanley Credit Card 2X |

| Select US Department Stores | Morgan Stanley Credit Card 2X |

| US Shipping | Business Gold Rewards Up to 4X** |

| US Advertising in select media | Business Gold Rewards Up to 4X** |

| US Computer related purchases |

Business Gold Rewards Up to 4X** |

| US Construction/Hardware Stores | Business Platinum 1.5X |

| Everywhere else | Blue Business Plus 2X EveryDay Preferred 1.5X* |

** The Business Gold Rewards card offers 3X points on a single category of your choice and then 2X on all other available categories from the following list: Airfare purchased directly from airlines; U.S. purchases for advertising in select media; U.S. purchases at gas stations; U.S. purchases for shipping; U.S. computer hardware, software, and cloud computing purchases made directly from select providers.

***The Business Gold Rewards card offers 4x points on two categories where you spent the most in a particular month. It automatically picks the highest two categories from the following: Airfare purchased directly from airlines; U.S. purchases for advertising in select media (online, TV, radio); U.S. purchases made directly from select technology providers of computer hardware, software, and cloud solutions; U.S. purchases at gas stations; U.S. purchases at restaurants; U.S. purchases for shipping.

Amex Offers

Amex Offers are usually best for saving cash. But, sometimes, Amex Offers provide terrific opportunities for point earning instead. One (now expired) example was an offer for Reebok: Spend $75 or more, Get 1,500 Membership Rewards points. And one for Hugo Boss: Spend $250 or more, Get 5,000 points.

Credit Card Referrals

Another great way to earn Membership Rewards points is by referring friends and relatives. Check for any special referral offers by logging into your account.

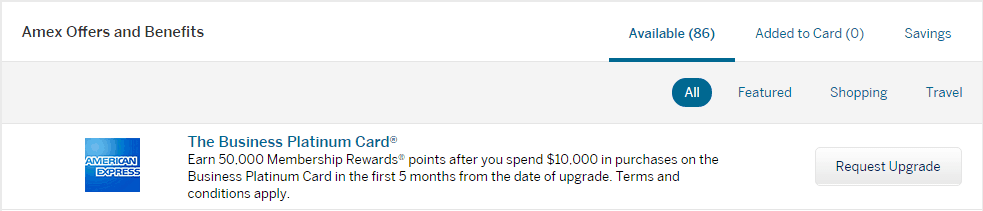

While you’re logged into your account, check the section titled “Amex Offers and Benefits” to look for offers like these.

Miscellaneous Other Options for Earning Points

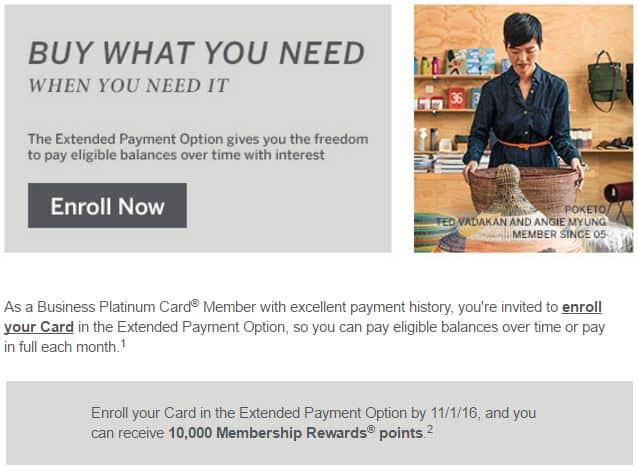

Extended Payment Option

Amex charge cards often offer an easy way to earn additional Membership Rewards points. Once you sign up for a charge card, you will start getting emails and letters inviting you to sign up for the Extended Payment Option. This option essentially turns your charge card into a credit card. Don’t do it. That is, don’t sign up until the offer includes a bonus of 5,000 to 10,000 Membership Rewards points. In my experience, these bonus offers usually appear toward the end of your first year of card membership (as long as you haven’t enrolled already).

