This Travel Freely is all about maximizing your free travel in the easiest way possible. This means finding cards with great welcome offers and ongoing value. The American Express Gold® card holds a top spot in our card rankings because of this. It is a great option because of it’s long-term travel value and current stay-at-home value with it’s 4x categories. Simply put, the Amex Gold card is a can’t miss card that will help you diversify your points and rack up great stay-at-home earnings.

American Express Gold Card current offer:

A must-have for anyone who loves Amex points. Some of the highest returns (4x!) for spending at U.S. supermarkets and restaurants worldwide (plus takeout and delivery in the U.S). Definitely worth a spot in your wallet. Terms apply.

Here are some great reasons to love the “Amex Gold.”

1) Welcome offer valued at $1200

When you hit your minimum spending bonus, you’ll get 75,000 American Express Membership Rewards points. You can redeem these points in all sorts of ways: cash back, gift cards, travel booking, transfer to airline and hotel partners, etc. Keep reading below for the best ways to redeem.

2) Earn 4x on groceries and dining

The spending “multiplier” of 4x earning on groceries (U.S. only, and capped at $25,000 per year) and restaurants worldwide. These combine for what is the best-in-class for earning travel rewards on groceries and dining worldwide. Note, sometimes people do not realize that a “restaurant” can be any place that codes as dining on your credit card statement. This normally includes coffee shops, fast food restaurants, etc. For groceries, warehouse clubs like Costco or Sam’s and superstores like Target will most likely not count as groceries.

Additionally, with the current welcome offer, you’ll earn 20% back as a statement credit on purchases made at restaurants worldwide within the first 12 months of Card Membership, up to $250 back.

3. Up to $240 in food credits

This is where I can easily justify the annual fee of $250. In addition to the 4x points earnings on U.S. supermarkets (up to $25,000 per year) and restaurants worldwide, the Amex Gold card also offers $240 in food credit each year.

This is because you can earn up to $120 dining credits — dolled out in up to $10 in statement credits monthly — with participating dining partners (boxed.com, select Shake Shacks, Wine.com, Goldbelly Milk Bar, Grubhub and The Cheesecake Factory). You’ll also receive up to $120 in Uber Cash annually — again divvied in up to $10 credits per month. This benefit is valid for Uber Eats orders or Uber rides in the U.S.

4. Earn 3x on flight purchases

When you book directly with an airlines or on amextravel.com, you will earn 3x points.

5. Ways to redeem points for free travel

There are two popular ways to redeem Amex points for free travel. The first option is to use their friendly online travel portal to book flights (at a value of 1 cent per point) or cards, hotels, vacations, or cruises (at a value of 0.7 cents per point). Note, this is much lower value compared to those familiar with the Chase travel portal.

The much better value is the second option, which is to transfer to points to their airline and hotel partners. You can get some great value with this strategy, including booking Delta flights with Virgin miles and American Airlines flights with British Airways miles. For a list of transfer partners, see our Amex Membership Rewards Guide.

Some travel agencies are known to be Amex partners where you can redeem points when booking with them. However, the redemption values can vary and may not be a good use of points.

6. Application tips

Amex is generally the safest bank for trying your luck at a new welcome offer. It is known that they will not issue a hard pull when denying your application. Plus, they’ll now warn you during the application process if you’re not eligible for the offer.

Lifetime Rule: If you’ve ever had the same card before, you are most likely prohibited from getting a welcome bonus for the card if you apply now. Fortunately you’ll be warned during the application process if this is the case. Amex is known to “forget” that you’ve had a card after about 7 years.

Amex 5/90 Rule: In general, you can get at most one credit card within 5 days and 2 within 90 days. The 5 day limit is not enforced when your applications are automatically approved. Neither rule is enforced for charge cards.

5 credit card max: Amex usually won’t approve applications for new credit cards if you already have 4 or more Amex credit cards or 10 or more charge cards.

Hard inquiries combine into 1 when approved same day

My application experience

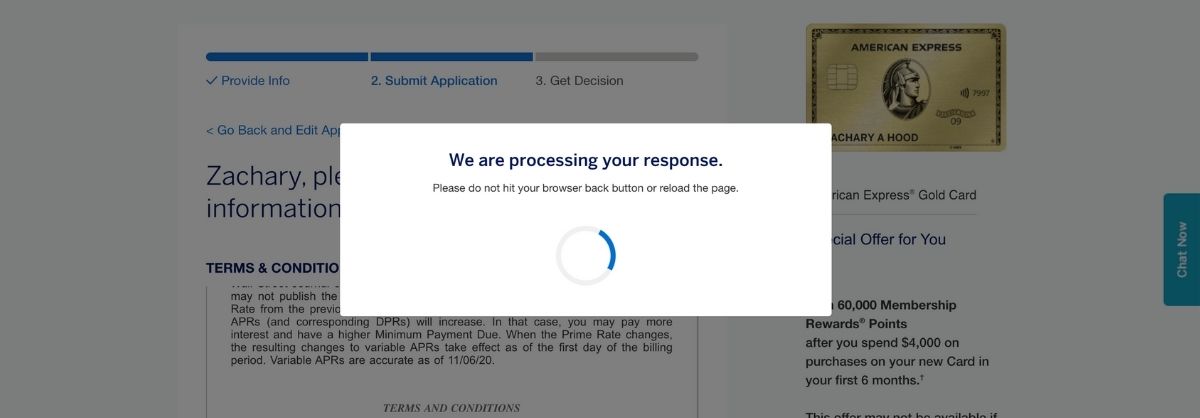

I recently applied for the Amex Gold card. It took about 2 minutes in total. Thankfully, I was approved immediately!