Once you get an offer like the one shown above, go ahead and sign up. As long as you keep paying your card’s complete balance each month, there is no downside to enabling this feature.

Redeem Points

In general, Membership Rewards points are worth up to 1 cent each. Fortunately, there are three ways in which it is possible to get more value: redeem points for flights, transfer points to hotel or airline partners, or invest rewards. More on each below…

Travel

Those with American Express Platinum cards automatically get 1 cent per point value when redeeming points for travel. That’s not particularly good, but it’s much better than the value people get without a Platinum card. Currently, the only way to get better than 1 cent per point value when redeeming points for travel is with the Business Platinum Card.

The Business Platinum Card offers a 35% Airline Bonus: Get 35% of your points back when you redeem points through Amex Travel for either a First or Business class flight on any airline or for any flights with your selected airline.

After you receive the 35% rebate, the value works out to 1.54 cents per point. That’s very good, but it does require owning this ultra-premium card.

Transfer points

The best use of Membership Rewards points is to transfer points to airline and hotel partners in order to book high-value awards. Your best bet is usually to wait until you find a great flight or night award before transferring points. One exception: Amex often offers 30% or higher transfer bonuses to certain programs (Virgin Atlantic and British Airways are two recent examples). If you’re confident that you’ll use the points for good value, it may make sense to transfer points when those bonuses are in effect.

Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user or employee on the account.

Transfer Partners

It is free to transfer Membership Rewards points to foreign airlines. For transfers to US airlines, however, Amex charges an “excise tax offset fee” of $0.0006 per point (with a maximum fee of $99). Airlines subject to this fee are noted below.

| Rewards Program | Transfer Ratio | Best Uses |

|---|---|---|

| Aer Lingus | 1:1 | Aer Lingus shares the “Avios” currency with British Airways and Iberia. In most cases it is best to move points to one of those programs in order to book awards for less. |

| AeroMexico Club Premier Points | 1:1.6 | Aeromexico is part of SkyTeam, so you can use Club Premier Points to book partner awards on Delta, Air France, KLM, Korean Air, Avianca, and Copa flights |

| Air Canada Aeroplan | 1:1 | Redeem for Star Alliance flights. Multiple stopovers allowed on international flights. Reasonable award prices to Europe for business and first class. |

| Air France / KLM Flying Blue | 1:1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. |

| Alitalia | 1:1 | Alitalia is a member of the SkyTeam alliance. Despite multiple devaluations, Alitalia still offers very good award prices on many routes, so they’re worth a look. Unfortunately, fuel surcharges can be quite high, and partner awards cannot be booked online. |

| ANA | 1:1 | Redeem for Star Alliance flights. Multiple stopovers allowed. Very good award prices for round-the-world travel. See also: How To Find Business Class Awards To Europe For 88,000 Miles Or Points. |

| Avios | 1:1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Great value can be had in redeeming BA points for short distance flights. Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower than when booking through British Airways. Aer Lingus shares the “Avios” currency with British Airways and Iberia. In most cases it is best to move points to one of those programs in order to book awards for less. |

| Cathay Pacific Asia Miles | 1:1 | Cathay Pacific has a fairly generous distance based award chart and allows multiple stopovers. Fuel surcharges can be very high on certain routes. See: Best Use of Asia Miles (Cathay). |

| Choice Privileges | 1:1 | Choice Privileges points seem to be randomly quite valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan |

| Avianca LifeMiles | 1:1 | Book business class to Europe with no fuel surcharges, and they have excellent business class awards between North and South America |

| British Airways Executive Club | 1:1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Great value can be had in redeeming BA points for short distance flights. Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower than when booking through British Airways. Aer Lingus shares the “Avios” currency with British Airways and Iberia. In most cases it is best to move points to one of those programs in order to book awards for less. |

| Delta SkyMiles® | 1:1 plus excise tax | Award flights to Canada are often a great deal. Partner awards often have terrific availability, but you may pay more miles than with other programs. |

| Emirates | 1:1 | Emirates has different award charts for each airline partner. Sometimes they allow one-way awards, sometimes they do not. In general, award prices are fairly high. |

| Etihad | 1:1 | Etihad has a very competitive award chart for American Airlines flights, among others. Beware that booking awards can be very difficult |

| Finnair Plus | 1:1 | Finnair announced they’ll be adopting the Avios award currency in 2024. They’ll be converting Plus Points to Avios on a 3:2 basis |

| Iberia Plus | 1:1 | Iberia offers very low award prices on their own flights. Round trip partner awards can offer good value under some circumstances as well. Fuel surcharges are often lower than when booking through British Airways. |

| Hawaiian Airlines HawaiianMiles® | 1:1 plus excise tax | Hawaiian Airlines’ award prices tend to be quite high, but there are some not-terrible uses: fly to neighboring islands for 7.5K miles, fly first class round-trip from Hawaii to South Pacific islands for as few as 95K miles, fly first class round-trip from Hawaii to Australia for as few as 130K miles. |

| Hilton | 1:2 | 5th Night Free awards |

| JetBlue TrueBlue™ | 250:200 | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one or both cards. |

| Marriott | 1:1 | 5th Night Free awards |

| Qantas | 1:1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. |

| Qatar Airways | 1:1 | Qatar offers one of the best business class seats in the world, QSuites |

| Singapore Airlines Kris Flyer | 1:1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members) or for Star Alliance awards. Low change fees and no close-in booking fees make this a very good program for booking United Airlines flights. |

| Virgin Atlantic® Flying Club | 1:1 | Virgin Atlantic miles can be usefully thought of as a way to get a discount off Virgin Atlantic flights (high fuel surcharges make the flights far from free), but there are some better uses. Use miles to upgrade paid flights or to fly partner airlines. A fantastic use is to fly ANA in business or first class thanks to Virgin’s generous ANA partner award chart. Or, if you can find saver level Delta awards for nonstop international travel, you can often book through Virgin Atlantic far cheaper than with Delta directly. |

Other ways to redeem points

You can also redeem points for gift cards or merchandise. At most, with this approach, you’ll get 1 cent per point value, but usually, you’ll get quite a bit less.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone gets into your Amazon account, they might spend your Ultimate Rewards points – causing you a headache in getting your points reinstated).

Manage Points

Combine Points Across Cards

Amex automatically pools all of your points together. When you earn points with different cards, the point total shown when viewing either card is the total across cards.

Share Points Across Cardholders

Unlike Chase and Citibank, Amex doesn’t allow members to move points from one person’s account to another. That said, transferring one person’s points to another person’s loyalty program account is possible. The key is that the person who receives the points must be an authorized user or employee on the other person’s account. For example, my wife can transfer Membership Rewards points to my Virgin Atlantic account as long as I’m an authorized user (or employee) on any of her Membership Rewards cards.

How to Keep Points Alive

Thankfully, it is very easy to keep Amex Membership Rewards points alive. Simply keep any Membership Rewards card open. For example, if you are about to close your one and only Membership Rewards card, then open another Membership Rewards card account first in order to preserve your points. Amex offers some no-fee Membership Rewards cards, such as the Blue Business Plus and the Amex Everyday, so this shouldn’t be much of a burden.

One of the best Amex business cards with no annual fee. It has transfer partners and offers 2x points on everyday business purchases such as office supplies or client dinners. Earn 2x on the first $50,000 of eligible purchases per year, 1 point per dollar thereafter. Eligible purchases are for goods and services minus returns and other credits. Terms apply.

Terms apply.

More information

Amex’s official Membership Rewards page can be found here.

Note: This article was inspired by Frequent Miler – any content used with permission.