Here’s my nervous moment this morning… waiting for a decision.

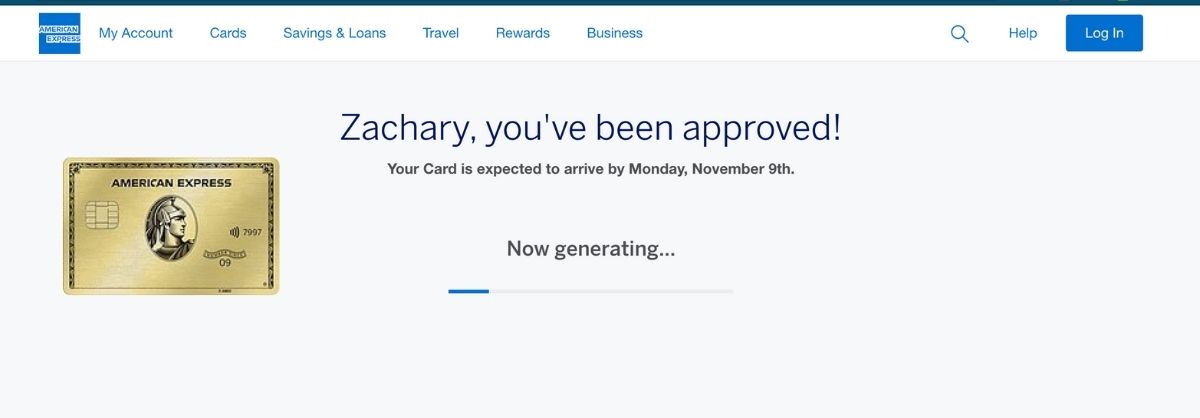

Here’s the big sigh of relief!

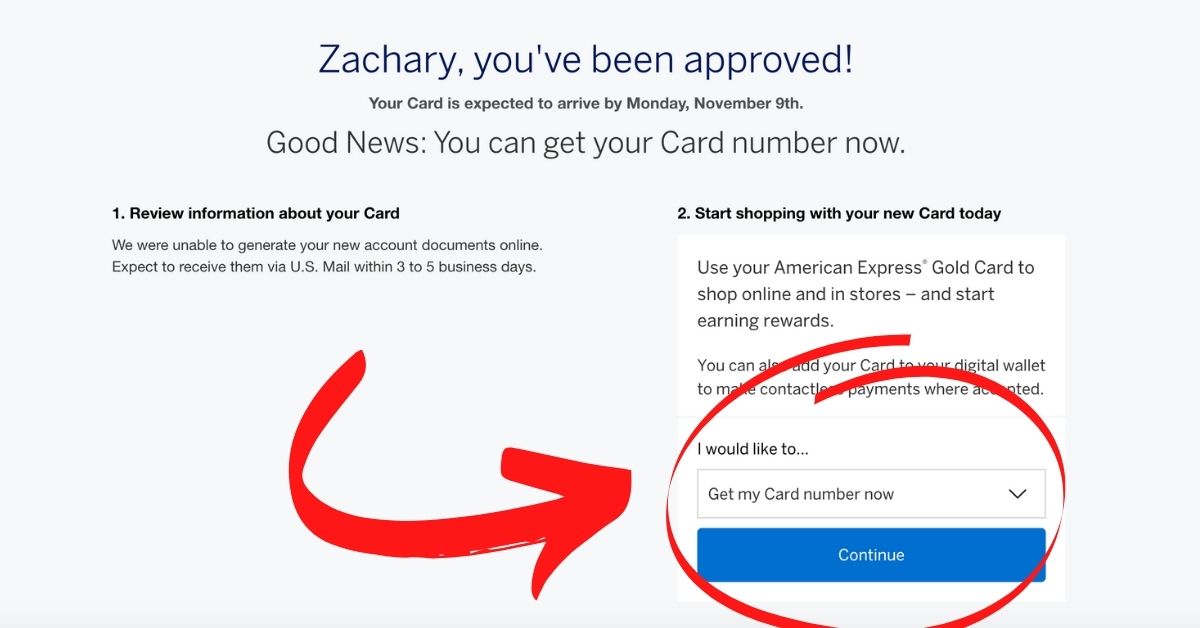

One very cool thing with Amex is the ability to get your credit card number immediately. If you literally have a purchase to make later in the day, you can make it with your brand new card.

To get this number, you will see this option to get your card number instantly on approval.

In Summary

With higher than normal welcome offers, it’s an especially good time to consider the Amex Gold.

A must-have for anyone who loves Amex points. Some of the highest returns (4x!) for spending at U.S. supermarkets and restaurants worldwide (plus takeout and delivery in the U.S). Definitely worth a spot in your wallet. Terms apply.

Related Articles

https://travelfreely.com/amex-membership-rewards-guide/